Who made the gains in January? Here are the top ASX resources winners

AusQuest was the star player with a potentially huge copper discovery in Peru, but gold stocks dominated the ASX resources Top 50 in January.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

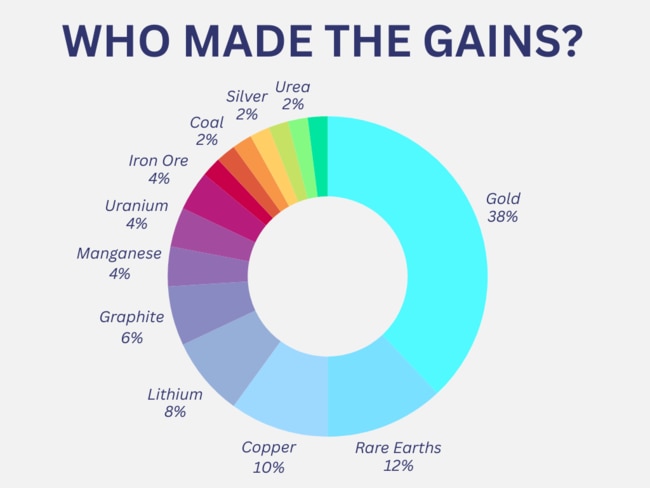

The top 3 commodities for July include gold, rare earths and copper

AusQuest tops the charts for the biggest monthly stock gain

Western Gold Resources soars as it closes on gold producer status

It may be a good time to be in gold, but it was a breakout copper stock that emerged as January's top ASX resources gainer with AusQuest (ASX:AQD) up 388% after announcing a large porphyry discovery at low altitude in Peru.

The discovery hole intersected 348m at 0.26% copper and 0.06ppm gold from surface, powering the long-time ASX battler and prospect generator to a major monthly run, with its shares tripling on the day of the discovery alone.

“We are generally a fairly conservative group but this has (sent) a bit of excitement through the company and the board about what the future holds,” MD Graeme Drew told Stockhead's Bevis Yeo.

“We have results from six more holes to come in and that’s going to tell us a lot, so over the next few weeks, we will get a better picture of what is there.

“Either way, we have just scratched the surface of this target. We have a large caldera-type structure, which you can see on satellite imagery, and that’s anywhere from several km2 up to 10-20km2 possibly.”

READ: Has ASX explorer AusQuest made the next big South American copper discovery?

Lithium and graphene took out second and third biggest moving stocks with Cosmos Exploration (ASX:C1X) up 119% and First Graphene (ASX:FGR) recording a 115% gain.

Cosmos established itself as a potential first-mover into the immature Bolivian lithium scene, looking to invigorate the forgotten corner of South America's Lithium Triangle using DLE technology developed by $1.3bn capped Vulcan Energy Resources (ASX:VUL). FGR secured patents in Australia and Korea for a technology that processes petroleum waste into graphite, graphene and hydrogen.

Gold stole the show overall this month for the biggest commodity gains. A total of 19 gold companies made the top 50 and, of those, Western Gold Resources (ASX:WGR) and Koonenberry Gold (ASX:KNB) flew past the +100% mark.

Plenty of analysts see the metal flying further, with Aussie producers now enjoying prices in the order of $4558/oz.

WGR in particular is chasing that sweet, sweet producer status, looking to get up and running at its Duke gold project in WA – which has a resource of 3.25Mt at 2.1g/t gold for 214,000oz of gold, including 26,000oz at 1.91g/t gold at the recently updated Gold King deposit.

Progressing a gold deposit to production is a canny if obvious move with gold prices trading around record highs in the wake of Donald Trump's tariff tango, and bets remaining bullish.

Last year, WGR released a scoping study outlining a target mining inventory of 447,000t at 2.55g/t to produce 34,000oz of gold.

Based on a gold price of $3500/oz, the operation would cost $2.1-2.5m and generate an estimated undiscounted accumulated cash surplus of $38.1m, rising to $55m when using a $4000/oz gold price.

The company recently confirmed it was in discussions with multiple plant owners in the region. The closest – less than 50km away – is Wiluna, which continues to operate despite the collapse of owner Wiluna Mining Corporation in mid-2022.

