Lunch Wrap: ASX up 1pc to near record high; News Corp soars on strong Q2

ASX near-record highs as News Corp soars, Pexa and Beach Energy dip, and US trade deficit hits $1.2 trillion.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX nears record high as tariff tensions ease

News Corp shines, Pexa and Beach Energy struggle

Oil dips, gold soars as US trade deficit hits US$1.2 trillion

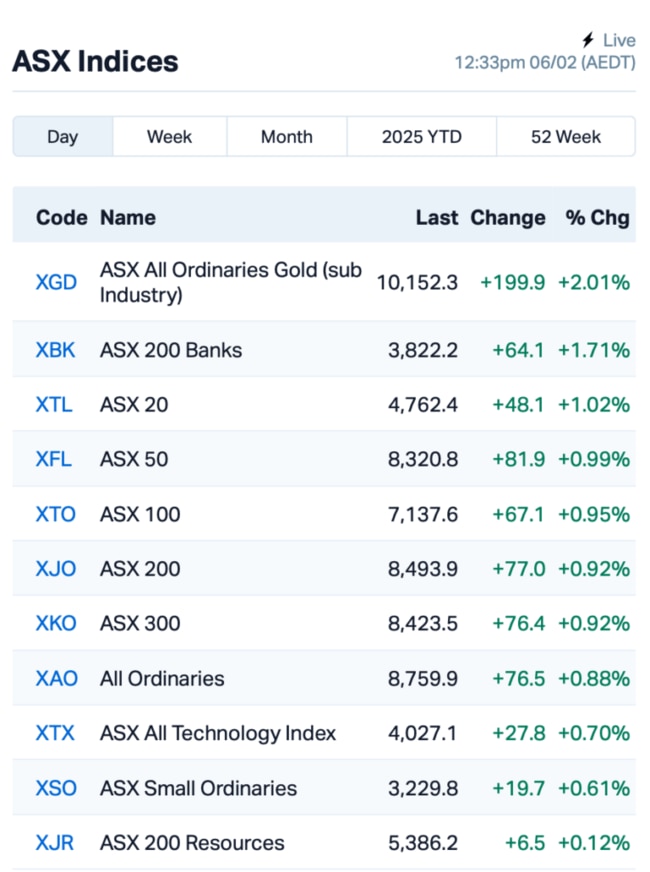

The ASX nudged up towards a record high this morning as traders breathed a sigh of relief over the latest tariff drama.

The benchmark ASX 200 jumped nearly 1% at around lunch time, keeping the momentum going from Wednesday’s rally.

Overnight, US stocks also crept higher as the “tariff war” tension somewhat faded into the background for now, which gave the market a nice little breather.

About 350 companies in the S&P 500 climbed, with Nvidia Corp leading gains in the AI space, up by 5.3%.

Alphabet (Google’s parent), however, had its biggest drop in over a year, down 7% after some disappointing earnings.

“The real risks now will be something like DeepSeek that comes out of left field that changes people’s thinking,” said Jim Chanos, a well-known American short seller.

Oil had a bit of a wobble, as Brent crude dropped 2% to dip under $US75 a barrel, which weighed down on energy stocks.

Gold made a brief run for the record books, hitting an all-time high of US$2,882 an ounce before paring gains.

The US trade deficit report was released, and the numbers came in ugly: a record US$1.2 trillion for 2024. US exports also took a hit due to US dollar strength.

