Coronavirus Australia: How economy will survive massive debt from pandemic

Australia’s economy is facing a meltdown and our only hope of avoiding calamity is doing the one thing we’ve been warned against for years.

Well, the economic and fiscal update is out and things look grim. Australia’s economy is shrinking and the unemployment rate is rising.

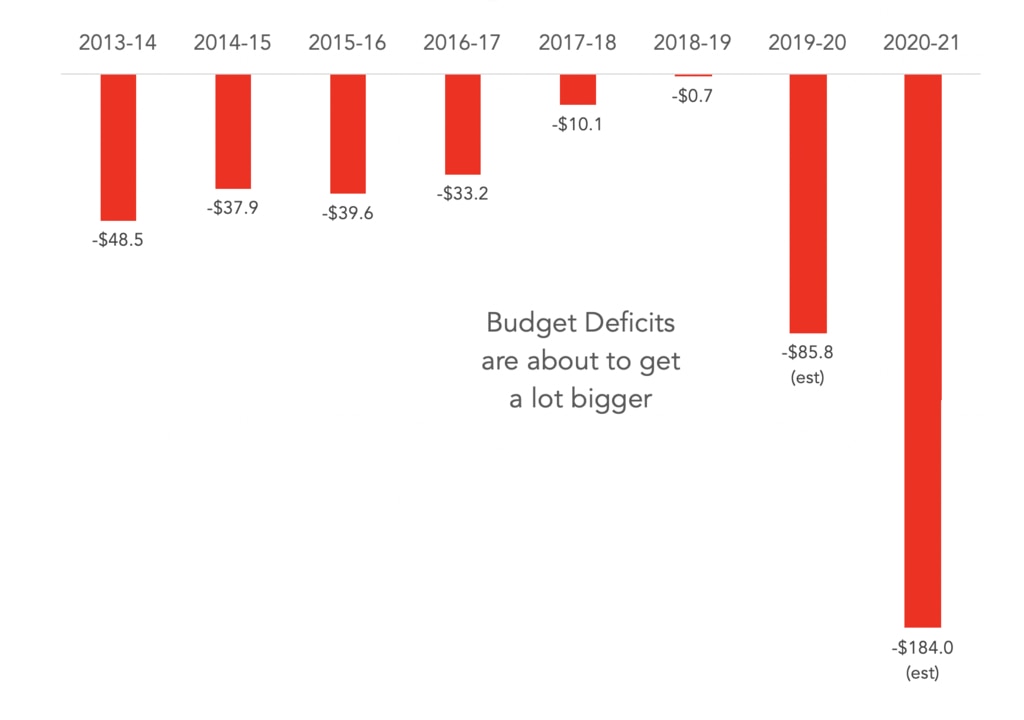

Also: We’re going to be running deficits for the previous financial year and the current financial year. They are big and they will add to the debt.

Now, I made the bars in the graph above red. Red is a danger colour. But I do not want to alarm anyone. Deficits are good right now. Right now, government spending is the last defence against total calamity.

Without Jobkeeper, hundreds of thousands more Aussies would be out of work. Without JobSeeker, lots more would be struggling to pay rent.

There are actually some healthy signs in the Australian economy at the moment. Government spending – those deficits – are why.

