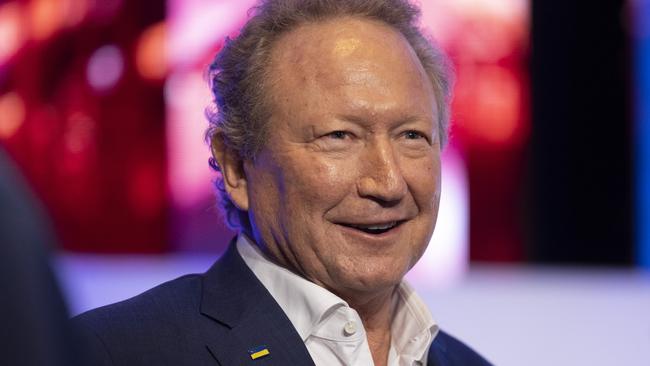

Andrew Forrest biggest green player after $4bn CWP play

Billionaire Andrew Forrest has touted his role as Australia’s biggest renewable energy player after buying CWP Renewables for $4bn-plus.

Fortescue Metals chairman Andrew Forrest says he plans to build his privately owned Squadron Energy vehicle into Australia’s biggest energy company after beating a raft of incumbents with a $4bn-plus deal to buy CWP Renewables.

The buyout will catapult Squadron, part of Dr Forrest’s Tattarang investment group, into the nation’s biggest renewables owner.

“Australia’s largest energy companies must be green for both the sake of the environment but as importantly for the sake of every Australian’s standard of living and their right to low-cost reliable energy,” Dr Forrest told The Australian on Wednesday.

As first flagged by The Australian’s DataRoom column on Wednesday morning, the deal will be financed through Squadron Energy and follows a move earlier this year when Dr Forrest pledged to bankroll a $3bn Queensland clean energy project including one of the world’s biggest batteries.

Dr Forrest said the deal would propel Squadron into Australia’s largest renewable energy investor, operator and developer with a 2.4 gigawatt portfolio and a local development pipeline of 20GW.

“I’m quite happy to say it was in excess of $4bn. It doesn’t cause the Squadron Group any indigestion,” he said.

“We’ve been able to finance it easily. And we did it because we need the scale. And we did it because the country needs the scale in its green energy companies.”

Big energy companies have been nervously watching a looming intervention by the federal government.

Squadron hopes to bring on Australia’s first LNG import plant by the end of next year in NSW’s Port Kembla, but Dr Forrest said the nation’s dependency on fossil fuels left Canberra with little alternative.

“It is deeply concerning for very long-term projects to move the goalposts,” Dr Forrest said.

“But what I can say is that we can understand why the government is doing it, but we say strongly as a group that this is what happens when you rely on fossil fuels. And this is another very strong message to the government and to the Australian people that we simply must get off fossil fuels as soon as possible.”

Squadron decided against a takeover of either Origin Energy or AGL Energy, pointing to their fossil fuel footprint and faltering leadership on green transition.

“Their way of generating energy is yesteryear. It’s disposable. It is not the future which Australia needs,” Dr Forrest said.

“I didn’t see in the leadership of those companies anything like the vision, the personal energy, the professionalism, the speed, the decisiveness, the effectiveness that we’ve been able to pull together in Squadron and we saw very clearly in CWP.”

The mogul’s acquisition of CWP had not been tipped by the market, with the three favourites the world’s largest wind farm owner, Iberdrola, along with QIC, AGL Energy’s renewable energy venture Tilt Renewables, and Origin Energy with CDPQ.

Origin, fielding an $18.4bn takeover offer from Brookfield and EIG, pulled out of the race.

Squadron’s portfolio will provide enough electricity to power 8.5 million homes, more than double the number of homes in NSW, according to the company.

CWP spans wind, solar and battery farms, and provides energy to Transurban, Woolworths, Sydney Airport, Commonwealth Bank and Snowy Hydro.

It currently operates more than 1.1GW of wind assets, including NSW’s Sapphire Wind Farm, the largest in the state, Murra Warra, with a combined 435MW, and the 142MW Crudine Ridge.

CWP had approvals in place to construct four more wind farms in NSW totalling more than 750MW, along with a construction-ready 414MW wind farm, 180MW solar farm, two battery farms and a firming power station capable of using hydrogen, biofuels and hydrogen gas blends, Squadron said.

“The acquisition will unlock an unparalleled development pipeline in NSW and Victoria to ensure reliability of supply across the east coast and transform the market from generator-led to customer-led,” Squadron said.

Squadron also owns 15 per cent of the giant $35bn Sun Cable project – which plans to export green electricity from the Northern Territory to Singapore – and is developing the Clarke Creek renewables hub in Queensland, while also holding a 75 per cent stake in wind farm developer Windlab.

The company’s chief executive, Eva Hanly, said it would be starting construction of another 2GW worth of projects within the next 18 months.

Squadron is working to develop a major LNG terminal at Port Kembla in NSW, along with a gas and green hydrogen power station at the same location.

Dr Forrest hired businessman Rod Eddington to join the advisory board of Squadron in November, with ex-Australian Energy Market Operator boss Audrey Zibelman signed on in September.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout