Worrying sign interest rate rises won’t bring down inflation

Interest rates are scheduled to keep going up but there’s a worrying sign it won’t be enough to save the Aussie economy.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

When it comes to the world of economics and finance, the divergence between different short term predictions for various data points is generally relatively small, that was up until the pandemic.

Since then pretty much every forecaster under the sun has ended up with egg on their face at one point or another, as the impact of the pandemic and the second and third order effects that followed, complicated matters enormously.

The path of Australian interest rates has been no different, with few analysts last year seeing a rise in the cash rate as early May. There is also a major divergence in opinions over where the peak in the cash rate will be for this cycle, with a sizeable gulf between the predictions of a 1.6 per cent peak from the Commonwealth Bank and 3 per cent+ from ANZ.

Arguably the key point on where the various forecasts differ is the impact rising rates will have on the economy and the housing market, and by extension the rate of inflation.

A great deal of that impact will be defined by the confidence levels of households and their willingness to continue to spend despite rising rates. But that is something that is rather challenging to accurately quantify, particularly now.

But if we focus on what we do know in terms of how rising rates will directly impact household budgets, a more complex picture emerges than one might initially expect.

Many borrowers immune to moderate rate rises

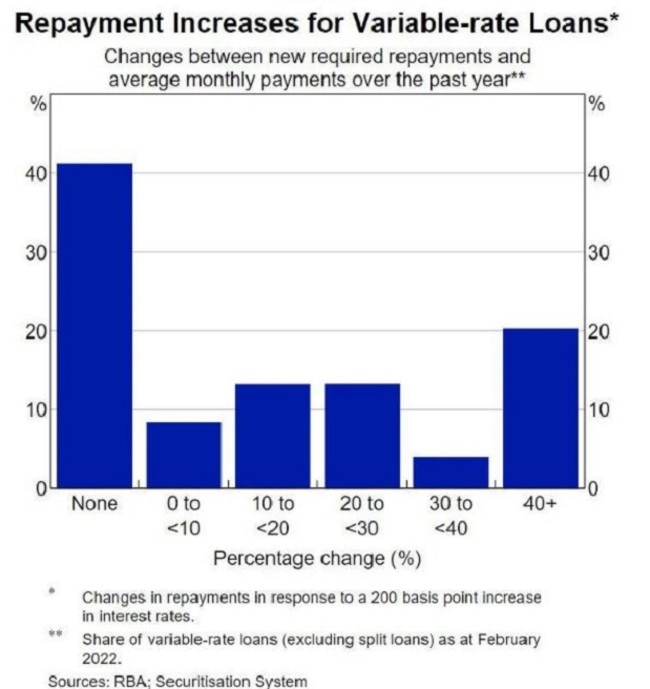

According to figures from the Reserve Bank more than 40 per cent of borrowers on a variable rate would see no increase to their mortgage repayments if the RBA cash rate was to rise to 2.1 per cent.

The reason these borrowers won’t face a rise in their mortgage repayments is that they are already paying more than they would if the cash rate was to rise to 2.1 per cent.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

This can occur for a number of reasons. But perhaps the most notable one is many of these mortgages were written years ago at significantly higher interest rates and these households have chosen to keep up the higher than needed rate of repayments rather than reducing it to a lower rate.

Around one in four mortgage holders find themselves in this particular category.

This complicates things significantly for the RBA. These households have no reason to curtail their spending based solely on the impact of a moderate rise in interest rates, thereby placing no downward pressure on inflation.

Fixed rates buy borrowers time

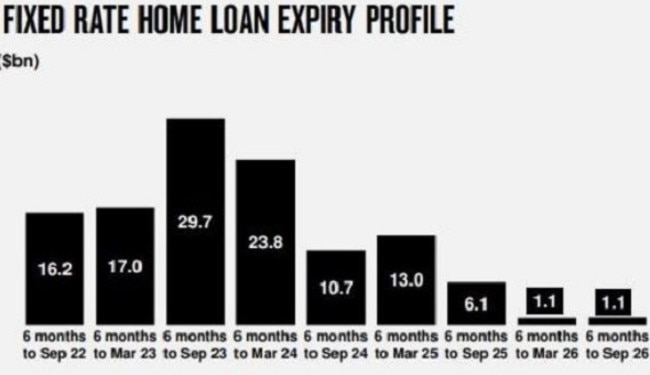

In years and decades gone by, Australian mortgages have traditionally been heavily concentrated on variable rate loans. The RBA’s ‘Term Funding Facility’ (TFF) which committed to providing up to $200 billion to the banks at just a 0.1 per cent interest rate changed all that.

By providing the banks with extremely cheap money, the RBA facilitated the writing of one to three year fixed rate mortgages at rates of less than 2 per cent. These low fixed rates and the promise of interest rates staying low until 2024 appealed to buyers and refinancers alike, as the rate payable on Aussie mortgages tumbled to record lows.

As a result, the proportion of total mortgages on a fixed rate rocketed. As of April, around 40 per cent of mortgages are currently on a fixed rate.

According to data from National Australia Bank (NAB), based on their loan book, only 27 per cent of fixed rate loans as a proportion of dollars outstanding expire prior to April 2023.

If we were to assume that there is a broadly similar trend present in fixed rate mortgages overall and conservatively overlay the impact of around 73 per cent of fixed rates borrowers being immune to rate rises prior to April 2023, that leaves roughly 29 per cent of overall borrowers not facing a rate rise.

A complex picture for the RBA

With rough estimates showing that more than half of mortgage holders face no rise in mortgage repayments from a 2.1 per cent cash rate prior to April 2023, the RBA’s job is made far more complex than it once was.

If a household’s main consideration is the mortgage repayments they face and not the impact on broader confidence or housing prices, many mortgage holders may continue to spend at pre-rate rise levels, having zero impact on lowering inflation.

So what does the RBA do by year end if inflation isn’t sufficiently addressed by whatever rate rise they have so far deemed necessary?

In short, they would consider raising rates even more in order to put greater levels of downward pressure on inflation.

Ultimately, the direction of interest rates will depend upon a myriad of factors stemming from both domestic and international considerations. It is entirely possible that the Commonwealth Bank’s estimate will be correct and inflation could come down due to the economy’s inability to cope with much higher rates.

On the other hand global inflationary pressures stemming from the war in Ukraine and lockdowns in China could combine with the muted direct impact of rate rises on household budgets, forcing the RBA to adopt a significantly more aggressive rate rise cycle than currently expected.

Tarric Brooker is a freelance journalist and social commentator. | @AvidCommentator

Originally published as Worrying sign interest rate rises won’t bring down inflation