‘It’s on’: Major bank expects Feb rate cut

In welcome news for mortgage holders, a third major bank is now expecting a rate cut in February following lower-than-expected inflation data.

In welcome news for mortgage holders, a third major bank is now expecting a rate cut in February following lower-than-expected inflation data.

In welcome news for mortgage holders, a third major bank is now expecting a rate cut in February following lower-than-expected inflation data.

A new report suggests help is on its way for struggling homeowners who have had their mortgage increase in many cases by $12,000 a year.

Australia’s economy might be hitting a turning point on the back of better household spending – but economists are warning more work needs to be done.

Mortgage holders and business owners should not hold their breath for any interest rate relief on Tuesday.

One of Australia’s largest companies has found its new chief executive, an international banker of “calibre and extensive experience”.

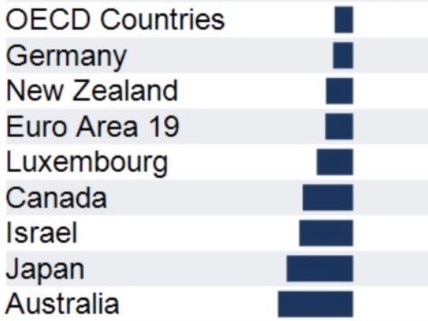

Australians are getting poorer and a leading economist has produced a simple chart that shows why.

The big four bank is holding on to predictions of a rate cut in February following Australia’s anaemic growth figures released on Wednesday.

A surprise jump in spending in major two areas has given early indications Aussies are starting to spend again, in spite of a high cost of living.

Strong public spending is offsetting an overall weak economy, new figures from the ABS reveal, ahead of the release of the latest growth figures on Wednesday.

Australia’s leading business body has just ranked the best and worst states and territories for commerce and a surprising state has come out on top.

Australia’s sharemarket has started the last month of the year with a strong day of trading, as new retail data was surprisingly good.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/14