Closing Bell: Energy wanes but gold gleams and ASX is on cusp of new record

The ASX has closed up over 1.2%, News Corp’s killing it, and Nissan is ditching Honda for a US electric car buddy.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX surges and eyes record highs

News Corp jumps and Wesfarmers shines

Nissan ditches Honda, eyes US partner for electric push

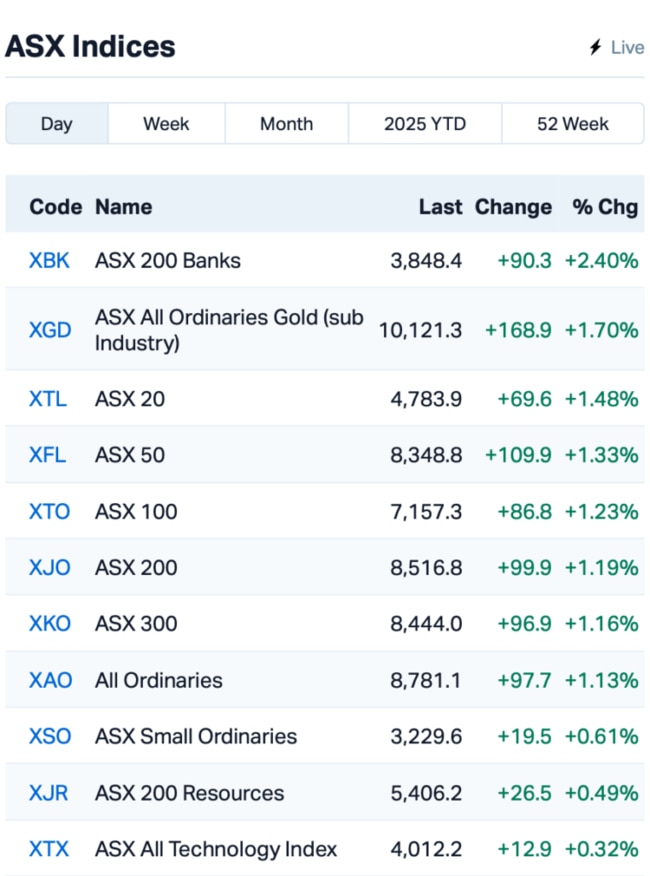

The ASX200 lifted by 1.23% on Thursday as the index sits just shy of its record high.

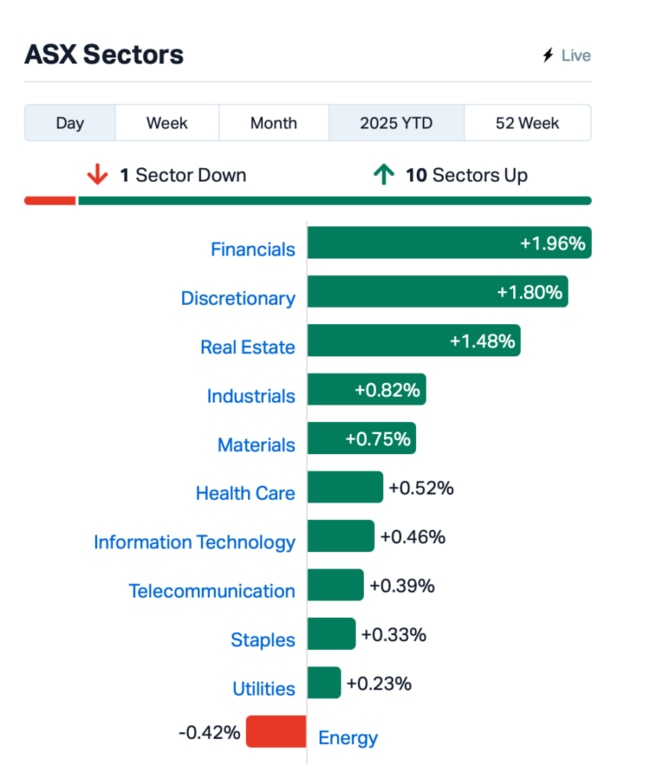

Ten out of the 11 sectors saw bids from investors, with financial and consumer stocks leading the charge.

Investors got a break after trade tensions settled down temporarily as Trump took his eye off the trade ball and focused on his Middle East plans.