WGR believes it can be in production within 7-8 months of signing a toll treatment deal. Looking at KNB, the company found a 4km gold trend this month at its Prince of Wales project in New South Wales as major partner Newmont also started exploration for gold and copper at the Junee JV.

Here are the top 50 ASX resources stocks for the month of January

| Security | Description | Last | %Mth | MktCap |

|---|---|---|---|---|

| AQD | Ausquest Limited | 0.039 | 388% | $44,067,453 |

| C1X | Cosmosexploration | 0.068 | 119% | $5,675,729 |

| FGR | First Graphene Ltd | 0.058 | 115% | $40,599,391 |

| WGR | Westerngoldresources | 0.068 | 113% | $11,669,144 |

| KNB | Koonenberrygold | 0.025 | 108% | $21,857,187 |

| AUH | Austchina Holdings | 0.002 | 100% | $4,800,767 |

| AX8 | Accelerate Resources | 0.013 | 86% | $8,082,801 |

| SMX | Strata Minerals | 0.035 | 75% | $6,678,531 |

| TMX | Terrain Minerals | 0.005 | 67% | $9,053,477 |

| LYN | Lycaonresources | 0.15 | 67% | $7,947,723 |

| ETM | Energy Transition | 0.064 | 64% | $98,957,355 |

| GDM | Greatdivideminingltd | 0.375 | 63% | $10,400,083 |

| MEU | Marmota Limited | 0.063 | 62% | $68,454,436 |

| AGD | Austral Gold | 0.035 | 59% | $21,430,897 |

| VTX | Vertexmin | 0.325 | 57% | $59,441,958 |

| FTZ | Fertoz Ltd | 0.039 | 56% | $11,561,961 |

| ESR | Estrella Res Ltd | 0.031 | 55% | $58,932,195 |

| GCM | Green Critical Min | 0.021 | 50% | $40,410,369 |

| CRI | Criticalim | 0.018 | 50% | $48,392,075 |

| PUA | Peak Minerals Ltd | 0.012 | 50% | $30,625,323 |

| NRZ | Neurizer Ltd | 0.003 | 50% | $8,894,612 |

| EMN | Euromanganese | 0.043 | 48% | $9,031,677 |

| NPM | Newpeak Metals | 0.016 | 45% | $4,831,076 |

| EG1 | Evergreenlithium | 0.087 | 45% | $4,892,010 |

| ASO | Aston Minerals Ltd | 0.013 | 44% | $16,835,835 |

| HVY | Heavymineralslimited | 0.165 | 43% | $11,062,193 |

| SMM | Somerset Minerals | 0.017 | 42% | $4,190,279 |

| RHK | Red Hawk Mining Ltd | 1.195 | 41% | $238,774,717 |

| ASL | Andean Silver | 1.145 | 41% | $181,795,949 |

| MAG | Magmatic Resrce Ltd | 0.042 | 40% | $17,516,130 |

| GSN | Great Southern | 0.021 | 40% | $20,744,261 |

| AKO | Akora Resources | 0.14 | 40% | $17,556,387 |

| WAK | Wakaolin | 0.07 | 40% | $36,654,389 |

| CAY | Canyon Resources Ltd | 0.25 | 39% | $354,221,072 |

| PXX | Polarx Limited | 0.009 | 38% | $21,379,509 |

| EUR | European Lithium Ltd | 0.058 | 38% | $83,820,525 |

| FXG | Felix Gold Limited | 0.115 | 37% | $37,824,234 |

| ERM | Emmerson Resources | 0.105 | 36% | $66,739,982 |

| MEK | Meeka Metals Limited | 0.105 | 36% | $261,094,921 |

| NRX | Noronex Limited | 0.015 | 36% | $7,495,311 |

| BOE | Boss Energy Ltd | 3.31 | 36% | $1,286,420,502 |

| CYL | Catalyst Metals | 3.51 | 36% | $793,202,239 |

| TOR | Torque Met | 0.072 | 36% | $17,975,803 |

| REZ | Resourc & En Grp Ltd | 0.031 | 35% | $20,820,813 |

| PTR | Petratherm Ltd | 0.41 | 34% | $126,770,601 |

| KLI | Killiresources | 0.063 | 34% | $8,834,096 |

| ERL | Empire Resources | 0.004 | 33% | $5,935,653 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | $7,431,504 |

| FBM | Future Battery | 0.024 | 33% | $15,968,542 |

| AOA | Ausmon Resorces | 0.002 | 33% | $2,179,455 |

More small cap standouts

Accelerate Resources (ASX:AX8)

This month Accelerate unveiled its new gold strategy in Kalgoorlie, underpinned by the acquisition of a 70% stake in the Kanowna East gold project from Metal Hawk.

