Closing Bell: Traders across Asia panic as stocks, metals, crypto bleed under Trump’s tariff storm

A global selloff is hitting markets hard after Trump’s tariffs, with Ethereum plunging and copper prices taking a dive.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Global selloff hits markets after Trump's tariffs

Ethereum sinks and copper prices dive

Fisher & Paykel crumbles over tariff costs

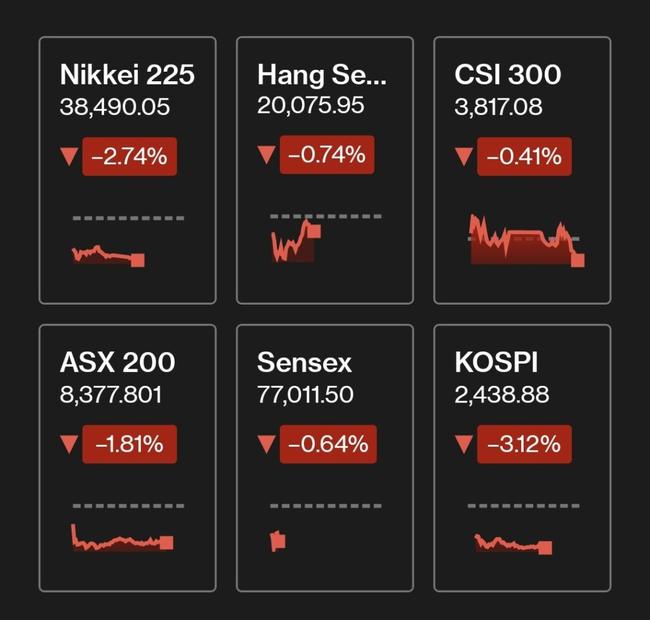

The global selloff is tearing through markets as traders headed for the exit following Trump’s tariff announcements.

Trump’s decision to impose a blanket 10% tariff on China and 25% on Canada and Mexico sent shockwaves, and now the fear of a full-blown trade war is causing all sorts of fear in the market.

“So investors have started what will probably be a de-risking phase, taking money out of stocks and crypto and shifting to the safety of the US dollar and gold,” said Moomoo’s Jessica Amir.

“We could see the US dollar move to new highs, along with gold, while stocks could be pressured lower.”

The Canadian dollar is at its lowest since 2003, while the Aussie dollar had at one point crumbled to a four-year low to US60.5 cents before coming back to US61.2 cents.

Across Asia, everything from Japanese carmakers to Chinese e-commerce firms, nosedived this afternoon.

Copper, aluminium, and iron ore prices are all heading south. Even gold, the supposed risk haven, was dumped.

Ethereum, meanwhile, had its worst day in years, dropping by nearly 26%, with Bitcoin also sinking into the red (-6.6% at time of writing).

And, as if on cue, there was more bad news out of China.

According to data today, the country’s factory activity slowed for a second straight month in January, with the Caixin manufacturing purchasing managers index falling to 50.1, just above the line that separates growth from contraction.