Goldies rose as geopolitical and economic uncertainty is keeping demand for safe-haven assets.

Trump’s comments that the US should “own” Gaza added to the chaos which, unsurprisingly, pushed gold’s appeal even higher.

Gold is trading at US$2,868.65 right now, a stone's throw from its record high of US$2,822.

However, energy stocks had a rough time today as Brent crude fell below $US75 a barrel.

In the consumer space, things were looking pretty sweet. Wesfarmers (ASX:WES) shot up over 3% on no specific news, but a note we got out of UBS showed the bank has given the stock a neutral upgrade.

Still in the large caps space, News Corp (ASX:NWS) (which publishes Stockhead) was the standout, jumping over 6% after reporting a solid Q2 with a nice bump in revenue from its real estate REA Group division.

Beach Energy (ASX:BPT) didn’t have the best day, dropping 4%, even though it posted a solid 37% profit rise.

On the economics front, NAB’s latest quarterly survey showed business conditions in Australia are still in the negative, weighed down by high wage costs.

According to the survey, pressure on margins, wages, and labour availability were top of mind for CEOs.

This is where things stood for the ASX leading up to Thursday’s close:

Meanwhile, over in Asia, the markets were seeing some positive movements, too.

Stocks in Hong Kong and South Korea rose; and in Japan, Nissan's shares jumped 7% after it pulled the plug on talks with Honda about a merged company.

The Japanese carmaker is now searching for a new partner, ideally from the US tech sector it said, as it aims to push into the electric vehicle space.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap 88E 88 Energy Ltd 0.002 50% 758,451 $28,933,812 ASR Asra Minerals Ltd 0.003 50% 366,907 $4,625,260 CUL Cullen Resources 0.006 50% 85,666 $2,773,607 JAY Jayride Group 0.003 50% 1,336,834 $477,158 OZM Ozaurum Resources 0.155 48% 27,853,278 $20,707,212 AQD Ausquest Limited 0.064 36% 57,977,627 $53,475,787 BYH Bryah Resources Ltd 0.004 33% 1,682,023 $1,509,861 DDT DataDot Technology 0.004 33% 2,775,017 $3,632,858 OB1 Orbminco Limited 0.002 33% 21,746,875 $3,249,885 RAN Range International 0.004 33% 1,623,626 $2,817,871 MQR Marquee Resource Ltd 0.013 30% 2,455,123 $4,854,805 ENV Enova Mining Limited 0.009 29% 46,062,059 $8,614,505 PKD Parkd Ltd 0.045 29% 1,091,733 $3,640,486 AII Almontyindustriesinc 1.950 27% 570,075 $46,334,582 NRZ Neurizer Ltd 0.003 25% 5,229,600 $6,129,741 PIL Peppermint Inv Ltd 0.005 25% 2,023,800 $8,635,433 TMK TMK Energy Limited 0.003 25% 6,286,381 $18,651,130 OMX Orangeminerals 0.031 24% 832,479 $2,777,557 KAL Kalgoorliegoldmining 0.023 21% 5,502,222 $5,189,060 ASP Aspermont Limited 0.006 20% 330,000 $12,350,058

Cullen Resources (ASX:CUL) said it has a strong gold target in Yardilla in WA, with two key prospects, Lila and Cleanthes, showing promising gold-in-soil anomalies. Previous drilling at Lila and Cleanthes showed gold hits, but Lila West and Ten Mile Rocks have never been drilled. These areas are wide open for further exploration, the company said.

AusQuest (ASX:AQD) has confirmed a major porphyry copper-gold discovery at its Cangallo Project in Peru, with strong results that include 304m at 0.30% Cu and 0.06ppm Au. Mineralisation starts near the surface, indicating potential for both shallow copper oxide and deeper sulphide resources. Drilling has only tested a small part of the target area, and the mine is located near good infrastructure nearby.

Orbminco (ASX:OB1) reported good trench sampling results from its Bronze Fox Project in Mongolia. The results show high-grade copper and gold on the western side of the West Kasulu resource, with some decent intersections like 17m of 0.5% Cu and 0.34g/t Au. There’s also a lot of unexplored ground, and an IP survey has flagged some promising anomalies for future drilling.

