12 months of hell coming for Aussies

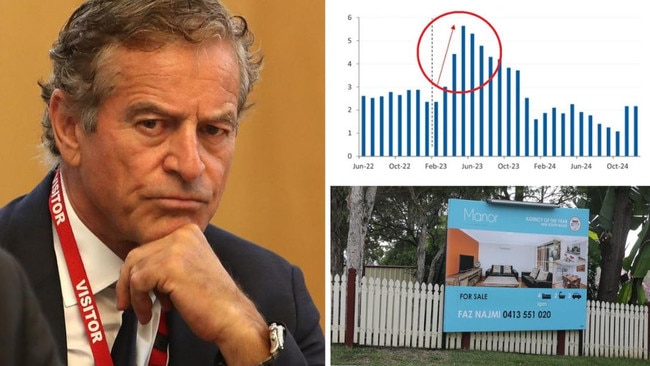

Economists predict Australians will cop it in the coming months whether the RBA increases rates or not on Tuesday.

Economists predict Australians will cop it in the coming months whether the RBA increases rates or not on Tuesday.

For the second week in a row, one major bank has announced it will hike interest rates for some unlucky customers.

A financial nightmare is now unfolding – and money expert Mark Bouris says it will be “disastrous for hundreds of thousands of families”.

The Australian share market has jumped to a five-month high, thanks to new official figures showing inflation is receding.

On the eve of the RBA’s interest rate, a mortgage lender has jumped the gun and is advertising the lowest home loan rate on record.

Aussies have done something hugely beneficial for their hip pockets during the coronavirus lockdown, saving themselves thousands.

The Reserve Bank of Australia says its “best guess” is Australia’s economy grew in the September quarter, spelling an end to the recession.

A further cut to Australia’s record low interest rate could be on the cards, with the Reserve Bank governor dropping a hint in a speech.

A big four bank has slashed the savings rate on two main deposit accounts in the midst of the COVID-19 recession.

Australians are rushing to commit to new home loans while interest rates remain at historically low levels, latest figures show.

The Reserve Bank has held tight to the current low cash rate, but economists predict there could be a cut before the end of 2020.

The RBA has kept the official cash rate steady at an unprecedented low rate, leaving it with ammunition if the economic slump worsens.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/193