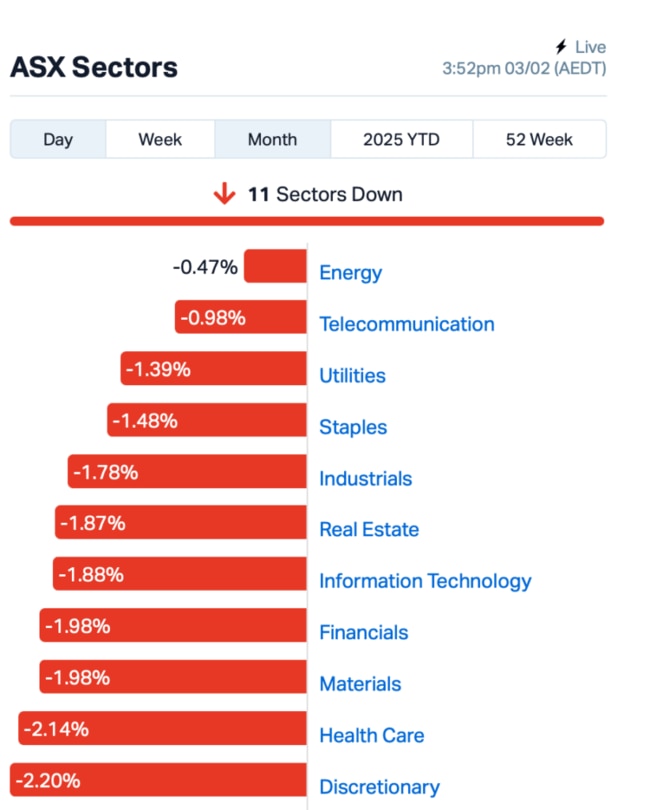

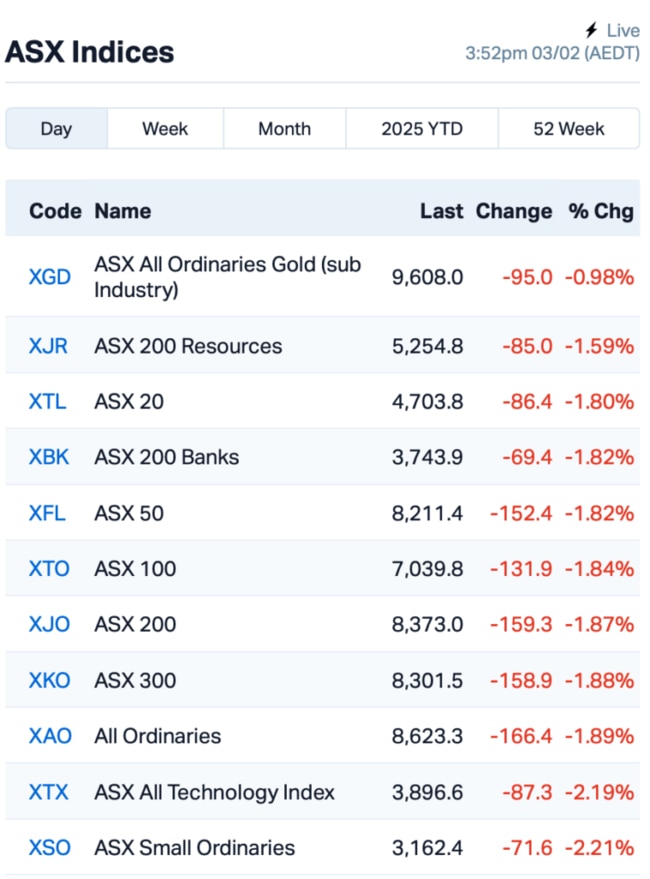

Back home on the ASX, all sectors opened in the red, but tech and healthcare copped the brunt of the seloff.

Champion Iron (ASX:CIA) tumbled by 4%, and critical minerals players like Liontown Resources (ASX:LTR) and FireFly Metals (ASX:FFM) also sold off heavily.

New Zealand’s biggest public company, Fisher & Paykel Healthcare (ASX:FPH), crumbled by 7.5% after it warned that the new US tariffs would bump up its costs.

The company, which manufactures nearly half of its products in Mexico, said the tariffs would hit its bottom line, pushing back its target of reaching a 65% profit margin by two to three years.

Sill in the large caps space, Westgold Resources (ASX:WGX) crashed 12% after cutting its full-year production guidance as the ramp-up of its Beta Hunt and Bluebird-South Junction mines took longer than expected. Now, WGX is aiming for 330,000 to 350,000 ounces, down from the previous target of 400,000 to 420,000.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap OZM Ozaurum Resources 0.062 72% 53,894,019 $7,099,615 AKN Auking Mining Ltd 0.004 33% 3,079,544 $1,544,336 NES Nelson Resources. 0.004 33% 20,000 $6,515,783 RTG RTG Mining Inc. 0.032 28% 738,534 $27,122,738 BB1 Blinklab Limited 0.335 26% 3,069,977 $16,227,582 ADD Adavale Resource Ltd 0.003 25% 1,163,968 $4,546,558 FHS Freehill Mining Ltd. 0.005 25% 500,000 $12,314,111 PRX Prodigy Gold NL 0.003 25% 2,000,005 $6,350,111 SIS Simble Solutions 0.005 25% 10,000 $3,345,321 UCM Uscom Limited 0.025 19% 50,000 $5,260,017 ROC Rocketboots 0.074 17% 82,032 $7,164,543 CAV Carnavale Resources 0.004 17% 500,000 $12,270,655 EVR Ev Resources Ltd 0.004 17% 3,184,603 $5,437,510 ICG Inca Minerals Ltd 0.007 17% 4,101,978 $6,160,335 PUA Peak Minerals Ltd 0.014 17% 12,245,846 $30,625,323 CLU Cluey Ltd 0.072 16% 18,332 $21,875,072 MVP Medical Developments 0.770 16% 1,297,935 $74,917,785 PLC Premier1 Lithium Ltd 0.008 14% 51,640 $2,576,424 LGM Legacy Minerals 0.165 14% 32,774 $18,059,267 YOJ Yojee Limited 0.125 14% 286,982 $30,316,424

OzAurum Resources’ (ASX:OZM) shares almost doubled after hitting a new high-grade gold discovery at its Mulgabbie North Project in WA’s Eastern Goldfields. Aircore drilling nailed multiple shallow, high-grade gold zones, with standout intercepts like 20m at 3.57g/t and 10m at 6.59g/t. The new target is just 1.3km south of previous drilling and lines up with old data, suggesting big potential said OZM.

