Closing Bell: ASX swings to loss; but Pilbara and Arafura surge on funding news

The ASX dipped on Wednesday as CSL and Brambles dragged. Meanwhile Pilbara, and Arafura soared on funding, and all eyes are on the US CPI.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX reverses gains, CSL and Brambles weigh

IG6, Pilbara, Arafura surge on funding

All eyes now on the US CPI report

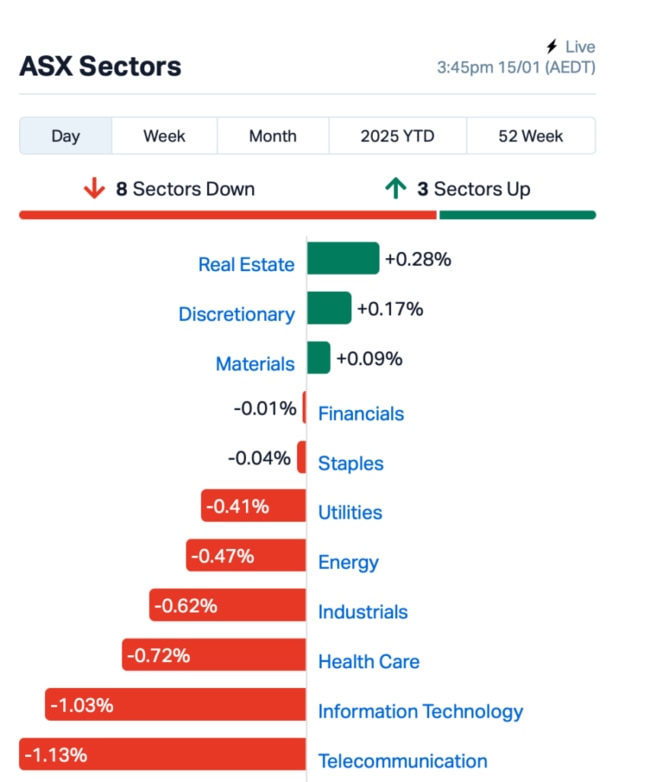

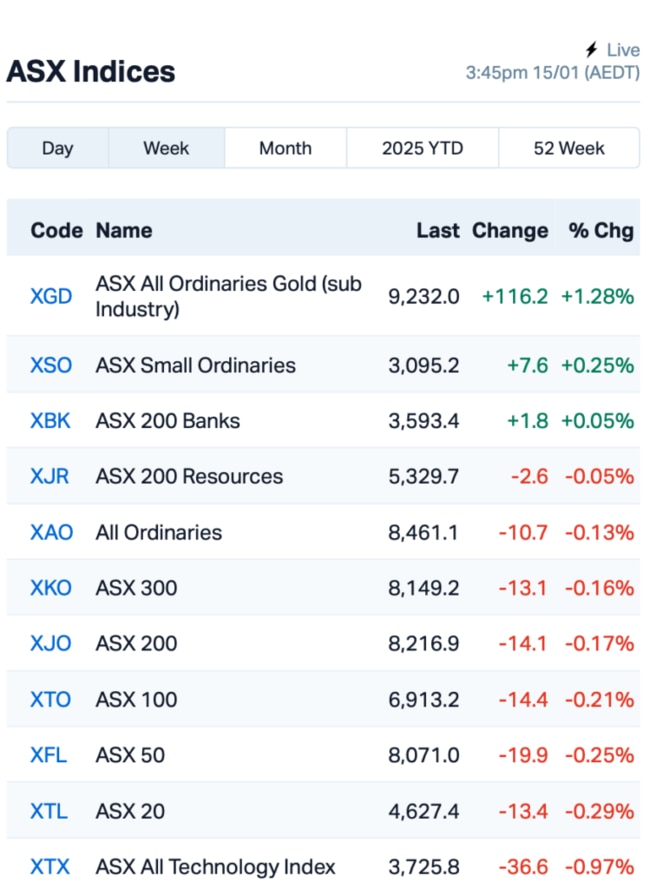

The ASX had a bumpy ride on Wednesday, down by 0.22% after an afternoon selloff, erasing earlier property stock-led momentum.

