Has ASX explorer AusQuest made the next big South American copper discovery?

AusQuest’s successful initial holes have offered a glimpse into the huge potential of its Cangallo porphyry copper project in southern Peru.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

After years of touting its exploration prowess, AusQuest may have backed that up with a potentially major copper find in Peru

Discovery hole intersects 348m at 0.26% copper and 0.06ppm gold FROM SURFACE

Could majors come sniffing after near ASX punters deliver $22m capped AQD a near 200% gain?

It is all but impossible to miss the buzz surrounding AusQuest after it announced on Thursday that maiden drilling at its Cangallo porphyry copper project in southern Peru had returned wide swaths of copper and gold mineralisation.

As is often the case with porphyry discoveries, the two intersections returned to date are incredibly thick – try 348m – if somewhat low grade at 0.26% copper and 0.06 parts per million gold.

And what could be the first significant ASX exploration story of 2025 has investors asking whether majors could come sniffing as AQD works to build on its initial success.

Porphyries are the key sources of copper in Chile and Peru, the first and third largest copper producing countries in the world in 2024.

What these deposits tend to lack in grade they make up for it in scale and there’s certainly tremendous potential for scale at Cangallo.

AusQuest (ASX:AQD) managing director Graeme Drew told Stockhead that while work at the project was still at the early stages, there are clear signs that the company is sitting on a potentially massive deposit.

“We are generally a fairly conservative group but this has (sent) a bit of excitement through the company and the board about what the future holds,” he said.

“We have results from six more holes to come in and that’s going to tell us a lot, so over the next few weeks, we will get a better picture of what is there.

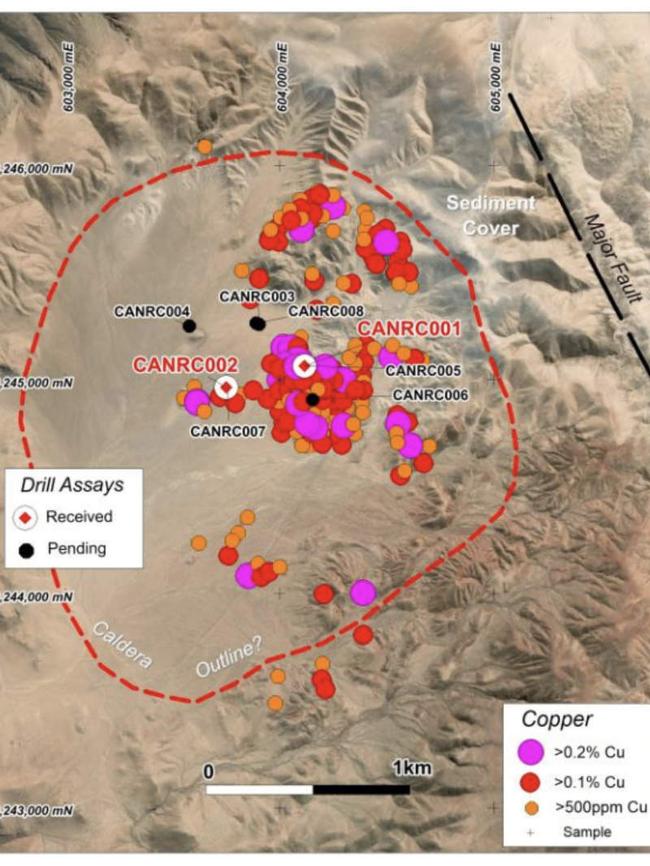

“Either way, we have just scratched the surface of this target. We have a large caldera-type structure, which you can see on satellite imagery, and that’s anywhere from several km2 up to 10-20km2 possibly.”

Drew also isn’t fazed by the low grades intersected to date, noting that other deposits being developed in southern Peru have head grades ranging from 0.3-0.4%.

“If you look at some of those deposits, Cerro Verde is 0.4%, which is low grade, but if they are shallow enough and they are large enough, then they can still be economic,” he added.

“We have a copper-gold system, which is not totally unusual, so there will be gold credits you can add.”

The big reveal on Thursday saw AusQuest shares lift 200% to 2.4c, their highest close since June 2022.

Rich reward for persistent battler

Led by former Rio Tinto exploration manager Graeme Drew and backed by coal mining millionaire and AQD board member Chris Ellis, AusQuest has long been respected for its exploration nous with little to show for its efforts.

