AustralianSuper to vote against $18.7bn Origin Energy takeover

The super fund’s rejection will raise pressure on Brookfield and EIG to raise their offer price or risk defeat.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

AustralianSuper will vote against Brookfield and EIG’s $18.7bn bid for Origin Energy, a move that will heighten pressure on the consortium to raise its offer or risk defeat.

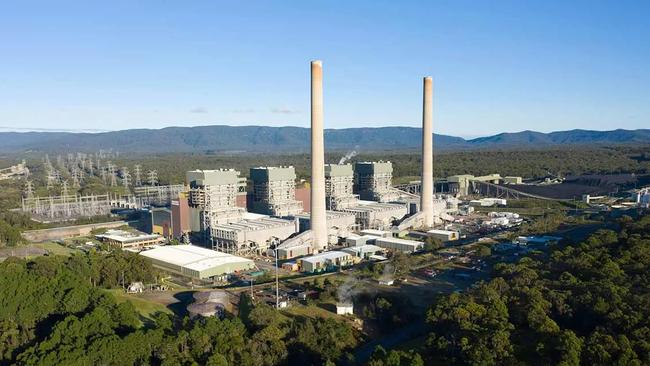

AustralianSuper is Origin’s largest shareholder, owning more than 13 per cent of the country’s largest electricity and gas retailer, and with a growing number of smaller equity holders already vowing to oppose the offer Brookfield and EIG consortium is struggling to secure the more than 75 per cent of shareholder support it needs for the deal.

The superannuation giant said it had determined it would oppose the deal after concluding Origin was in pole position to capture the value of Australia’s energy transition.

“The current offer from the Brookfield and EIG-backed consortium remains substantially below our estimate of Origin’s long-term value,” AustralianSuper said in a statement.

“AustralianSuper believes the ongoing energy transition, as we move towards net zero by 2050, has further enhanced the value of strategic energy transition platforms, such as Origin.”

The resolution of AustralianSuper scuppers Brookfield and EIG’s hopes that the findings of an independent report that the consortium’s offer was fair value would sway sufficient numbers of shareholders.

The market has already apparently decided Brookfield and EIG would need to offer more. Brookfield and EIG’s offer equates to about $8.81 a share, which is well below what Origin shares have traded at.

Macquarie has suggested Brookfield and EIG will need to raise its offer to closer to $10 a share, although other analysts have gone higher still.

AustralianSuper, however, said it disagreed with the findings of the Grant Samuel report, insisting that the independent expert had used valuation multiples that are significantly below recent precedents.

Opponents of the Brookfield and EIG offer cite recent transactions such as Squadron Energy’s $4.1bn deal for CWP Renewables – a deal worth about 25 times EBITDA – well ahead of the 5.8 to 6.5-times multiple that the independent expert said the consortium’s offer for Origin was worth.

Brookfield and EIG did not immediately comment on AustralianSuper’s announcement.

Sources close to the consortium have continued to insist the offer is fair when considering the vast amount of money that Origin will need to invest in zero-emission power generation and the impact on existing shareholders.

The sources also questioned the like-for-like comparison used to diminish Brookfield and EIG’s offer, especially when considering Origin shareholders will likely be impacted by the retailer’s ambition to build 5GW of new generation capacity.

Brookfield has said it would invest $20bn to $30bn to develop 14GW of large-scale green generation and storage capacity in Australia, investments which former NSW energy Minister Matt Kean said would be vital if the country is to meet its transition targets.

“Investments like this one are exactly what is needed if we are going to actually deliver the transition. In fact we need transactions like this right across the Australian energy system,” Mr Kean told The Australian.

“It's really important for the Australian economy and the planet that we see more big institutional investors bank rolling the Australian energy transition because companies that do not have access to build the energy future are at risk of being left behind and saddling Australian consumers with more expensive and less reliable energy.”

AustralianSuper’s announcement overshadowed Origin’s latest quarterly results, which showed lower revenues from its LNG operations and energy business as mild weather dented demand and easing global prices weighed.

Origin Energy chief executive Frank Calabria said the quarter demonstrated strong operational performances across both the LNG and energy markets businesses.

“Australia Pacific LNG production for the first quarter was higher than the comparable quarter of FY2023 as the teams continued to focus on reducing the backlog of offline wells and production optimisation following the wet weather impacts in previous periods. This improved production allowing Australia Pacific LNG to boost sales volumes to the domestic market and deliver $2.35bn in revenue for the quarter,” said Mr Calabria.

The result could be Origin’s last as a publicly listed company, though a revised offer may have to come to sway sufficient numbers of shareholders.

Origin shareholders are set to vote on the takeover deal on November 23. A revised bid could see a delay to the vote, however,

A scuppering of the bid for Origin would be a blow for Australia’s ambitious energy transition ambitions.

Brookfield will be able to spend far more than Origin on new generation capacity, much needed as Australia has set an aggressive target of having renewable sources generate more than 80 per cent of the nation’s electricity by 2030. Australia is struggling to meet the target.

Brookfield’s capacity to accelerate generation investment was a key reason the Australian Consumer and Competition Commission approved the consortium’s bid, despite admitting it had some antitrust concerns about the deal.

The scale of the delays led the Australian Energy Market Operator to earlier this year warn urgent investment was required to ensure reliable supplies of electricity for the next decade.

More Coverage

Originally published as AustralianSuper to vote against $18.7bn Origin Energy takeover