Logistics tech company, Yojee (ASX:YOJ), has secured a 51% joint venture (JV) with SmartClear to integrate its customs tech into Yojee’s MOSAIC platform. This partnership will speed up the development of MOSAIC and cut costs, initially targeting the freight and customs markets in the ANZ. On top of that, Yojee raised $3.5 million through an oversubscribed placement to fuel this growth.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap AMS Atomos 0.005 -36% 26,982,699 $8,505,129 AOK Australian Oil. 0.002 -33% 2,000,000 $3,005,349 AYM Australia United Min 0.002 -33% 256,614 $5,527,732 EEL Enrg Elements Ltd 0.001 -33% 2,122,014 $4,880,668 H2G Greenhy2 Limited 0.002 -33% 2,507,596 $1,794,553 LNU Linius Tech Limited 0.001 -33% 5,742,767 $9,226,824 NRZ Neurizer Ltd 0.002 -33% 54,188,157 $9,194,612 WNR Wingara Ag Ltd 0.005 -29% 30,000 $1,228,798 88E 88 Energy Ltd 0.002 -25% 6,907,588 $57,867,624 AVE Avecho Biotech Ltd 0.003 -25% 2,714,004 $12,677,188 PKO Peako Limited 0.003 -25% 266,666 $4,380,566 PRM Prominence Energy 0.003 -25% 202,000 $1,556,706 SRN Surefire Rescs NL 0.003 -25% 6,925 $9,665,231 XF1 Xref Limited 0.160 -22% 3,845,233 $39,358,000 HPC Thehydration 0.012 -20% 3,278,999 $4,573,696 CDX Cardiex Limited 0.100 -20% 807,962 $50,653,817 CTO Citigold Corp Ltd 0.004 -20% 4,000,000 $15,000,000 CUL Cullen Resources 0.004 -20% 167,521 $3,467,009 CYQ Cycliq Group Ltd 0.004 -20% 2,176,470 $2,302,583 KTA Krakatoa Resources 0.008 -20% 186,580 $5,901,340 PIL Peppermint Inv Ltd 0.004 -20% 1,309,507 $10,794,292 RAN Range International 0.004 -20% 205,805 $4,696,452

Cettire (ASX:CTT), the online luxury goods retailer, was one of the biggest losers, crashing by 18%. The company tried to reassure investors, saying only 7.5% of their sales from the US were tied to China, Mexico, or Canada. But the damage was already done as tariff fears took their toll.

Terry Holohan is stepping down as CEO of Resolute Mining (ASX:RSG), effective immediately. Holohan’s departure follows his highly publicised kidnapping by the Mali government last year. Chris Eger, who’s been acting as CEO, will take on the role full-time. Shares were down 7%.

IN CASE YOU MISSED IT

Perpetual Resources (ASX:PEC)has discovered a fourth pegmatite trend at its Isabella project in Brazil’s ‘Lithium Valley’, growing its mineralised footprint. The new trend is said to run sub-parallel and proximal to previously uncovered pegmatite trends. Rock chip results are expected by late February, with maiden drilling to start in H1 2025.

Near-term gold producer Vertex Minerals (ASX:VTX)has kicked off commissioning the recently installed Tomra ore-sorter and pre concentrator at the Hill End gold plant in New South Wales. The company is using Tomra’s ore sorting technology, with first production and sales planned for February.

Astral Resources (ASX:AAR) has launched a unanimously recommended off-market takeover offer for Maximus Resources (ASX:MXR) to create a WA gold developer with a combined resource of ~1.8Moz. The offer values MXR at ~$31m, with shareholders set to receive one AAR share for every two MXR shares.

Firetail Resources (ASX:FTL)has struck more high-grade copper at its Skyline project in Newfoundland, Canada. The latest results from its recently completed 5000m diamond drill campaign include a standout intercept of 17.6m at 2.1% CuEq from 170.3m, further validating the continuity of mineralisation and extensions at depth.

St George Mining (ASX:SGQ)has strengthened its in-country management team in Minas Gerais, Brazil, with the appointment of Ricardo Maximo Nardi, a world-leading expert in niobium ore processing. Formerly head of mineral processing at CBMM, Nardi’s 30+ years of experience is a major boost for SGQ as it looks to optimise processing options at its high-grade niobium-REE Araxá project and fast-track development plans.

Top End Energy (ASX:TEE) has finalised its acquisition of Serpentine Energy and its natural hydrogen project in Kansas, USA, following shareholder approval on January 28. TEE is now expanding its lease holdings and conducting geological evaluations ahead of exploration drilling planned for the second half of 2025.

Explorer Antares Metals (ASX:AM5) has its eye on several uranium targets at its Mt Isa North project in Queensland. The company shared with the market today that ten priority targets have been generated at the project, part of a total 49 targets now on the books.

Antares say the targets bare similarities to Paladin Energy’s (ASX:PDN) Odin-Valhalla-Skal cluster of uranium deposits in the vicinity. Antares will undertake ground truthing of its high-priority targets during the next field season at Mt Isa North.

At Stockhead, we tell it like it is. While Perpetual Resources, Vertex Minerals, Astral Resources, Firetail Resources, St George Mining and Top End Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Traders across Asia panic as stocks, metals, crypto bleed under Trump’s tariff storm