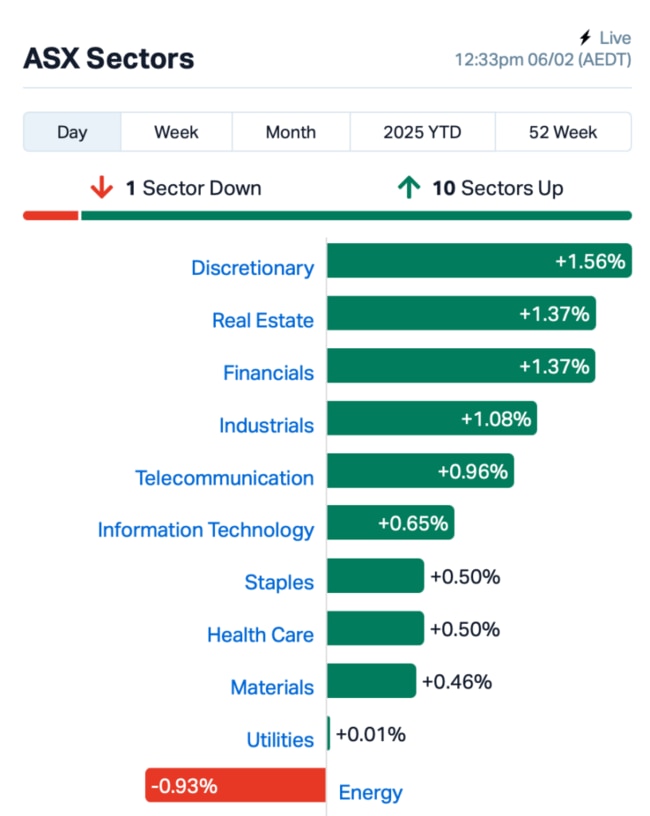

Back to the ASX, there was green flashing all over the board, with 10 out of 11 sectors rising. Only energy stocks were down, trailing behind a slip in oil prices.

In the large caps space, News Corp (ASX:NWS) (Stockhead's publisher) was the biggest winner this morning, shooting up over 5% after posting a 5% jump in revenue in Q2, thanks to its real estate division REA Group smashing it with record-high revenues.

Beach Energy (ASX:BPT) wasn’t having the best morning though, dropping 4.5% after narrowing its profit guidance for 2025, even though profits were up 37%.

Pexa (ASX:PXA), the digital property settlement services, dropped 3% after raising its impairment forecast and announcing that its CEO for Australia, Les Vance, was stepping down.

Meanwhile, data from market operator, the ASX (ASX:ASX), shows that the value of new stock listings in the first half was down by a massive 72% vs the pcp, from $33.2 billion to $9.4 billion. ASX’s shares still jumped by 1%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 6 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.002 | 100% | 618,451 | $28,933,812 |

| ASR | Asra Minerals Ltd | 0.003 | 50% | 366,907 | $4,625,260 |

| CUL | Cullen Resources | 0.006 | 50% | 85,666 | $2,773,607 |

| MQR | Marquee Resource Ltd | 0.014 | 40% | 1,897,456 | $4,854,805 |

| DDT | DataDot Technology | 0.004 | 33% | 2,653,473 | $3,632,858 |

| LNR | Lanthanein Resources | 0.004 | 33% | 2,500,369 | $7,330,908 |

| ENV | Enova Mining Limited | 0.009 | 29% | 40,013,679 | $8,614,505 |

| OZM | Ozaurum Resources | 0.135 | 29% | 18,674,672 | $20,707,212 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 697,334 | $4,546,558 |

| PIL | Peppermint Inv Ltd | 0.005 | 25% | 2,023,800 | $8,635,433 |

| TMK | TMK Energy Limited | 0.003 | 25% | 2,323,381 | $18,651,130 |

| HE8 | Helios Energy Ltd | 0.016 | 23% | 1,450,872 | $33,852,643 |

| RAU | Resouro Strategic | 0.250 | 22% | 123,710 | $8,855,397 |

| AQD | Ausquest Limited | 0.057 | 21% | 36,164,437 | $53,475,787 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 548,507 | $12,497,745 |

| MTB | Mount Burgess Mining | 0.006 | 20% | 1,087,065 | $1,697,687 |

| XPN | Xpon Technologies | 0.012 | 20% | 1,063,481 | $3,624,415 |

| AII | Almontyindustriesinc | 1.800 | 17% | 417,695 | $46,334,582 |

| CHM | Chimeric Therapeutic | 0.007 | 17% | 64,020 | $9,450,899 |

| MEM | Memphasys Ltd | 0.007 | 17% | 1,145,448 | $10,626,089 |

Cullen Resources (ASX:CUL) said it has a strong gold target in Yardilla in WA, with two key prospects, Lila and Cleanthes, showing promising gold-in-soil anomalies. Previous drilling at Lila and Cleanthes showed gold hits, but Lila West and Ten Mile Rocks have never been drilled. These areas are wide open for further exploration, the company said.

