Lunch Wrap: ASX rallies as China teases stimulus; Telix hit by FDA blow

ASX lifts on Wall Street’s rally and China’s stimulus talk, but Telix cops a hit from the FDA while Lynas and Flight Centre face pressure.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX lifts as Wall Street rallies and China teases stimulus

Big tech stocks rally, Tesla and Nvidia steal the show

Telix hit by FDA blow, Lynas and Flight Centre face pressure

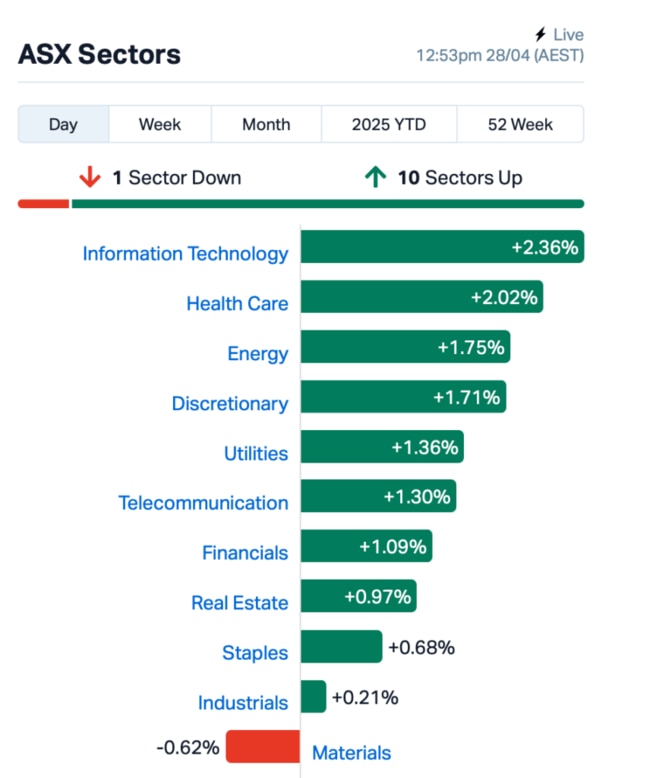

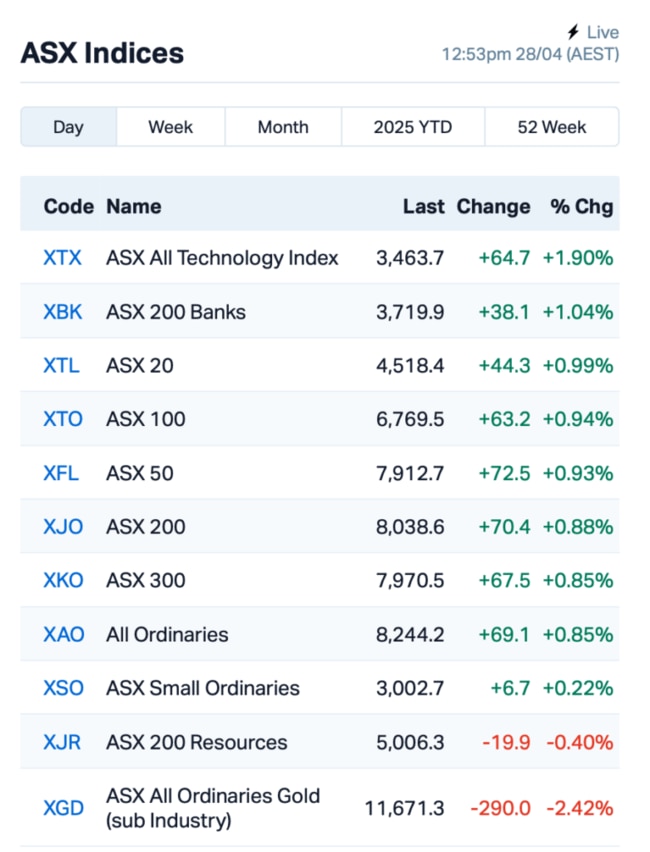

After climbing more than 2% last week, the ASX opened the week in a good mood, climbing 0.8% by lunch time, AEST.

This was mainly driven by a strong finish from Wall Street, and the prospect of fresh economic juice from China.

On Friday, Wall Street closed out the week with a bit of a swagger. The S&P 500 notched up 0.74%, making it four winning sessions on the trot.

The Nasdaq also jumped 1.26% as tech stocks came roaring back to life.

Tesla leapt nearly 10% as the market got giddy over the company’s potential launch into India, and fresh signals from Washington about loosening the red tape on self-driving tech. Nvidia was close behind, climbing 4.3%.

There’s more Big Tech news to come, too. Microsoft and Meta will report their earnings mid-week, while Amazon and Apple will share theirs on Thursday, US time.

Meanwhile, the broader market was taking cues from President Trump, who piped up again about trade talks with China.

He said progress was being made, although China immediately denied that any real discussions were happening.

Still, a few reports floated over the weekend suggesting China might roll back some of its 125% tariffs on US goods.