Enova Mining (ASX:ENV) said its drill results at CODA North are looking strong, with multiple high-grade titanium dioxide (TiO2) intercepts over 15%. Over 3,100m drilled so far, the results confirm a rich mix of titanium and rare earths. Standout hits include 16m at 19.2% TiO2 and 14m at 18.2% TiO2.

TMK Energy (ASX:TMK) had a massive jump in gas production in January 2025, with output up around 300% compared to the previous month. The company set a new record, producing about 40% more gas than ever before. The new wells drilled in January are already showing great results, with existing wells also performing better than usual. While it’s still early days, TMK said it’s on track to hit its goals in late Q1 or early Q2 2025.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap EDE Eden Inv Ltd 0.001 -33% 10,003 $6,164,822 TIG Tigers Realm Coal 0.002 -33% 1,325,948 $39,200,107 UCM Uscom Limited 0.017 -32% 60,000 $6,261,925 SOC Soco Corporation 0.090 -28% 560,433 $17,419,386 CRB Carbine Resources 0.003 -25% 199,299 $2,206,951 MMR Mec Resources 0.003 -25% 7,553,101 $7,399,063 NTM Nt Minerals Limited 0.003 -25% 226,669 $4,843,612 AKO Akora Resources 0.110 -21% 95,304 $17,556,387 PTR Petratherm Ltd 0.315 -20% 11,950,284 $122,132,653 AKN Auking Mining Ltd 0.004 -20% 2,719,438 $2,573,894 ALM Alma Metals Ltd 0.004 -20% 500,000 $7,931,727 GMN Gold Mountain Ltd 0.002 -20% 103,550 $11,448,058 SIS Simble Solutions 0.004 -20% 35,000 $4,181,652 TYX Tyranna Res Ltd 0.004 -20% 1,573,060 $16,439,627 YAR Yari Minerals Ltd 0.004 -20% 230,319 $2,411,789 REM Remsensetechnologies 0.046 -19% 1,241,053 $9,454,002 ASE Astute Metals NL 0.028 -18% 4,791,195 $20,682,581 TFL Tasfoods Ltd 0.014 -18% 5,075,788 $7,430,624 BGE Bridgesaaslimited 0.030 -17% 82,810 $7,194,931 ERA Energy Resources 0.003 -17% 812,450 $1,216,188,722 ROG Red Sky Energy. 0.005 -17% 27,210 $32,533,363 VML Vital Metals Limited 0.003 -17% 703,902 $17,685,201

IN CASE YOU MISSED IT

QMines (ASX:QML)has released the final results from maiden drilling at its Develin Creek project in Queensland, delivering eye-catching hits, including 114m at 1.64% copper. The company has resource upgrades at the Scorpion and Window deposits planned for this quarter, where 5000m was drilled as part of the maiden program.

Pure Hydrogen (ASX:PH2) has completed the handover of Australia’s first hydrogen fuel cell rear loader leading to Australian waste management company, Solo Resource Recovery. It’s a key milestone for the company as part of its ongoing vehicle rollout strategy to promote sustainable waste management and reduce carbon emissions.

Arizona Lithium (ASX:AZL) has released an updated phased development plan for its Prairie lithium project in Saskatchewan, Canada, slashing the capex required to start production down to just US$22m ($35m). The updated plan is another effort in de-risking and developing the project, allowing for the rapid and cost-effective scale-up to increase production in Phase II and III.

Petratherm (ASX:PTR)has delivered titanium-rich heavy mineral sands hits from drilling at the Rosewood prospect within its Muckanippie in South Australia. The results come from 45 holes, with a standout including 28m grading 13.6% HM from 10m including 8m at 26.3% HM from 29m (24RW019). It complements exceptional results from the first five holes, which included 22m at 19.1% HM from 8m in hole 24RW020, with mineralisation open to the north, east and west.

Cannindah Resources (ASX:CAE) has appointed the experienced John Morrison to its board as it moves into the next stage of its development. Morrison brings extensive experience in investment banking and the resources sector, having held director roles in several ASX-listed companies in the past, including a mining firm.

At Stockhead, we tell it like it is. While QMines, Pure Hydrogen, Arizona Lithium, Petratherm and Cannindah Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Energy wanes but gold gleams and ASX is on cusp of new record