Mathieson says Star has ‘hurdles’ to get over but marvellous assets

The biggest shareholder in troubled casino operator The Star Entertainment Group says it faces hurdles but its ‘great assets’ make it a sound investment.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

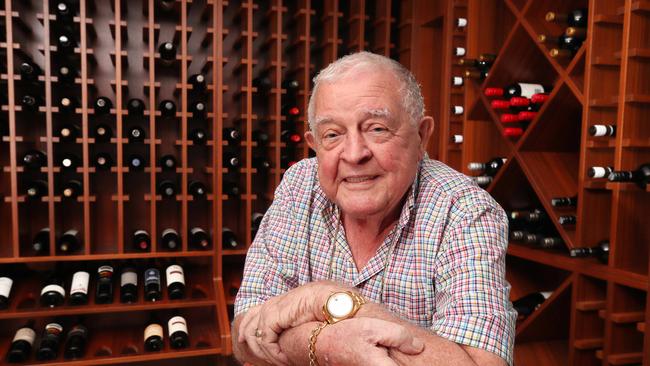

Billionaire publican Bruce Mathieson, the biggest shareholder in The Star EntertainmentGroup, conceded the firm faced a raft of hurdles after the regulator said a second probe into the troubled casino operator would be extended with hearings to be open to the public.

Mr Mathieson told The Australian that its short-term fortunes would hinge on who was brought in to run the company following the shock resignation of chief executive Robbie Cooke last Friday.

“Like anything in business it depends on whether you take a long term or short term view of the business,” said Mr Mathieson. “It does have some wonderful assets.”

In February the NSW Independent Casino Commission (NICC) announced a second inquiry by Adam Bell SC into Star’s suitability to operate its Sydney casino, amid concerns it was not moving quickly enough to restructure.

It was initially expected to run in private for approximately 15 weeks, with the final report due to the NICC on May 31.

However, the regulator has now been handed a further two months to complete the inquiry until July 31.

As a result, the NICC will seek an extension of the term of casino manager Nicholas Weeks for a further period to September 30.

The NSW public inquiry, which will start on April 15 and run for up to three weeks, will consider the company’s culture, including risk management, and whether it has, or is “able to obtain financial resources that are both suitable and adequate for ensuring its financial viability.”

It also will look at The Star’s management and reporting lines as well as it internal control manuals. Mr Bell has decided to hold most of the hearings “primarily in public.”

Star told investors on Monday it “continues to appreciate the opportunity to demonstrate it has the ability to regain suitability…as well as continuing to participate in the inquiry in an open, transparent and facilitative manner.”

Star’s new crisis comes as the Victorian Gambling and Casino Control Commission announced it will release the outcome on Tuesday whether rival Crown Resorts is able to maintain its licence in Melbourne. Crown’s casino licence is on the line after revelations the business had been facilitating money laundering and organised crime.

Some market sources now believe the best option for The Star is a potential sale to private equity or a break up of the business.

“Who else is going to run it now with the licence under review?” Hunter Green broker Charlie Green said.

“The most likely outcome is a sale to private equity.”

Under the scenario, the property and hotels would be sold off separately to its casino operations.

Alternatively, the business could be sold to private equity much like Crown Resorts in 2022 to Blackstone for $8.9bn, Mr Green said.

Star has been fighting to maintain its casino licences in both Queensland and NSW, which are now under the control of Mr Weeks.

Mr Mathieson and son BruceJnr this month increased their stake in the casino operator to 8.21 per cent from 6 per cent, making him the largest investor followed by Perpetual Investment with 7.61 per cent, Far East Consortium with 2.81 per cent and Firmament Investment, also with 2.81 per cent.

Mr Cooke exited the business after just 16 months in the role along with chief financial officer Christina Katsibouba and chief of staff Peter Jenkins.

The Star is about to open its $3.5bn Queen’s Wharf integrated resort in Brisbane that it hopes will help turn around its fortunes.

Mr Cooke defended his efforts to reform the casino operator following allegations of money laundering and other regulatory breaches but indicated the NICC was not happy with the pace of reform. The Star shares fell 2.8 per cent to 52 cents on Monday.

If Crown gets the green light from regulators, it has foreshadowed a big investment to attract the tourist dollar in Melbourne, backed by its deep-pocketed owner, Blackstone. That could potentially bring more competitive pressure on Star.

Sydney is the only market where Star and Crown go head to head, albeit targeting different customers. Crown’s Barangaroo property is near the city’s financial and law districts, while Star operates at Pyrmont on the fringe of the CBD. In its latest first-half results, Star’s revenue fell 14.6 per cent to $865.7m, with Star Sydney’s revenue off 16.9 per cent at $450m

Wilson Asset Management, Star’s fifth-largest shareholder, said over the weekend that Mr Cooke’s exit was a “necessary step” that should ensure the casino owner regains its operating licence. Matthew Haupt, the lead portfolio manager at Wilson Asset Management Leaders, told The Australian on Sunday the exit was “part of a necessary process for Star to regain their licence.”Mr Haupt said Mr Cooke’s position had become “untenable” following criticism from the inquiry’s chief commissioner Philip Crawford.