That was enough to get investors dreaming of a trade thaw, even if it’s more smoke than fire for now.

Trump was also back in front of the cameras late Friday, saying he wouldn’t drop tariffs on China unless he got something decent in return.

He reckoned another pause in the tariff war was “unlikely,” but you know how it goes, the market hears what it wants to hear.

Back on the home front, Aussie traders were eyeing China too, waiting to see if the People’s Bank of China would finally crack open the stimulus toolbox.

Finance Minister Lan Fo’an said the country was ready to roll out “more effective policies” to fire up growth.

On the stock front, ASX large-capped tech names followed the US lead this morning, with NextDC (ASX:NXT) jumping 4%.

The big banks also chipped in, with Australia and New Zealand Banking Group (ASX:ANZ) up 2%.

But the iron ore miners were dragging their boots a bit, tracking the price of the ferrous metal downhill.

Gold has also taken a hit, dropping to around US$3,282/oz this morning as de-escalating trade tensions between the US and China put pressure on the price, and it's dragging down gold stocks, too.

In the large caps space, Telix Pharmaceuticals (ASX:TLX) took a hit of 5% after a US FDA knocked back its application for TLX101-CDx, the imaging drug designed to help diagnose brain cancer.

The FDA reckons the submission needs more clinical evidence, even though Telix had been in constant consultation and there are no safety concerns. Telix plans to challenge the decision, and is already working on bolstering its data through current trials.

Lynas (ASX:LYC) edged higher by over 3% after posting a solid lift in quarterly sales, but warned that the US-China trade stoush is still throwing a spanner in the rare earths market.

And finally, Flight Centre (ASX:FLT) said it was bracing for headwinds. The company has downgraded its full-year profit forecast to between $300 million and $335 million, citing a tough market and slower-than-hoped trading in its busiest period. FLT shares were up 2%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 28 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ADD | Adavale Resource Ltd | 0.002 | 50% | 3,058,746 | $2,287,279 |

| RAN | Range International | 0.003 | 50% | 4,580 | $1,878,581 |

| AZL | Arizona Lithium Ltd | 0.007 | 40% | 10,824,744 | $22,809,073 |

| INF | Infinity Lithium | 0.028 | 40% | 2,814,183 | $9,451,842 |

| TON | Triton Min Ltd | 0.007 | 40% | 10,000 | $7,841,944 |

| MMR | Mec Resources | 0.004 | 33% | 604,687 | $5,549,298 |

| PCL | Pancontinental Energ | 0.008 | 33% | 29,093,104 | $48,819,515 |

| AGI | Ainsworth Game Tech. | 0.985 | 33% | 150,688 | $249,227,507 |

| TMB | Tambourahmetals | 0.034 | 31% | 22,307,371 | $3,057,341 |

| MBK | Metal Bank Ltd | 0.013 | 30% | 207,773 | $4,974,590 |

| ASR | Asra Minerals Ltd | 0.003 | 25% | 2,263,455 | $4,746,254 |

| EAT | Entertainment | 0.005 | 25% | 155,815 | $5,235,144 |

| MTB | Mount Burgess Mining | 0.005 | 25% | 199,400 | $1,406,811 |

| OSL | Oncosil Medical | 0.005 | 25% | 250,000 | $18,426,321 |

| 1AI | Algorae Pharma | 0.006 | 20% | 974,112 | $8,436,974 |

| AJL | AJ Lucas Group | 0.006 | 20% | 106,673 | $6,878,648 |

| AQX | Alice Queen Ltd | 0.006 | 20% | 500,001 | $5,734,450 |

| FIN | FIN Resources Ltd | 0.006 | 20% | 600,000 | $3,474,442 |

| GCM | Green Critical Min | 0.012 | 20% | 8,049,418 | $19,616,783 |

| MRD | Mount Ridley Mines | 0.003 | 20% | 202,154 | $1,946,223 |

| RDS | Redstone Resources | 0.006 | 20% | 330,655 | $4,626,892 |

| SMN | Structural Monitor. | 0.390 | 18% | 168,418 | $50,920,666 |

| PUA | Peak Minerals Ltd | 0.011 | 17% | 1,783,023 | $25,265,892 |

| VN8 | Vonex Limited. | 0.035 | 17% | 15,000 | $22,578,106 |

Dart Mining (ASX:DTM) is handing over the keys to a couple of its non-core Victorian gold and copper projects after cutting a $3.4 million deal with Infinity Lithium (ASX:INF). The agreements give Infinity a crack at snapping up 100% of the Mitta Mitta Project and earning into 80% of the Corryong Project, both tucked in the Lachlan Fold Belt. The setup includes a 60-day exclusivity window and a small upfront fee of $25,001, with $475,000 more due if Infinity pulls the trigger.

Ainsworth Game Technology (ASX:AGI) has struck a deal with its majority shareholder, Novomatic, to buy up the remaining 47.1% of shares Novomatic doesn’t already own, offering $1.00 per share in cash. This offer represents a 35% premium to Ainsworth’s last closing price, valuing Ainsworth at $336.8 million. If the deal goes ahead, Ainsworth shareholders may also receive a fully franked dividend, which could adjust the cash offer. The deal is subject to shareholder approval.

