Closing Bell: ASX flat as Chinese AI DeepSeek spooks markets

The ASX closed flat as Chinese AI disruptor DeepSeek spooked Nasdaq, tanked Nvidia and infected local tech stocks.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX closes flat as Chinese AI disruptor DeepSeek spooks Nasdaq and local tech stocks

Nuix, NextDC and DigiCo face sharp losses as concerns grow China is closing the AI gap

Red Hawk Mining up 44% today after Fortescue cash takeover bid that could net $1.20 a share

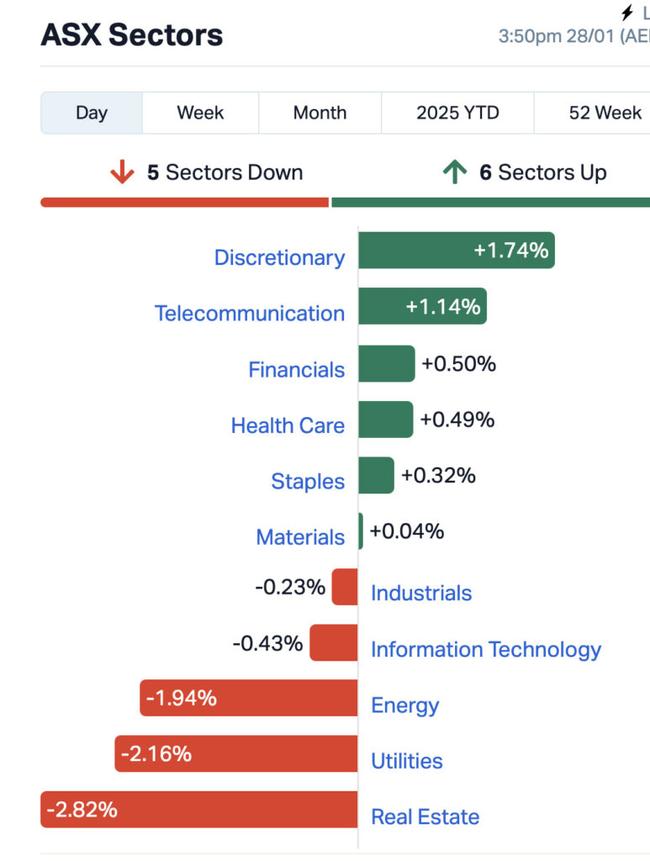

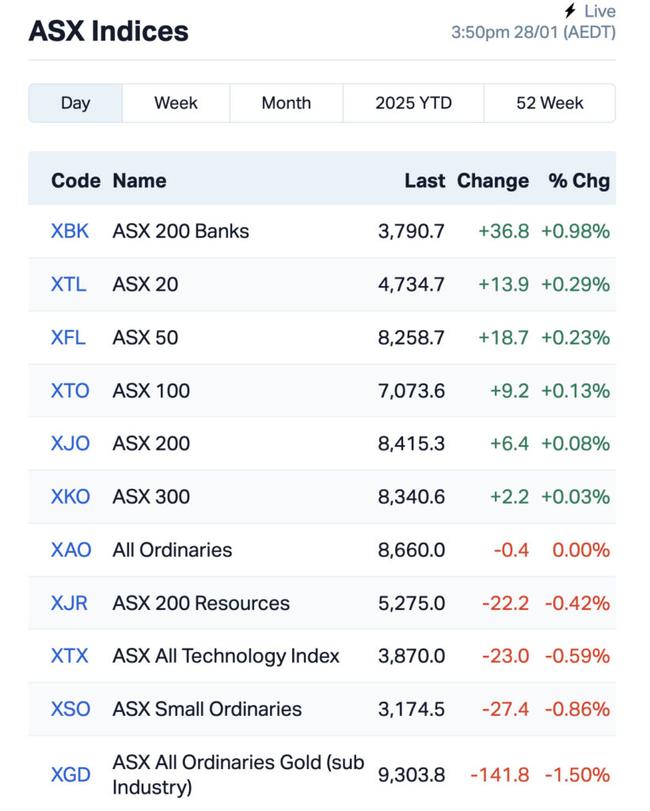

Aussie shares closed flat in afternoon trade with the S&P/ASX 200 benchmark finishing up by only 0.04% in the first day back after a long weekend, but all the talk was on tech as concerns over China’s new AI model DeepSeek triggered a global sell-off.

