Banks unveil multibillion dollar profits after royal commission report

Commonwealth Bank is the first of the big four to unveil its multi-billion first-half cash profit today, just days after the royal commission shamed them and bank bosses launched a PR blitz to keep their jobs.

QLD Business

Don't miss out on the headlines from QLD Business. Followed categories will be added to My News.

THE big four banks have started unveiling their multibillion-dollar profits, just days after the royal commission shamed them for their greed and bank bosses launched a PR blitz to keep their jobs.

Bank staff’s sales bonuses in Labor’s sights

Shamed Big Four banks pocket $19b in share market surge, NAB chief confident his job is safe

Banking industry’s professional clowns make for good comedic material says Vince Sorrenti

Commonwealth Bank was the first to reveal, reporting its first-half cash profit has fallen 2.1 per cent to $4.676 billion, weighed down by factors including customers’ switch away from investment and interest-only mortgages.

Australia’s biggest bank says cash profit for the six months to December 31 fell from $4.871 billion in the prior corresponding period after revenue fell 1.9 per cent to $12.41 billion.

Volume growth was offset by a lower net interest margin due to the increased cost of funding loans, competition and customers switching from interest-only to principal and interest or from investor to owner-occupied home loans

On Wall Street, the Dow Jones Industrial Average was up 0.65 per cent, the S&P 500 was up 0.39 per cent and the Nasdaq Composite was up 0.70 per cent. Commonwealth Bank released its results on Wednesday morning, saying first-half cash profit had fallen 2.1 per cent to $4.676 billion, weighed down by factors including customers’ switch away from investment and interest-only mortgages.

It comes after Prime Minister Scott Morrison softly applied pressure on two NAB bosses to resign yesterday in the wake of the damning report, while Opposition Leader Bill Shorten said more executives should fall on their sword.

As Labor in Brisbane flagged it would ramp up its attack on banker accountability and turn it into an election issue, the nation’s biggest home lender — Commonwealth Bank of Australia — will today reveal their half-yearly profits, expected to be in the billions of dollars.

Meantime, the Reserve Bank of Australia’s first meeting of the year yesterday held the official interest rate at 1.5 per cent.

With the banks surviving the royal commission without recommendations of major structural change, the sharemarket yesterday recorded its biggest one-day rise in more than two years. Three of the four major banks and AMP clocked their biggest one-day gain since 2009, helping to drive the $33 billion added to the sharemarket.

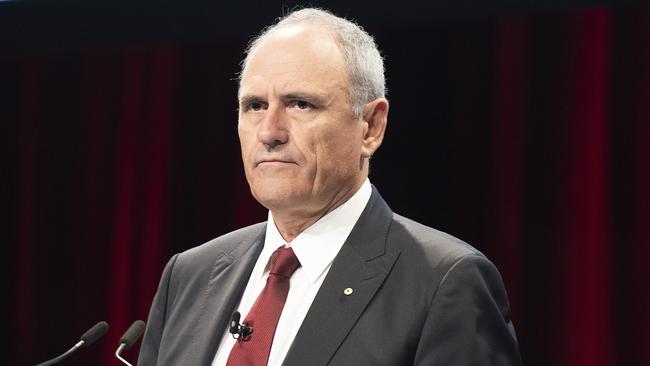

NAB chief executive Andrew Thorburn and chairman, Ken Henry, the two bank bosses lambasted by Commissioner Kenneth Hayne for failing to convince they had learned from past mistakes, refused calls to step down yesterday.

Mr Thorburn, who cancelled his long-service leave to head back to work, batted away questions on why he would take leave during the long-awaited release of the report.

Mr Thorburn told Sky News he had a marriage, children and ageing parents and needed to have a life outside of work.

He launched a media blitz, hitting TV and radio stations to counter the royal commission’s findings that NAB bosses had paid lip service while giving evidence.

Mr Morrison said: “I wouldn’t be so bold as to suggest” the men resign “but I think Commissioner Hayne was pretty sharp in his assessment and I think that gives them a lot to reflect on.”

Mr Shorten, who wrote to Mr Morrison yesterday urging more Parliamentary sitting days to consider legislation, said several banking executives and board members needed to consider their positions.

“I regard this banking royal commission as an absolute day of disgrace … I’m not saying someone who’s turned up in the last year or two — but some of those longer serving board members,’’ Mr Shorten said.

It comes as Malcolm Turnbull — who when prime minister repeatedly refused to call a royal commission into banks before finally being forced into it by Queensland Nationals — yesterday said the blowtorch should have been held sooner.

“There were some cases, examples of wrongdoing, that came out in the royal commission that shocked me in the sense that I did not believe the cultural failures had been as bad as that,” Mr Turnbull.

“I believe with the benefit of hindsight we should have held the royal commission earlier.”

The other three big banks will release their half-year financial earnings in April.