Tambourah Metals (ASX:TMB) has extended the gold mineralisation at the Tambourah King lode, with drilling showing significant gold over a 200m strike. Results include intersections like 3m at 2.99g/t Au and 5m at 1.35g/t Au. The mineralisation is still open to the north and south, and the company is gearing up for more drilling. Tambourah’s also secured up to $180k in government co-funding to continue drilling on high-grade targets.

Mount Burgess Mining (ASX:MTB) has released promising interim results from hydrometallurgical test work on its Nxuu Deposit. The tests showed high recoveries for key metals: zinc (96%), vanadium (91%), germanium (77%), and gallium (59%). While lead recovery was lower at 79.4%, previous flotation tests had shown a better recovery of 93%. These results will be used in a scoping study planned for later in 2025.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 28 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HCF | HGH High Conviction | 0.400 | -47% | 73,571 | $14,748,923 |

| CGO | CPT Global Limited | 0.049 | -35% | 13,593 | $3,142,302 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 1,505,000 | $9,862,021 |

| HCD | Hydrocarbon Dynamics | 0.002 | -33% | 101,006 | $3,234,328 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 586 | $7,254,899 |

| PEB | Pacific Edge | 0.075 | -32% | 111,649 | $89,310,757 |

| BRX | Belararoxlimited | 0.094 | -30% | 2,473,261 | $21,130,518 |

| 1TT | Thrive Tribe Tech | 0.002 | -25% | 30,728,282 | $4,063,446 |

| EEL | Enrg Elements Ltd | 0.002 | -25% | 1,149,000 | $6,507,557 |

| CAV | Carnavale Resources | 0.004 | -20% | 2,732,828 | $20,451,092 |

| EVR | Ev Resources Ltd | 0.004 | -20% | 1,194,203 | $9,929,183 |

| OVT | Ovanti Limited | 0.004 | -20% | 1,842,918 | $13,507,739 |

| SRJ | SRJ Technologies | 0.019 | -17% | 2,589,130 | $13,928,296 |

| 1AD | Adalta Limited | 0.005 | -17% | 400,000 | $3,859,337 |

| CUF | Cufe Ltd | 0.005 | -17% | 1,927,836 | $8,079,449 |

| SER | Strategic Energy | 0.005 | -17% | 254,320 | $4,026,200 |

| TSL | Titanium Sands Ltd | 0.005 | -17% | 26,357 | $14,020,483 |

| ECS | ECS Botanics Holding | 0.011 | -15% | 2,313,549 | $16,848,644 |

| EV1 | Evolutionenergy | 0.011 | -15% | 940,751 | $4,714,456 |

| GLL | Galilee Energy Ltd | 0.006 | -14% | 2,022,890 | $4,833,683 |

| JAV | Javelin Minerals Ltd | 0.003 | -14% | 8,585,348 | $21,161,522 |

| MKL | Mighty Kingdom Ltd | 0.006 | -14% | 2,000,000 | $2,254,354 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 723,739 | $11,196,728 |

| SHE | Stonehorse Energy Lt | 0.006 | -14% | 64,257 | $4,791,046 |

IN CASE YOU MISSED IT

Miramar Resources (ASX:M2R) is preparing to delve deeper into the Glandore gold project in Western Australia, following up on historical results of up to 1m at 161 g/t gold with plans for a seismic survey and multi-element analysis of end of hole samples. The company will advance its geophysical and metallurgical efforts as it waits on the grant of Glandore’s pending mining licence application.

Caprice Resources (ASX:CRS) has kicked-off a 5,000-metre Phase 3 drilling program at the Island gold project, targeted several high-grade, structurally controlled gold targets and following up on results of 28m at 6.4 g/t gold from 114m and 22m at 2.3 g/t gold from 168m of depth.

Entering into a binding head of agreement with Red Hill Minerals (ASX:RHI), Brightstar Resources (ASX:BTR) will receive a cash payment of $4 million in return for a 2% gross revenue royalty once BTR completes 80,000m of drilling at the Sandstone gold project.

Two fully developed stope blocks containing 2,075 tonnes at 17.8 g/t gold has been identified by Vertex Minerals (ASX:VTX) at its Reward Mine. The company says the stopes are suitable for airleg mining, and were not included in the production forecast detailed in VTX’s 2024 PFS.

Adding more than 30 years’ experience in executive decision making and financial markets experience to the board, Petratherm (ASX:PTR) has tapped Rob Sennitt to become executive director of the board, effective May 1. Sennitt joins the team as PTR moves to develop its titanium-rich HMS Mickanippie project to commercialisation.

At Stockhead, we tell it like it is. While Miramar Resources, Caprice Resources, Brightstar Rsources, Vertex Minerals and Petratherm are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX rallies as China teases stimulus; Telix hit by FDA blow