Besides sitting just 25km from the Super Pit and 9km from the Kanowna Belle gold mine, Kanowna East also hosts targets identified from historical data including drilling that returned results such as 4m at 17.7g/t gold and 8m at 4.5g/t gold.

Should a commercially viable resource be defined, the company will have the option to quickly bring the project into production through low-cost toll treatment given its proximity to no less than 10 process plants within a 75km radius.

Former De Grey Mining (ASX:DEG) senior geologist and now AX8 chief executive officer Luke Meter said the acquisition is a strategic move into an area which it considers to be highly prospective for potential Tier 1 gold discoveries.

“Accelerate plans to actively drill the significant gold targets we have defined to date and expand our exploration in this area," he said.

"With gold prices at record highs in Australia, it is time to play to the strengths of our team in this commodity and create value in the near term."

The company has also applied for a licence over 5km of highly prospective strike along the Scotia-Kanowna dome near Kanowna Belle.

Strata Minerals (ASX:SMX)

Strata Minerals has been granted a Program of Work to start maiden drilling at the Penny South project, which takes in a ~2.5km strike extension of the Penny West Shear, just 550m from Ramelius Resources’ (ASX:RMS)

Penny deposits in the southern Youanmi Greenstone Belt, which are estimated to contain 440,000t at 22g/t, or 320,000oz of contained gold.

While over 1000 holes have been drilled at the project, these were mostly RAB and AC holes with RC holes accounting for only ~3% of the drill holes. There has been no diamond drilling.

The average downhole length of the historical drill holes within Penny South is ~42m with only 18 holes deeper than 100m and 7 holes deeper than 200m.

SMX has reinterpreted all available data and will now test two priority targets at depth. This mirrors the strategy followed by Spectrum Metals, which reported outstanding exploration success at Penny North and at the southern end of the Penny West pit within deeper drill holes beneath cover. It proved to be a company maker, leading to its eventual $208m takeover by RMS.

Terrain Minerals (ASX:TMX)

The company kicked off stage two followup RC drilling at its Wildflower gold project, zeroing in on two new targets based on field observations from the stage one program last year.

Those assays are pending, but the company has high hopes the Mirja target, which is under newly found historic workings, could prove promising.

“The combination of favourable geological features and encouraging historical data suggests significant potential for a gold discovery at the Wildflower gold project,” the company said.

They’ve also commenced drilling at their Lort River project, testing high-priority Vtem bedrock sulphide conductor targets in the same mineralised belt as IGO’s (ASX:IGO) Nova-Bollinger nickel-copper mine.

TMX says the target conductors are on the western edge of the “eye” feature, similar to Nova-Bollinger’s orebody locations, and that they may share a similar mafic intrusion origin as the Nova-Bollinger deposits.

“We strongly believe we are at the forefront in the search for the next Nova-Bollinger-style magmatic nickel-copper deposit within the Albany-Fraser Belt,” executive director Justin Virgin said.

“IGO’s success with Nova has shown that these highly valuable ore bodies are not isolated occurrences but part of a broader, richly mineralised region.

“IGO invested $1.8 billion in Nova-Bollinger when nickel prices were significantly lower, highlighting the immense potential of these deposits.

“IGO’s 4Q24 results presentation also demonstrated that the Nova-Bollinger ore bodies are profitable even at today’s nickel price.”

At Stockhead we tell it like it is. While Strata Minerals, Koonenberry Gold and Western Gold Resources are Stockhead advertisers, they did not sponsor this article.

Originally published as Who made the gains in January? Here are the top ASX resources winners