CSL (ASX:CSL) weighed down the health sector, while tech slipped ahead of the all-crucial US CPI report, which lands (very) early on Thursday morning, around 12.30am (AEDT).

All in all, eight of 11 ASX sectors were in the red, with volumes quiet as investors anxiously eyed the inflation report.

But amidst the market struggle, a few stocks were riding high.

Pilbara Minerals (ASX:PLS) jumped 4% on a $15 million loan to fund an electric spodumene calciner at its Pilgangoora lithium operations.

Homebuilder AVJennings' (ASX:AVJ)shares surged 8% after a fresh takeover bid from Singapore’s Ho Bee Land.

On the retail side, Baby Bunting (ASX:BBN) lifted 11% after reporting a 37% jump in H1 profit.

And, elsewhere, China’s central bank has just injected a record US$211 billion to ease a cash squeeze ahead of the Lunar New Year, as it battles rising pressure on the yuan.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap GMN Gold Mountain Ltd 0.003 50% 233,040 $9,158,446 WGR Westerngoldresources 0.068 48% 2,140,529 $7,836,332 PAT Patriot Lithium 0.060 40% 597,913 $5,435,972 AOA Ausmon Resorces 0.002 33% 2,553,975 $1,634,591 MDI Middle Island Res 0.014 27% 461,408 $3,004,020 ADR Adherium Ltd 0.015 25% 103,941 $9,102,960 AYT Austin Metals Ltd 0.005 25% 497,010 $5,296,765 TMK TMK Energy Limited 0.003 25% 1,930,390 $18,651,130 VML Vital Metals Limited 0.003 25% 422,566 $11,790,134 D3E D3 Energy Limited 0.079 22% 821,516 $5,165,875 IG6 Internationalgraphit 0.058 21% 341,189 $9,290,800 ADG Adelong Gold Limited 0.006 20% 71,833 $5,589,945 AOK Australian Oil. 0.003 20% 663,183 $2,504,457 BP8 Bph Global Ltd 0.003 20% 800 $1,183,270 IPB IPB Petroleum Ltd 0.006 20% 833 $3,532,015 LML Lincoln Minerals 0.006 20% 10,955,981 $10,281,298 MRD Mount Ridley Mines 0.003 20% 579,947 $1,946,223 EG1 Evergreenlithium 0.070 19% 64,842 $3,317,570 YRL Yandal Resources 0.170 17% 512,889 $44,839,072 OVT Ovanti Limited 0.021 17% 62,233,720 $41,967,861

International Graphite (ASX:IG6) was the star of the afternoon session, skyrocketing 19% after securing a fresh $4m grant from the WA Government to fast-track its Springdale-Collie graphite project. The cash will help with bulk extraction at Springdale and get Australia’s first graphite spheroidiser up and running at Collie. This brings the total government support to $17.2m.

Arafura Rare Earths (ASX:ARU) soared 13% after the Australian government pledged a $200 million boost to its Northern Territory mine and processing facility. The funding is part of the government's strategy to build a sovereign supply chain for critical minerals.

Evergreen Lithium's (ASX:EG1) Bynoe project is looking solid. Fieldwork in 2024 has confirmed LCT pegmatites for lithium, right next to Core Lithium’s Finniss. In addition, there’s gold potential with large areas showing promise, with assays for gold expected in early 2025.

Gold Mountain’s (ASX:GMN) drilling targets are set at its Salinas II project in Brazil’s Lithium Valley, with a 14-hole program planned to test 10 high-priority lithium anomalies. A strong regional structure mirrors the nearby Latin Resources’ lithium corridor, and GMN is now focused on securing permits before drilling begins.

Western Gold Resources (ASX:WGR) has tapped SSH Group as the preferred mining contractor for its Gold Duke project in WA. SSH has offered a deferred payment arrangement to support WGR’s cash flow as the project kicks off. The deal will have milestones like ore agreements and the Final Investment Decision. First-stage production will target 34,000 oz of gold across multiple deposits.

Yandal Resources (ASX:YRL) said its air-core drilling at Caladan is showing promise, with standout results like 11m at 1.7g/t Au from 97m in hole 24IWBAC063, including 3m at 3.5g/t Au. The gold’s coming from an 8km by 3km-fold structure.

