Why JobSeeker, JobKeeper reductions could cause economic crisis

The worst is coming. There’s a fiscal cliff on the horizon for the economy and it will affect everyday Aussies and big businesses alike.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

When it comes to the economy, Aussies are asking these same questions: When will the worst hit? When will we be through to the other side? When can we start to feel hopeful?

This fiscal cliff is coming, and I can’t help thinking about this iconic scene from The Simpsons.

Recovery is not going to be simple, and you can start to see that in the official predictions.

Treasury’s new forecasts show unemployment peaking later than previously expected. The Reserve Bank of Australia’s old baseline scenario was for unemployment to peak in June this year, now Treasury thinks it will rise until December 2020, and average 8.75 per cent this financial year.

RELATED: Answer to scary debt question

Mind you, Treasury’s forecasts are pretty optimistic on the situation in Victoria, expecting the lockdown to end after only six weeks.

I won’t be able to relax until at least March. The economy has to weather a lot of serious storms, starting in two months time.

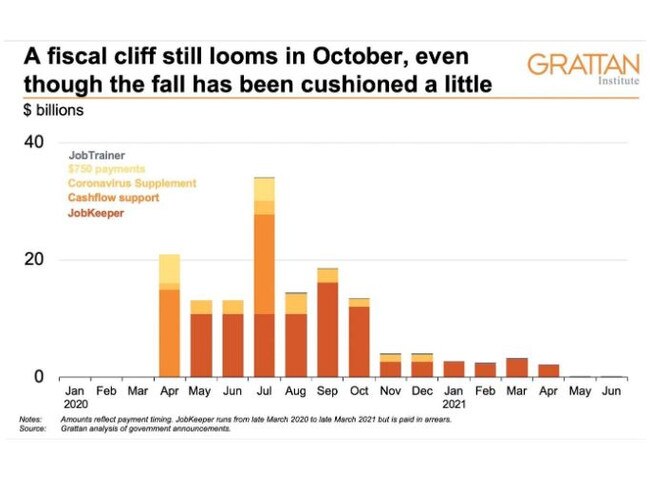

The Government is reducing its emergency spending at the end of September, and that means a lot less money will be flowing around the economy by November. They call this the fiscal cliff (fiscal refers to government spending).

The next graph shows how the JobKeeper payment will shrink, pulling away one of the big support that is currently holding up the Australian economy.

RELATED: Why houses prices could actually go up

The amount of the JobKeeper payment itself to be cut is only small, from $1500 a fortnight to $1200. The big cut is in eligibility. Instead of 3.5 million employees being eligible it will now be 1.4 million. That’s more than 2 million people whose jobs are no longer being supported.

Reducing JobKeeper is fair. It would be strange and unusual to give money to businesses that have recovered their revenues and are now going fine.

We have to go back to normal eventually. But going back to fair and normal won’t be easy. There are billions of dollars floating around the economy in September that won’t be there in November and we will miss them when they are gone. What goes around comes around, and that props up everyone’s jobs.

Like Homer Simpson, we’re heading for a long and painful fall down. It’s not just JobKeeper. There is also a cut in the JobSeeker supplement. The maximum payment was an extra $550 on top of the usual unemployment payment, Now it will be just $250. That’s going to hurt spending in the economy, and it won’t just kick in once the payment is cut. People are likely to start saving their welfare payments now, to help them cover the fall.

RELATED: Closing borders ‘good for our economy’

On top of that, the rules around insolvency are all planned to snap back in September. For now, there’s almost no reason, under the law, to declare a business insolvent.

A business owner can build up debts, trade while insolvent without liability, and not respond to claims for up to six months. Unsurprisingly, almost no businesses have gone insolvent under these temporary rules. But they are due to revert on September 24.

Suddenly business owners will have to face the reality. Expect to hear the phrase “the well-known retailer/cafe/franchise is entering administration” a lot in October.

But that’s not all. Banks also gave borrowers the chance to defer their loans, and 800,000 customers accepted. That was initially planned to change in September but it was extended by four months. And borrowers seem to need it.

By June, just over 20 per cent of home loan customers had started repaying again. When loan repayments start up for real again – in January and February – there’s a risk of forced sales and even defaults.

WINTER IS COMING

Even after we leapfrog over all the policy challenges, Australia will still face a considerable risk. We depend on the global economy being strong, and for now things look okay in Europe and Asia.

But winter is coming, and that brings with it a risk of a big second wave of infections. As we saw in Victoria, if you combine some residual infected people and some cold weather, the virus can quickly spiral out of control.

It’s 21 degrees in London and 35 degrees in Beijing this week. Summer weather. People are outdoors and windows are open. But by December, temperatures will be heading for zero across Northern Europe, across Asia, and across the northern USA. (America’s current huge outbreaks are in Texas, Florida and California – the warm parts of the country which didn’t get hit in winter.)

The global economy will slow sharply and markets could easily plunge if cases surge again in the northern hemisphere. That will be bad news for business confidence in Australia, and it’s why I won’t be confident we’re past the worst – not until we get to March.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.

Originally published as Why JobSeeker, JobKeeper reductions could cause economic crisis