The company has been listed since 2003 with little to show for it in terms of tier-1 discoveries, has drilled projects in Peru since at least 2015 and has spent the past eight years in an exploration licence with ASX 20 miner South32 (ASX:S32), the latter's decision to continue the relationship a credit to the esteem with which Drew and his team are held as explorationists.

READ: Barry FitzGerald: It's time to revisit South32's exploration partner

Drew considers the discovery of large-scale mineralisation at Cangallo to be the reward for persisting in the hunt for district-scale resources.

That the discovery was made in an area without any historical drilling just makes it that much sweeter, though having most of it under cover means that more drilling and possibly geophysics would be required to prove its extent.

Cangallo also has a leg up over a lot of other porphyry discoveries in that it is fairly near surface, which could make an open cut mine viable.

It also has copper oxides, which could be amendable for lower cost heap leaching, though Drew says it is too early to tell at this stage.

Government backing in Peru

Cangallo lies in Peru, historically the second largest producer of copper in the world behind Chile before it was unseated by the Democratic Republic of the Congo in 2024.

Recent years have seen waves of civil unrest and government instability plague Peru's copper miners, with production flatlining. But AusQuest says it has approvals to keep drilling and is confident in the support of the government for more copper mining developments.

“The Peruvian government is supportive of developments as it is a major part of their economy. They are fairly positive,” Drew said.

“We are also very aware of communities and environmental and other factors that come into play and we have been working on those since day one in the anticipation that we will find something.

“We have been working closely with communities in our area and at this point in time, we are quite confident there are no major issues.”

The project sits about 1000-1200m above sea level, which is relatively low in Peru.

Drew certainly believes it will make for easier development compared to being higher up in the Andes.

This is backed by its proximity to the coast as well as good existing infrastructure, which includes power lines that run past the company’s property.

Community issues are also expected to be lesser, owing to Cangallo sitting in what’s essentially a coastal desert.

AQD will be in good company in Peru with fellow ASX-listed companies such as Firetail Resources (ASX:FTL) and Solis Minerals (ASX:SLM) also operating in country.

FTL operates the Picha copper project, which was recently selected for BHP’s Xplor accelerator program, while SLM started initial reconnaissance activities at its Canyon project in November 2024.

Takeover target?

Given the magnitude of AusQuest's potential discovery and its existing relationship with $16bn capped South32 (ASX:S32), questions are already being asked about whether it's now a takeover target for a major.

Copper is high on the agenda for most mining giants, with BHP (ASX:BHP) placing South American copper high on its agenda with its failed bid for Anglo American and US$3bn deal for half of Lundin Mining's Filo Del Sol and Josemaria mines in Argentina's Vicuna region.

Under the SAA, South32 provides up to $US4.5 million in funding to earn up to a 70% interest in exploration projects (plus 10% on completing a pre-feasibility study) worked up by AQD, which receives a 15% fee. Cangallo is not part of that alliance and is 100% held by AQD.

But South32 has taken its own steps into South American copper in recent years, acquiring 45% of KGHM's Sierra Gorda mine in northern Chile in 2022.

"The reality is once we get all our data in then the strategy going forward is a key and major question for the board, to say how do we best utilise what we've found for value for shareholders," Drew said on an investor webinar yesterday.

"It's early days to call but the initial results, if that gets repeated, then in many ways we've de-risked the next phase of drilling because you would think another phase of drilling if you extend it out would hit at least more of the same and maybe better. Who knows?"

The scale of a porphyry find like Cangallo means it could need significant capital and drilling investment to realise its potential.

"To explore this thing properly, you're right, you're going to need big bucks, we've always known that which is why we've tried to engage with major players," Drew added.

"South32, I've always said it, fantastic group, loved working with them, they've been good for us and I'd hope we've been good for them. So I'm absolutely more than happy to talk with them and see where it's at."

Drew said AusQuest had spoken to Peru based majors previously, but they were relatively unfamiliar with its geological potential because the find was made under cover, rather than in the Andean outcrop known to Peruvian geologists.

"We've dealt with a lot of majors and that's one of the possibilities. If the deal's good enough we would absolutely look at doing it no question," Drew said.

"How do we go forward? ... between now and the end of February those are discussions and decisions that we'll need to make and they're fairly important from a shareholder point of view."

Drew told Stockhead that AusQuest expects to carry out at least two large drilling programs in Australia as well over the next six months.

At Stockhead, we tell it like it is. While Firetail Resources is a Stockhead advertiser, it did not sponsor this article.

Originally published as Has ASX explorer AusQuest made the next big South American copper discovery?