Lunch Wrap: MinRes rallies; DY6 goes ballistic, up 300pc after monster gallium hit

The ASX kept grinding higher on Tuesday morning, while MinRes jumped and DY6 lit up the boards with a massive gallium strike in Malawi.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX grinds higher as Wall Street wobbles

MinRes rockets despite weak update as punters bet worst is over

DY6 explodes 300pc on hot gallium strike in Malawi

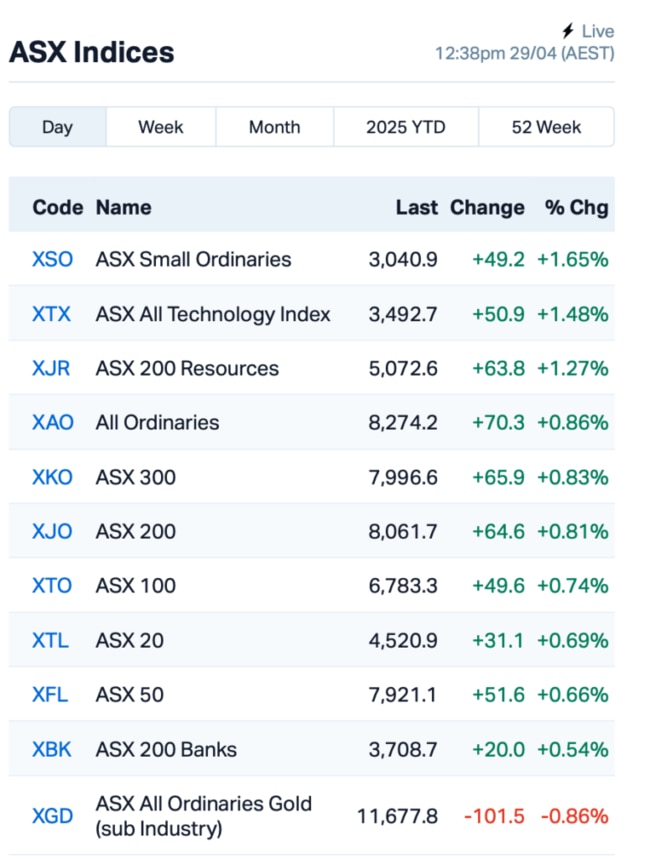

The ASX put on a decent show Tuesday morning, lifting for the fourth session in a row despite a jittery Wall Street session last night.

The benchmark ASX 200 index crept up around 0.7% by lunch time, AEST.

Last night, Wall Street wobbled early on, but found its feet late in the session. The S&P 500 managed to scratch into positive territory, while the Nasdaq dipped 0.1%.

Big Tech was front and centre of investors’ minds, with Apple, Amazon, Meta and Microsoft all due to report their quarterlies over the next couple of days.

Investors are also eyeing US inflation and GDP figures, both of which will help shape the Fed’s next move.

But what got investors really buzzing was a bit of trade news.

Treasury Secretary Scott Bessent gave markets a sliver of hope, saying the US will soften the blow of automotive tariffs by pulling back some of the duties slapped on foreign-made parts.

The timing of the announcement, of course, is no accident. Trump is about to visit Michigan, ground zero for auto makers.

But over in China, officials rejected the idea that any talks are happening and accusing the US of trade bullying.

The People’s Daily, the Communist Party’s mouthpiece, ran a full-page piece saying if other nations keep backing down, the bullies will only keep pushing.

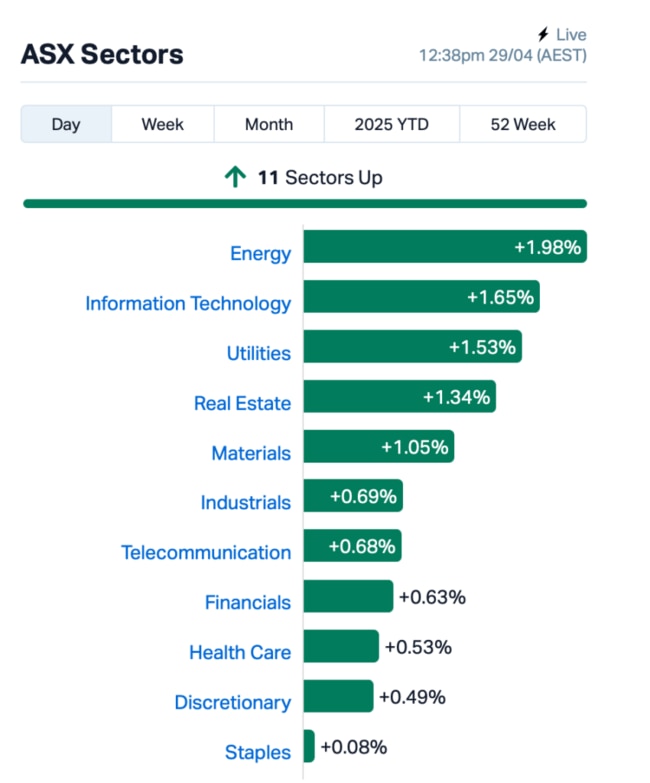

Back home, it was energy and tech stocks doing the heavy lifting this morning, riding on optimism that inflation might finally be crawling back down.