On Wall Street the Nasdaq dropped 3%, and Nvidia saw its market cap shrink by hundreds of billions after a 17% plunge.

Chinese AI competitor DeepSeek has launched a new model that experts warn could disrupt the market.

Offering similar capabilities to OpenAI at a fraction of the cost, it raises concerns that China is closing the AI gap with the US. DeepSeek’s model was trained for just US$5.6 million, a small fraction of what OpenAI spent on GPT.

#DeepSeek was trending on Twitter today where OpenAI chief executive Sam Altman seemed to welcome the competition.

deepseek's r1 is an impressive model, particularly around what they're able to deliver for the price.

we will obviously deliver much better models and also it's legit invigorating to have a new competitor! we will pull up some releases.

— Sam Altman (@sama) January 28, 2025

"By developing cutting-edge AI models with less advanced and more cost-efficient hardware, DeepSeek challenges the heavy investments US tech companies are pouring into high-cost AI infrastructure."

Chanana said its lower development costs raise critical questions about whether the traditional capital-intensive approaches by US tech companies were sustainable in the long run.

Australian tech stocks were hit by the DeepSeek inspired sell-off, with data centre operator NextDC (ASX:NXT) falling ~7.8%.

Nuix (ASX:NXL), which provides specialised software for analysing large data sets, tumbled 16.3%, while real estate investment trust with a focus on data centres DigiCo Infrastructure REIT (ASX:DGT) also dropped more than 10%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| YAR | Yari Minerals Ltd | 0.005 | 67% | 12,798,937 | $1,447,073 |

| 1TT | Thrive Tribe Tech | 0.003 | 50% | 518,202 | $4,063,446 |

| AYM | Australia United Mining | 0.003 | 50% | 357,868 | $3,685,155 |

| CZN | Corazon Ltd | 0.003 | 50% | 170,000 | $2,369,145 |

| EVR | Ev Resources Ltd | 0.003 | 50% | 28,994,934 | $3,625,007 |

| RHK | Red Hawk Mining Ltd | 1.18 | 44% | 770,517 | $163,845,413 |

| CTO | Citigold Corp Ltd | 0.004 | 33% | 3,011,021 | $9,000,000 |

| DTR | Dateline Resources | 0.004 | 33% | 1,023,000 | $7,548,781 |

| EAT | Entertainment | 0.004 | 33% | 205,912 | $3,926,358 |

| PKO | Peako Limited | 0.004 | 33% | 125,000 | $3,285,425 |

| PRX | Prodigy Gold NL | 0.002 | 33% | 16,627,348 | $4,762,583 |

| TTI | Traffic Technologies | 0.004 | 33% | 129,490 | $3,461,200 |

| VPR | Volt Group | 0.002 | 33% | 126,375 | $16,074,312 |

| CNJ | Conico Ltd | 0.012 | 33% | 1,140,660 | $2,137,386 |

| DSE | Dropsuite Ltd | 5.7 | 30% | 3,480,669 | $309,141,329 |

| AQD | Ausquest Limited | 0.044 | 29% | 61,670,402 | $38,417,780 |

| AGD | Austral Gold | 0.053 | 26% | 246,728 | $25,717,077 |

| XPN | Xpon Technologies | 0.015 | 25% | 4,046,302 | $4,349,298 |

| TMX | Terrain Minerals | 0.005 | 25% | 1,548,728 | $7,242,782 |

| DEM | De.Mem Ltd | 0.135 | 23% | 495,359 | $32,207,271 |

| RCL | Readcloud | 0.0915 | 22% | 335,237 | $11,072,481 |

| ASO | Aston Minerals Ltd | 0.012 | 20% | 25,583,987 | $12,950,643 |

| MQR | Marquee Resource Ltd | 0.012 | 20% | 48,804 | $4,854,805 |

| OSL | Oncosil Medical | 0.006 | 20% | 3,247,938 | $23,032,901 |

| TEG | Triangle Energy Ltd | 0.006 | 20% | 42,648 | $10,446,170 |

Red Hawk Mining (ASX:RHK) is up 44% after Fortescue (ASX:FMG) made a cash takeover bid at $1.05 per share, a 28% premium on its last closing price.

