Australia’s major banks respond to Reserve Bank’s historic interest rate rise

As of Wednesday morning all of Australia’s biggest four banks have responded to the shock interest rate rise, with countless mortgage holders set to soon feel the pinch.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

All of Australia’s banking juggernauts have responded to Tuesday’s historic rate rise, as homeowners brace for months of pain ahead.

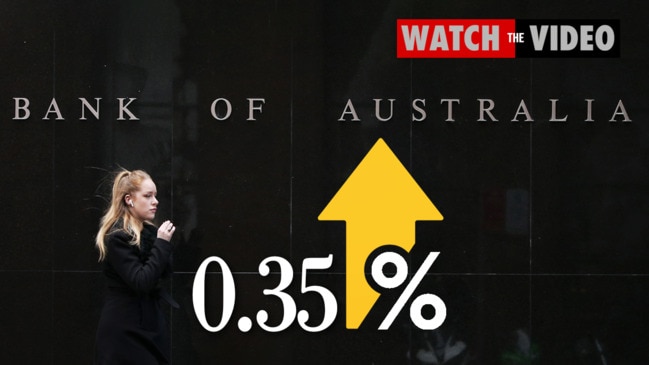

The Reserve Bank of Australia resolved to raise the nation’s official interest rate for the first time in 11 years by 25 basis points, from 0.1 per cent to 0.35 per cent.

The rate rise was announced in response to skyrocketing inflation, which has reached an annual rate of 5.1 per cent and has sent prices climbing at the fastest rate in two decades.

It also marks the first rate rise during an election campaign since 2007, when John Howard was defeated by Kevin Rudd.

NAB announced to its customers that it was changing its rate on Wednesday morning, meaning all of Australia’s four largest banks have changed their policy accordingly.

The bank said its standard variable home loan as well as its reward saver bonus interest rate will increase by 0.25 per cent.

Variable interest loans at NAB are now at 4.77 per cent.

The changes will come into effect from May 13.

NAB Group Executive Personal Banking Rachel Slade said of this decision: “While we have 930,000 home loan customers, the historic low interest rates have been difficult for our savings and deposit customers, including more than 1.3 million customers with a reward saver account. We want to support them as interest rates rise again.”

For NAB owner-occupier customers paying principal and interest on a 30-year $400,000 mortgage, the 0.25 per cent increase to a NAB Choice package variable rate of 3.67 per cent will mean an additional $57 a month on their repayments.

The Commonwealth Bank was first to react on Tuesday night, matching the RBA and lifting its home-loan variable interest rates by 0.25 per cent.

CBA, which is Australia’s largest bank and has a quarter of all home loans in the country, said the increase would come into effect from May 20.

Following the RBA’s cash rate decision, we will increase home loan variable interest rates by 0.25% p.a. You can read our statement in response to the RBA’s cash rate decision here https://t.co/e1veu9jNjW

— CommBank (@CommBank) May 3, 2022

CBA’s group executive for retail banking, Angus Sullivan, acknowledged rate rises would be foreign for many of its home loan customers.

“We are here to help customers who have loans and are considering how repayments might change. Some options available to help our customers manage repayments include fixing or splitting loans or setting up an offset account,” Mr Sullivan said.

CBA customers on a principal and interest loan of $500,000 will see their repayments increase by an extra $68 a month, according to Mozo’s online calculator.

ANZ followed suit shortly after CBA, announcing it would also pass the full amount on to home loan customers from May 13.

ANZ changes variable home loan rates https://t.co/VOWJN8ogjCpic.twitter.com/1bpNtQongE

— ANZ Newsroom (@ANZ_Newsroom) May 3, 2022

Westpac was the first major lender to respond to the RBA announcement, issuing a tweet within minutes.

We are currently reviewing our variable interest rates following the RBA’s cash rate decision. We will keep you up to date with any changes here.

— Westpac Bank (@Westpac) May 3, 2022

It later announced it will also follow and increase home loan variable interest rates by 0.25 per cent for new and existing customers from May 17.

The RBA Board lifted the cash rate by 0.25%, further than our forecast of 0.15%. Accordingly, we have lifted our forecast for the next move in June from 25 basis points to 40 basis points, while the rest of the profile remains unchanged https://t.co/6daA7eXU2m

— Westpac Economics (@WestpacMacro) May 3, 2022

Banks ‘caught off guard’ by increase

The nation’s cash rate has been sitting at the historic low of 0.1 since 2020, when it was slashed in response to the Covid-19 crisis.

Ahead of Tuesday’s RBA announcement, ANZ, NAB, and Westpac had all predicted a 0.15 per cent raise at the start of May, while the Commonwealth Bank had been expecting a rate rise in June, after the election was behind us.

All four were caught off guard by the central bank’s decision to increase the cash rate by 25 basis points, a scenario few saw coming.

St George, which merged with the Westpac Group in 2008, shared an identical message on its Twitter account.

Homestar Finance also announced it would keep its lowest variable rate loan on hold at 1.79 per cent – for new customers only.

‘Big question’ facing Aussies

As news of the first rate hike in more than a decade sinks in, attention is now turning to how the banks will react.

“The big question now is how quickly will lenders pass on the official interest rate increase to their customers and will they hike rates more than 25 basis points,” Mozo spokesman Tom Godfrey said.

“Obviously this will come as another hit to the household budget at a time when many borrowers are trying to come to terms with high prices at the petrol pump and supermarket checkout.”

When the big four banks last moved variable rates following an RBA decision in March 2020, they took an average of 14 days to pass on the rate reduction to their customers and they all passed it on in full.

Originally published as Australia’s major banks respond to Reserve Bank’s historic interest rate rise