Inflation delivers double blow to one group

One group of Australians have been dealt a brutal blow as fresh figures renew calls for the Prime Minister to urgently act.

One group of Australians have been dealt a brutal blow as fresh figures renew calls for the Prime Minister to urgently act.

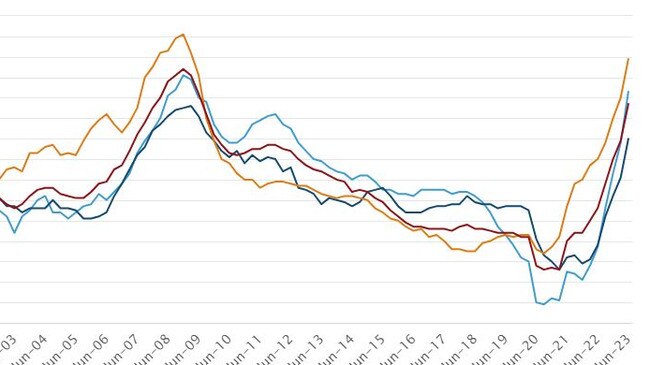

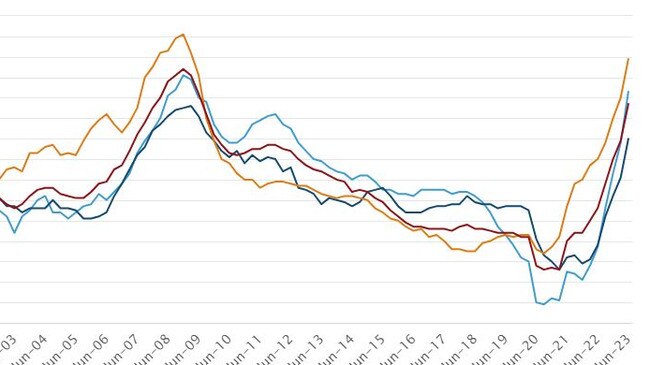

Australia’s latest inflation figures show interest rate hikes have been largely ineffective in bringing down inflation.

The RBA has revealed big changes to its operations next year, as Australians wait nervously for next week’s decision on rates.

Despite interest rates continuing to rise, house prices are expected spike further in 2023 and 2024, according to the National Australia Bank.

Savers already struggling with low deposit rates won’t like the latest move from one of Australia’s big four banks.

A subtle change in wording by the Reserve Bank could signal a rate cut is on the cards, one of Australia’s leading economists says.

Financially-distressed home buyers pressing pause on mortgages could be hit with higher interest fees from their banks if they seek further help.

Aussies appear to be approaching their finances differently during the coronavirus pandemic, and it’s hurting the banks’ bottom line.

Australia’s lending rate war is intensifying with a number of home loan providers offering rates at less than 2 per cent.

Despite the devastating economic effects of the coronaviurs, a new RBA survey shows housing affordability is at an all-time high.

The Reserve Bank has kept the interest rate at the historically low level of 0.25 per cent, warning that Victoria’s lockdown was hurting the economy.

It will be happy days for Aussie homeowners for the next three years according to PM Scott Morrison – if you’re lucky enough to own one that is.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/195