If Fortescue secures 75% of Red Hawk shares in the first seven days, the offer increases to $1.20 per share, a 46% premium. The Red Hawk board has recommended shareholders accept the offer, deemed fair and reasonable by independent expert BDO.

In other acquisition news, tech stock Dropsuite (ASX:DSE) has agreed to an all-cash takeover offer from NinjaOne for $5.90 per share, valuing the company at around $420 million.

The offer represents a 34% premium to its last closing price with the Dropsuite board fully backing the deal.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NIM | Nimy Resources | 0.09 | -38% | 2,766,334 | $27,001,721 |

| AOK | Australian Oil | 0.002 | -33% | 500,000 | $3,005,349 |

| BP8 | BPH Global Ltd | 0.002 | -33% | 20,000 | $1,449,924 |

| VML | Vital Metals Limited | 0.002 | -33% | 59,136 | $17,685,201 |

| BDM | Burgundy D Mines Ltd | 0.048 | -31% | 8,800,611 | $99,493,259 |

| FFF | Forbidden Foods | 0.007 | -30% | 6,843,886 | $5,722,235 |

| 88E | 88 Energy Ltd | 0.0015 | -25% | 1,523,651 | $57,867,624 |

| IRX | Inhalerx Limited | 0.02 | -20% | 324,747 | $5,336,206 |

| ENV | Enova Mining Limited | 0.004 | -20% | 4,090,747 | $4,924,647 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 1,073,333 | $6,125,968 |

| TMK | TMK Energy Limited | 0.002 | -20% | 2,563,712 | $23,313,913 |

| BMN | Bannerman Energy Ltd | 2.55 | -20% | 2,376,653 | $568,534,697 |

| NXL | Nuix Limited | 4.345 | -20% | 3,769,589 | $1,785,959,987 |

| LOT | Lotus Resources Ltd | 0.2075 | -19% | 27,289,513 | $602,476,245 |

| ASQ | Australian Silica | 0.022 | -19% | 80,000 | $7,610,230 |

| 1AE | Aurora Energy Metals | 0.05 | -18% | 480,091 | $10,922,888 |

| AI1 | Adisyn Ltd | 0.1 | -17% | 7,680,629 | $74,074,493 |

| BRN | Brainchip Ltd | 0.325 | -17% | 37,288,733 | $769,262,511 |

| EL8 | Elevate Uranium Ltd | 0.25 | -17% | 2,108,415 | $115,684,744 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 62,119 | $6,707,934 |

| MTB | Mount Burgess Mining | 0.005 | -17% | 50,000 | $2,037,225 |

| RLC | Reedy Lagoon Corp. | 0.0025 | -17% | 274,000 | $2,330,120 |

| DYL | Deep Yellow Limited | 1.2175 | -16% | 9,057,379 | $1,414,967,258 |

| CMD | Cassius Mining Ltd | 0.016 | -16% | 536,378 | $12,198,845 |

| MCO | Myeco Group Ltd | 0.016 | -16% | 170,773 | $11,335,591 |

In case you missed it

New South Wales explorer Australian Mines (ASX:AUZ) is preparing to drill at its high-grade scandium Flemington project, which currently holds a 6.3Mt resource at 466ppm scandium.

Australian Mines said it would drill out the project for roughly 50 aircore holes with the majority of the campaign focused on infill drilling and to test potential lateral extensions to the resource.

The remainder of the drilling will be for exploration and testing the Owendale Intrusive Complex which, outside of the company's tenements, hosts the Rio Tinto (ASX:RIO) Burra scandium project 4km to the east.

With the countdown on to FDA approval for its WiSE CRT (cardiac resynchronisation therapy) system EBR Systems (ASX:EBR) has signed an 11-year commercial lease agreement for a 4,751 sqm facility in a bid to boost its manufacturing scale and capabilities.

EBR expects to complete its move into the new Santa Clara facility during H1 2026. The company is expecting its to gain FDA approval for WiSE – touted as the only wireless cardiac pacing device for heart failure – on or before April 13, 2025, with commercial launch in H2 CY25.

At Stockhead, we tell it like it is. While Australian Mines and EBR Systems are Stockhead advertisers, they did not sponsor this article.

Disclosure: The author held shares in DigiCo at the time of writing this article.

Originally published as Closing Bell: ASX flat as Chinese AI DeepSeek spooks markets