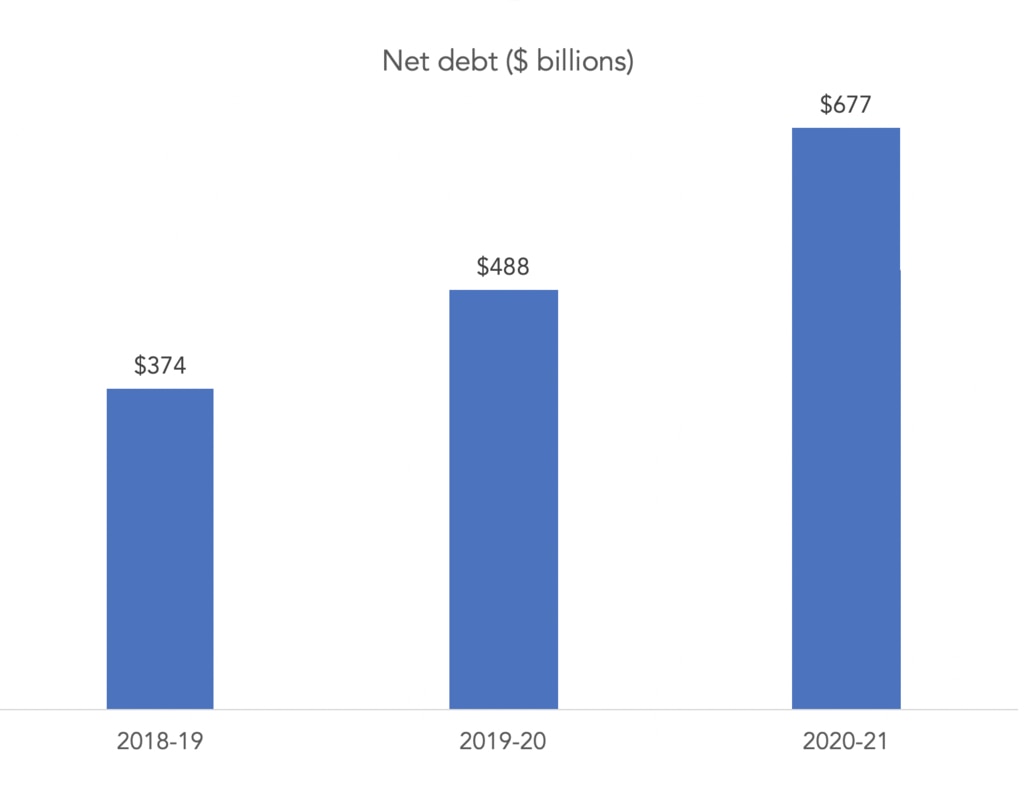

The Treasurer gave a press conference to announce the economic and fiscal update on Thursday. Journalists wanted to ping him over what these deficits will do to our national debt. The next graph shows our national debt over three years, from before the pandemic to the current financial year.

Net debt will rise because of those deficits. The Government will borrow money to finance its spending, and it does that by selling bonds, which it promises to repay later. The bonds are bought by foreign governments, big super funds and hedge funds, providing the government with cash.

Net debt is rising from around 25 per cent of GDP to around 36 per cent. It’s not high by international standards – Japan has debt of more than 200 per cent of GDP. But is even a little bit of debt bad?

If you have been paying attention to Australian politics, you know some people think it is. For a long time, Australian politics has been obsessed with debt. Remember former Treasurer Joe Hockey? He used to go on about what he called “a debt and deficit disaster”. But focusing on debt is the wrong move. When government spending is helping Aussies stay in work, we should celebrate that spending.

This was true in the GFC when Labor spent up big, and it is true now. We are in the biggest economic meltdown since the 1930s and anyone peering at the debt scoreboard is absolutely missing the main game.

Of course, Labor is cross at the government. The same government that gave it a hard time over debt and deficit is now building up debt via big deficits! The natural instinct will be for payback. They should instead take the opportunity to move our national debate onto something more useful, like making sure the government spends fairly. Why are universities excluded from Jobkeeper, for example, when they are such a big export earner?

BUT HOW DO WE PAY IT BACK?

Interest rates are crazy low right now. Last week the government borrowed $2 billion for ten years and is paying interest of 0.83 per cent on that. The cost of servicing our debt is going to be low.

That’s good, because the plan should not be to pay it back any time soon. Think about a mortgage. When your parents bought their house back in the day they had what seemed like an enormous mortgage. Flash forward 30 years and the amount they borrowed seems tiny compared to the value of the house, and compared to how much they make in a year.

Your parents had to pay back the mortgage though, because unlike a country, a person gets old and retires. What a country can do is keep the debt on its books, and just grow the economy. Through the magic of economic growth and inflation, the debt will get more and more manageable.

This is why the Treasurer talks about using economic growth to pay off the debt, not raising taxes to pay off the debt. The former chief economist of the IMF made the same point last year. So long as your interest rate on borrowing is less than your economic growth rate, debts shrink and deficits are not a problem.

So the plan for Australia is this: We don’t pay the debt back. We use time and economic growth to make it look piddly.

A GIFT FROM THE GREEKS

The people worrying about debt often want to cut government spending. It is very important we don’t do that. Not right now, at least. To see why, let’s look at Europe.

In the middle of the last recession, the GFC, the Europeans were very worried about debt. Many took on a policy called austerity, which involved cutting spending. It caused economic growth to fall further, and the result was completely paradoxical in some cases. They harmed their economic growth so much that it became harder to manage debt, rather than easier.

Reducing government spending is like closing down factories. It costs jobs and hurts people.

There’s a horribly ironic part to this story. The theory that austerity was the best policy was based on a lot of academic work, including a very famous academic paper by two Harvard economists called Reinhart and Rogoff. The paper came out in 2010 and it said debt was bad because it caused growth to be lower.

One person bothered to check their working, a young man in his 20s called Thomas Herndon. What he found is they made a mistake in a Microsoft Excel spreadsheet that totally undermined their conclusion. It took a while for people to pay attention to what young Mr Herndon was saying, but eventually they did. We can now move forward knowing that research is flawed: debt is not necessarily a problem.