This is how Aussie markets could get caught in the crossfire of Trump’s tariff war

Trump’s tariff threats are shaking markets, tech stocks are feeling the squeeze, and Aussie stocks could get caught in the crossfire.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Trump’s tariff chaos have put global markets on a knife's edge this week

US tech stocks brace for potential supply chain hits, costs rise

Aussie markets could also be impacted if trade wars intensify

US President Donald Trump's tariff threats against key trading partners Canada, Mexico, and China threw global markets into a spin earlier this week.

But after initially imposing hefty tariffs on imports from these nations, there’s been something of a reprieve, with Trump hinting that tariffs on Canada and Mexico will be delayed for at least 30 days.

Trump even hinted that he’d probably have a word with China about their tariffs in the next day or so, further lifting spirits.

This has given markets a bit of a breather, offering a small flicker of hope that other nations could see lighter treatment.

But let’s rewind a bit and set the stage.

On February 1, Trump signed off on some major tariffs. Canada and Mexico got hit with 25% on non-energy imports, while China faced 10% on a broad range of goods.

Trump even hinted at the possibility of slapping tariffs on the European Union, sending the message that the US was ready for a showdown.

And this time, it might be more than just posturing.

Canada, Mexico, and China all immediately started retaliating. Canada, for instance, counter-attacked and threatened tariffs on US$109 billion worth of US exports, including alcohol, furniture and dairy.

Meanwhile, China issued a counter statement, vowing to take “corresponding measures”.

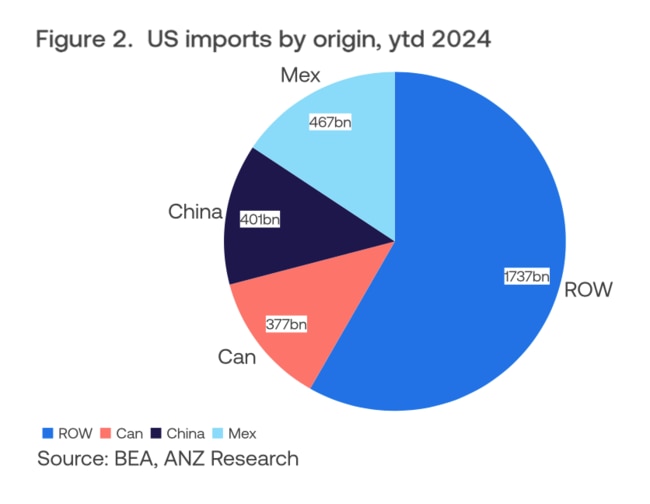

“Canada, China, and Mexico make up ~42% of US imports and are important components of both S&P 500 company supply chains and revenues,” Citi analysts noted.

The concern is clear: these tariffs have the potential to slow global economic growth, boost inflation and disrupt markets, with Citi forecasting a 1.5% hit to US GDP.

Tech giants to struggle

On the global front, the economic consequences of Trump's tariff spree are still unfolding.

But the US automotive and electronics sectors, heavily integrated with Canada, Mexico and China, are already feeling the pressure.

The impact on giants like Apple and Nike, which rely heavily on Chinese manufacturing, is also going to be felt across the board.

Consumers might end up paying more for everything from cars to clothing as companies pass on the increased costs.

Josh Gilbert, market analyst at eToro, had a sharp take on what this means for investors.

"Crypto assets are giving us an early sign as to what investors may see from tech stocks," Gilbert said.

"Bitcoin’s correlation to the Nasdaq has picked up this year, which tells us that US equities could be set to see a similar fate.”

As a reminder, on Monday Ethereum had its worst day in years, dropping by nearly 26%, with Bitcoin also sinking into the red.

Gilbert added that the big fear for tech stocks is supply chain issues that could result in higher costs.

“Big tech is spending big, and rising costs alongside growing capex is not a recipe for success. That will only cast doubt over earnings growth and margins.

“Big tech CEOs have done their best to schmooze Trump since his win, but that may only get them so far."

Damian McIntyre at Federated Hermes pointed out that with the recent announcements, Trump has notified the world that tariffs are a tool that he is willing and able to utilise.

While this could prove to be a negotiation tactic, McIntyre believes it has the potential to reshape global investing narratives, including the need for higher risk premiums by countries that Trump deems as not playing fair.

“We believe that investing in a broad range of globally diversified assets is one way that investors can maintain strong, resilient portfolios.”

How this will impact Australia and the ASX

Australia's not immune to the fallout either, as the ASX proved on Monday with a sharp drop of 1.7%.

The Australian dollar slipped briefly to below US61 cents (its lowest in four years), and commodities like iron ore, aluminium and copper were smashed.

"New Zealand and Australia are likely to face direct and indirect impacts from US tariff policy once universal tariffs are enacted, and as the Chinese economy responds to tariffs," said a note we received from Rabo Bank.

However, Australia and New Zealand’s free-floating currencies would help them stay competitive when tariffs hit, acting as shock absorbers.

And while both countries are vulnerable to US tariffs, New Zealand will be more exposed due to its trade reliance and bigger surplus with the US, added Rabo.

For ASX-listed companies selling to the US, things could get tricky, too.

Fisher & Paykel Healthcare (ASX:FPH), for example, announced on Monday that while it doesn’t expect a huge impact on its 2025 profits, tariffs might delay its margin targets by a couple of years. F&P manufactures nearly half of its products in Mexico.

Fortescue (ASX:FMG) and Rio Tinto (ASX:RIO) also slipped heavily, and if global trade tanks due to tariffs, it could weaken the demand for iron ore further across the board.

Smaller companies like Cettire (ASX:CTT), the online luxury goods retailer, also felt the pinch, crashing 15% on Monday.

The company tried to reassure investors, saying only 7.5% of its sales from the US were tied to China, Mexico, or Canada. But the damage was already done, as tariff fears took their toll.

On the whole, however, experts still believe the direct impact of the tariffs on Australia should be fairly minor, as exports to the US make up just 4% of Australia’s total.

Rather, the real risk lies in global trade.

If this trade war escalates, and other countries respond with counter tariffs, Australia could suffer. A 10% global trade decline could see Australia’s GDP shrink by up to 1.2%, according to an OECD study.

A key point to watch is, therefore, how long these tariffs stay in place and how aggressive Trump gets with them. If he keeps ramping up the pressure, the fallout could intensify.

Nigel Green at deVere Group isn’t sweating it, though. He sees this as a golden moment for investors ready to make moves.

“Those who hesitate risk being caught on the wrong side of market movements,” said Green.

“But for those who learn from past disruptions and take decisive action, this period of volatility could present some of the best opportunities in years.”

Originally published as This is how Aussie markets could get caught in the crossfire of Trump’s tariff war