That will be tested when the local quarterly CPI report lands on Wednesday.

In large caps news, Northern Star Resources (ASX:NST) took a beating, down 6% after cutting its gold output guidance. Access issues at its Golden Pike North mine, rising costs, and heavier royalties also left investors unimpressed.

Over in the coal patch, Whitehaven Coal (ASX:WHC) rallied 5% despite a soggy quarterly result. Production and sales took a hit from wet-season disruption in Queensland, and slower-than-hoped progress at Narrabri in NSW.

Still, WHC reckons it will hit the upper end of its annual output guidance, which seemed enough to keep the market happy.

Meanwhile, Woodside Energy Group (ASX:WDS) is going all-in after locking in a massive $27 billion bet on its Louisiana LNG project, with first gas set for 2029.

WDS said it’s aiming to pump out 16.5 million tonnes a year from this site alone, enough to make it one of the biggest players in global LNG by the 2030s. Shares were up 0.5%.

But the real fireworks this morning were over at Mineral Resources (ASX:MIN).

MinRes shares exploded 12.5%, which, on the face of it, seems odd given the miner had just slashed output guidance from its Onslow Iron Project and warned that costs and debt were both climbing.

It now sees annual output as low as 8.5 million tonnes, an 8% trim, while net debt jumped another $400 million in the March quarter.

So why the surge? Maybe it’s investors betting that the worst is already baked in.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 29 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| DY6 | Dy6Metalsltd | 0.165 | 293% | 5,842,597 | $2,117,255 |

| EAT | Entertainment | 0.008 | 60% | 18,622 | $6,543,930 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 2,598,009 | $3,253,779 |

| RAN | Range International | 0.003 | 50% | 270,606 | $1,878,581 |

| MVP | Medical Developments | 0.650 | 40% | 516,841 | $52,386,121 |

| NYM | Narryermetalslimited | 0.042 | 35% | 2,813 | $5,457,699 |

| ADD | Adavale Resource Ltd | 0.002 | 33% | 53,068 | $3,430,919 |

| ERA | Energy Resources | 0.002 | 33% | 22,141,755 | $608,094,361 |

| MMR | Mec Resources | 0.004 | 33% | 280,000 | $5,549,298 |

| SIS | Simble Solutions | 0.004 | 33% | 429,710 | $2,628,991 |

| ADN | Andromeda Metals Ltd | 0.013 | 30% | 25,878,389 | $34,287,277 |

| ICR | Intelicare Holdings | 0.009 | 29% | 12,703,913 | $3,403,317 |

| ID8 | Identitii Limited | 0.009 | 29% | 618,000 | $5,446,095 |

| PHL | Propell Holdings Ltd | 0.009 | 29% | 120,000 | $1,948,367 |

| PVT | Pivotal Metals Ltd | 0.009 | 29% | 1,860,001 | $6,350,581 |

| WYX | Western Yilgarn NL | 0.034 | 26% | 3,215 | $3,714,149 |

| UVA | Uvrelimited | 0.094 | 25% | 1,305 | $4,515,000 |

| ASR | Asra Minerals Ltd | 0.003 | 25% | 21,606,559 | $4,746,254 |

| BUY | Bounty Oil & Gas NL | 0.003 | 25% | 349,559 | $3,122,944 |

| CR9 | Corellares | 0.003 | 25% | 2,267,609 | $1,269,815 |

| DTM | Dart Mining NL | 0.005 | 25% | 1,100,000 | $2,751,056 |

| HLX | Helix Resources | 0.003 | 25% | 1,055,064 | $6,728,387 |

| YAR | Yari Minerals Ltd | 0.005 | 25% | 213,543 | $1,929,431 |

| MNC | Merino and Co | 0.180 | 24% | 693 | $7,696,103 |

DY6 Metals (ASX:DY6) surged almost 300% after striking something special at Tundulu in southern Malawi, near the border with Mozambique. A fresh look at old drill data has uncovered high-grade gallium right from surface, with some hits showing eye-popping grades over long stretches. One standout drill hole pulled 74 metres at over 93 g/t gallium, including a spike at 310 g/t. DY6 said less than half the area has been drilled, and the gallium keeps going deeper, hinting there’s plenty more below.