Enova Mining (ASX:ENV) said its drill results at CODA North are looking strong, with multiple high-grade titanium dioxide (TiO2) intercepts over 15%. Over 3,100m drilled so far, the results confirm a rich mix of titanium and rare earths. Standout hits include 16m at 19.2% TiO2 and 14m at 18.2% TiO2.

TMK Energy (ASX:TMK) had a massive jump in gas production in January 2025, with output up around 300% compared to the previous month. The company set a new record, producing about 40% more gas than ever before. The new wells drilled in January are already showing great results, with existing wells also performing better than usual. While it’s still early days, TMK said it’s on track to hit its goals in late Q1 or early Q2 2025.

Resouro Strategic Metals (ASX:RAU)’s recent drilling at the Tiros Central Project in Brazil has returned some impressive results, including high-grade titanium and rare earth element (REE) intersections. Notable findings include 7m at 24.5% TiO2 and 11,000ppm TREO, as well as 5m at 22.1% TiO2 and 10,000ppm TREO. The team is expecting more assay results to come through in February.

AusQuest (ASX:AQD) has confirmed a major porphyry copper-gold discovery at its Cangallo Project in Peru, with strong results that include 304m at 0.30% Cu and 0.06ppm Au. Mineralisation starts near the surface, indicating potential for both shallow copper oxide and deeper sulphide resources. Drilling has only tested a small part of the target area, and the mine is located near good infrastructure nearby.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 6 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.001 | -33% | 10,003 | $6,164,822 |

| TIG | Tigers Realm Coal | 0.002 | -33% | 1,325,948 | $39,200,107 |

| PTR | Petratherm Ltd | 0.270 | -32% | 9,108,525 | $122,132,653 |

| UCM | Uscom Limited | 0.018 | -28% | 55,056 | $6,261,925 |

| CRB | Carbine Resources | 0.003 | -25% | 199,299 | $2,206,951 |

| NTM | Nt Minerals Limited | 0.003 | -25% | 226,669 | $4,843,612 |

| ASE | Astute Metals NL | 0.027 | -21% | 4,391,195 | $20,682,581 |

| GMN | Gold Mountain Ltd | 0.002 | -20% | 103,550 | $11,448,058 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 45,000 | $7,937,639 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 1,573,060 | $16,439,627 |

| M2M | Mtmalcolmminesnl | 0.013 | -19% | 1,156,693 | $3,623,610 |

| TFL | Tasfoods Ltd | 0.014 | -18% | 5,075,788 | $7,430,624 |

| ERA | Energy Resources | 0.003 | -17% | 713,916 | $1,216,188,722 |

| FTC | Fintech Chain Ltd | 0.005 | -17% | 92,383 | $3,904,618 |

| VML | Vital Metals Limited | 0.003 | -17% | 15,387 | $17,685,201 |

| REC | Rechargemetals | 0.017 | -15% | 250,000 | $5,129,799 |

| BUY | Bounty Oil & Gas NL | 0.003 | -14% | 1,572,322 | $5,244,753 |

| EPM | Eclipse Metals | 0.006 | -14% | 428,149 | $20,018,733 |

| NES | Nelson Resources. | 0.003 | -14% | 38,698 | $7,601,747 |

| SKK | Stakk Limited | 0.006 | -14% | 1,062 | $14,525,558 |

| BGE | Bridgesaaslimited | 0.031 | -14% | 80,000 | $7,194,931 |

| INF | Infinity Lithium | 0.027 | -13% | 25,000 | $14,340,355 |

IN CASE YOU MISSED IT

Cannindah Resources (ASX:CAE) has appointed the experienced John Morrison to its board as it moves into the next stage of its development. Morrison brings extensive experience in investment banking and the resources sector, having held director roles in several ASX-listed companies in the past, including a mining firm.

At Stockhead, we tell it like it is. While Cannindah Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX up 1pc to near record high; News Corp soars on strong Q2