D3 Energy (ASX:D3E)’s testing at Nooitgedacht Major is showing potential in the northern part of ER315, with gas flowing at an average rate of 102 Mscfd over seven days. The gas has 5.6% helium and 83.2% methane, which is pretty much in line with the southern boreholes, despite being shallower.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap VEN Vintage Energy 0.004 -33% 3,597,872 $10,017,188 NRZ Neurizer Ltd 0.002 -25% 251,316 $5,929,721 QXR Qx Resources Limited 0.003 -25% 485,488 $5,120,311 SBR Sabre Resources 0.007 -22% 2,352,109 $3,536,657 TON Triton Min Ltd 0.007 -22% 498,002 $14,115,499 CDT Castle Minerals 0.002 -20% 24,297,630 $4,742,035 AVE Avecho Biotech Ltd 0.003 -17% 513,207 $9,507,891 ERA Energy Resources 0.003 -17% 111,420 $1,216,188,722 5EA 5Eadvanced 0.079 -16% 860,603 $31,705,246 KNG Kingsland Minerals 0.110 -15% 433,421 $9,432,918 FRS Forrestaniaresources 0.011 -15% 1,179,940 $3,132,683 NVA Nova Minerals Ltd 0.320 -15% 671,489 $120,741,531 ADY Admiralty Resources. 0.006 -14% 2,518 $18,406,356 PPY Papyrus Australia 0.012 -14% 560,804 $7,728,635 RNX Renegade Exploration 0.006 -14% 167,766 $8,988,024 BIM Bindimetalslimited 0.082 -14% 5,010 $5,533,750 SBW Shekel Brainweigh 0.019 -14% 341,614 $5,017,347 HCT Holista CollTech Ltd 0.020 -13% 20,000 $6,572,634 FLG Flagship Min Ltd 0.041 -13% 58,595 $9,509,227 BCB Bowen Coal Limited 0.007 -13% 2,815,241 $86,204,221 EPM Eclipse Metals 0.007 -13% 440,714 $18,302,844 IFG Infocusgroup Hldltd 0.014 -13% 171,581 $2,627,389

IN CASE YOU MISSED IT

African gold explorer Many Peaks Minerals (ASX:MPK) has kicked off diamond drilling at its Ferké project in Côte d'Ivoire, following on from nearly 7,000m of auger drilling. The company also recently dusted off more than 8,000m of air core drilling at its Odienné gold project, also in Côte d'Ivoire. Assay results from these recently completed programs are currently pending.

At Ferké, MPK’s diamond drilling is focused on defining the geologic controls to high-grade intercepts, where recent drilling intercepts included 45.3m at 3.16g/t gold from 45.9m and 39.7m at 3.54g/t gold from 51.4m.

Small cap darling Spartan Resources (ASX:SPR) has completed the sale of its Glenburgh and Egerton gold projects in Western Australia to Benz Mining Corp (ASX:BNZ).

The sale of these non-core assets nets SPR $1 million in cash and 33 million Benz CHESS Depository Instruments – roughly the equivalent of a 15% shareholding in Benz. SPR may also receive an additional $6 million in contingent payments. Following the transaction, SPR general manager of geology Nick Jolly has joined the BNZ board.

Canadian explorer White Cliff Minerals (ASX:WCN) was busy over the Christmas period, sharing with the market today a number of successes it has had on the approvals side of its Rae copper project in Nunavut.

WCN has received a Class A Land Use Permit from the Crown-Indigenous Relations and Northern Affairs Canada – paving the way for drilling activities and camp construction. This permit follows on from a positive screening decision by the Nunavut Impact Review Board, meaning Rae meets all regulator and environmental requirements.

The explorer is due to kick off a new round of drilling at Rae this March, welcoming back Aurora Geosciences to undertake the works after a successful engagement throughout 2024. Aurora has more than 40 years of experience operating in Canada’s North.

Greenvale Energy (ASX:GRV) has received $250,000 plus GST after completing the sale of EL145 to Mosman Oil & Gas. The sale comes after the company also received more than $1 million from a research and development rebate.

At Stockhead, we tell it like it is. While Many Peaks Minerals, Greenvale Energy, White Cliff Minerals and Spartan Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX swings to loss; but Pilbara and Arafura surge on funding news