Gallium is hot property right now thanks to demand in electronics and semiconductors, and most of the global supply is stitched up by China. DY6’s still running tests, but early signs point to a potentially serious play, and the market will be watching closely when results land in the coming weeks.

InteliCare (ASX:ICR) is teaming up with Mecwacare to trial its smart care tech at the Trescowthick Centre in Prahran, Victoria. Mecwacare is a major aged care player in Victoria, and InteliCare’s AI-powered platform is part of its push to become a tech-savvy leader in aged and disability care. The trial will run for three months once the system’s fully set up, and if it goes well, mecwacare could look to expand it across all 22 of its aged care homes. The deal’s worth $212k for now.

Pivotal Metals (ASX:PVT) has just dropped a major upgrade at Horden Lake, and the company said it’s shaping up as one of the best shallow, high-grade copper deposits on the ASX. New drilling has bumped the resource up to 407,000 tonnes of copper equivalent, with 341,000 tonnes sitting inside a single open pit shell grading 1.1%. That includes a 70% jump in copper alone, but include gold, nickel, palladium, platinum, silver and cobalt. Importantly, recent testwork confirms it can produce clean, high-grade concentrate. And it’s not done yet, heaps of scale are still to be drilled, Pivotal said.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for April 29 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HCF | HGH High Conviction | 0.085 | -76% | 81,459 | $6,792,267 |

| TMX | Terrain Minerals | 0.002 | -33% | 42,342 | $6,010,670 |

| SMX | Strata Minerals | 0.021 | -30% | 7,122,088 | $7,324,455 |

| AUK | Aumake Limited | 0.003 | -25% | 166,666 | $12,042,769 |

| MCO | Myeco Group Ltd | 0.015 | -21% | 6,901 | $11,335,591 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 1,623,827 | $15,867,318 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 2,810,980 | $4,349,768 |

| QFE | Quickfee Limited | 0.061 | -19% | 300,657 | $25,638,132 |

| PGH | Pact Group Hldgs Ltd | 0.900 | -18% | 137,331 | $376,997,608 |

| FCT | Firstwave Cloud Tech | 0.014 | -18% | 659,669 | $29,129,818 |

| PAB | Patrys Limited | 0.003 | -17% | 3,047,500 | $6,172,342 |

| SPX | Spenda Limited | 0.005 | -17% | 1,244,757 | $27,691,293 |

| VML | Vital Metals Limited | 0.003 | -17% | 250,165 | $17,685,201 |

| PNN | Power Minerals Ltd | 0.061 | -15% | 1,969,314 | $8,197,551 |

| AAU | Antilles Gold Ltd | 0.003 | -14% | 154,000 | $7,442,287 |

| FBR | FBR Ltd | 0.006 | -14% | 548,503 | $39,449,423 |

| HHR | Hartshead Resources | 0.006 | -14% | 2,000,000 | $19,660,775 |

| SRN | Surefire Rescs NL | 0.003 | -14% | 582,815 | $8,457,077 |

| TON | Triton Min Ltd | 0.006 | -14% | 357 | $10,978,721 |

| EMU | EMU NL | 0.020 | -13% | 133,334 | $4,452,832 |

| AKN | Auking Mining Ltd | 0.007 | -13% | 1,083,405 | $4,598,230 |

| AVW | Avira Resources Ltd | 0.007 | -13% | 16,005 | $1,464,902 |

| BNL | Blue Star Helium Ltd | 0.007 | -13% | 113,608 | $21,559,082 |

| LCL | LCL Resources Ltd | 0.007 | -13% | 634,963 | $9,558,502 |

IN CASE YOU MISSED IT

A listing to the OTCQB has unlocked access to US investors and global market traders for White Cliff Minerals (ASX:WCN), which has been approved to trade under the ticker WCMLF as of yesterday. The company says the listing will enhance accessibility for US investors, and increase liquidity and market visibility.

Anson Resources (ASX:ASN) is preparing to re-enter the Mt Fuel-Skyline Geyser 1-25 well after submitting a proposal to the local authorities, with plans to use the results from the Bosydaba#1 well to prove-up a JORC mineral resource at the Green River project.

Following-up on broad intersections of gold including 35.76m at 2.14 g/t gold from 14.27m of depth, Arika Resources (ASX:ARI) is set to begin a 6,000m RC drilling program to test extensions and investigate new prospects at the Yundamindra gold project in WA.

At Stockhead, we tell it like it is. While White Cliff Minerals, Anson Resources and Arika Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: MinRes rallies; DY6 goes ballistic, up 300pc after monster gallium hit