‘It’s on’: Major bank expects Feb rate cut

In welcome news for mortgage holders, a third major bank is now expecting a rate cut in February following lower-than-expected inflation data.

In welcome news for mortgage holders, a third major bank is now expecting a rate cut in February following lower-than-expected inflation data.

In welcome news for mortgage holders, a third major bank is now expecting a rate cut in February following lower-than-expected inflation data.

A new report suggests help is on its way for struggling homeowners who have had their mortgage increase in many cases by $12,000 a year.

Australia’s economy might be hitting a turning point on the back of better household spending – but economists are warning more work needs to be done.

A sharp sell-off in banking and tech stocks pushed the Australian sharemarket into the red on Tuesday, even as the heavyweight mining sector soared.

Homeowners desperate for some rate relief will need to wait until 2025, as the Reserve Bank of Australia held official interest rates for the ninth time in a row.

Homeowners desperate for some rate relief will need to wait until 2025, as the Reserve Bank of Australia held official interest rates for the ninth time in a row.

The RBA will reveal its latest interest rates decision within hours – and an expert has shared his prediction which no Aussie will want to hear.

Mortgage holders and business owners should not hold their breath for any interest rate relief on Tuesday.

One of Australia’s largest companies has found its new chief executive, an international banker of “calibre and extensive experience”.

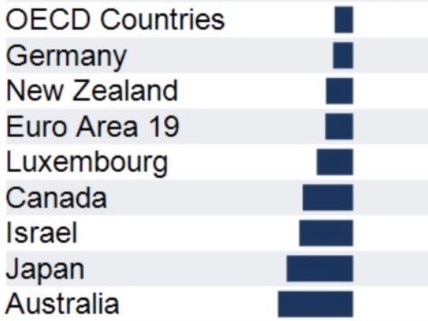

Australians are getting poorer and a leading economist has produced a simple chart that shows why.

The big four bank is holding on to predictions of a rate cut in February following Australia’s anaemic growth figures released on Wednesday.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/13