ASX Lunch Wrap: ASX rises despite Fed’s wait-and-see; Alibaba’s AI shakes Nvidia

ASX rises despite Wall Street dip, Alibaba’s AI shakes Nvidia, Lovisa hit with class action and IGO posts quarterly earnings loss.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX up despite Wall Street's dip

Alibaba's AI launch shakes up Nvidia

Lovisa slapped with class action, and IGO posts earnings loss

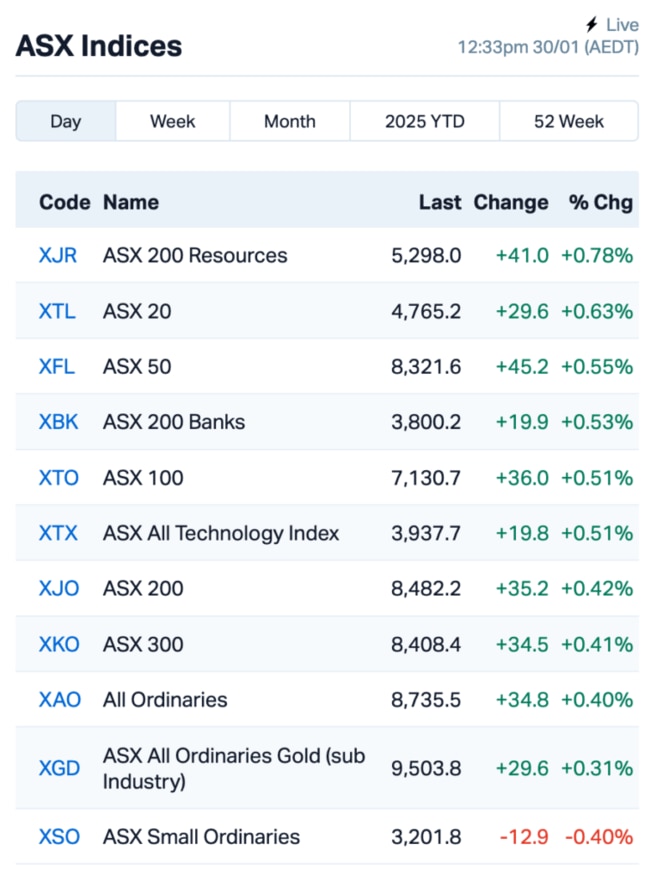

The ASX opened on a high today, up 0.5%, shaking off the negative vibes from Wall Street which closed lower overnight.

US stocks’ struggles came after Jerome Powell held the Federal Reserve’s interest rates steady, with investors now unsure about when the next rate cuts will come.

In a press conference, Powell said the Fed doesn’t need to rush to lower rates, contradicting what President Trump told the Davos audience last week.

“The committee is very much in the mode of waiting to see what policies are enacted,” Powell said.

“We need to let those policies be articulated before we can even begin to make a plausible assessment of what their implications for the economy will be.”

Trump jumped on Truth Social after the presser, saying: “Because Jay Powell and the Fed failed to stop the problem they created with inflation, I will do it!”

Meanwhile, the AI race is heating up.

Chinese giant Alibaba has just launched its own AI Qwen2.5 Max model, claiming that it can outperform the big guns – OpenAI, Meta, and even Deepseek – in nearly every test.

The news sent Nvidia tumbling another 4%, and followed DeepSeek's shock announcement earlier this week that it can train its R1 models for just under US$6m using outmoded Nvidia chips. That move spooked the Nasdaq on Monday as it tanked Nvidia 17% – a US$589bn one day loss.

Other mega tech giants were also all over the news last night.

Meta is looking good after reporting a 21% jump in quarterly revenue, hitting US$48.4 billion. Tesla announced plans to launch cheaper EVs by mid-2025, but its quarterly profits missed Wall Street’s targets.

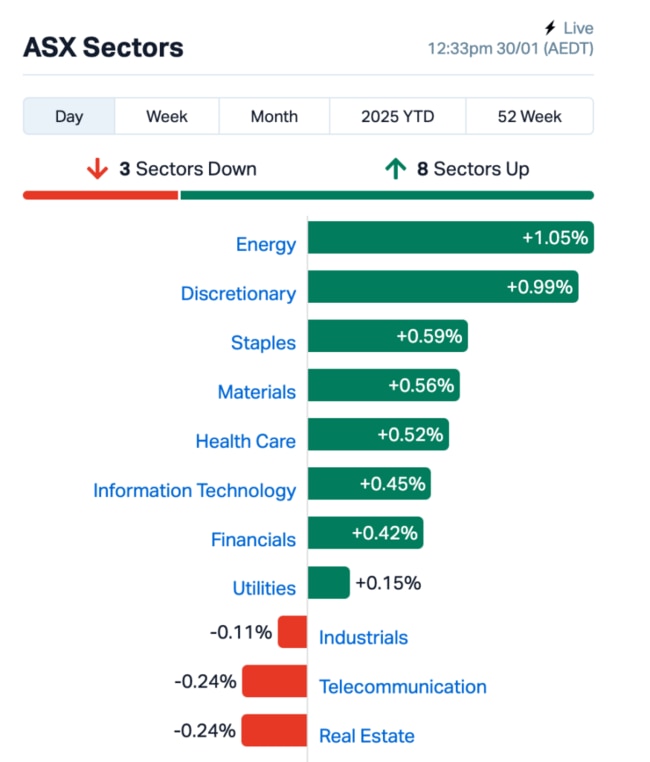

Back to the ASX, this is where we stood this morning. Energy and discretionary stocks led, while real estate lagged.

In large caps news, jewellery chain giant Lovisa Holdings (ASX:LOV) is feeling the heat after being slapped with a class action in the Federal Court over allegations that it underpaid staff since 2019. Shares were down almost 2%.

Lithium stock IGO (ASX:IGO) reported a $79 million EBITDA loss for the December quarter, largely due to weak results from its Tianqi Lithium Energy Australia joint venture. The stock dropped 3%.

Meanwhile, Mineral Resources (ASX:MIN) said it was on track for FY25, with Onslow Iron ramping up towards 35 million tonnes per year. It has $1.5 billion in liquidity, including $700 million in cash and an untouched $800 million credit line. Shares still fell by 5% despite improved pricing and product grades for its Wodgina and Mt Marion lithium concentrate.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 30 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ATH | Alterity Therap Ltd | 0.017 | 113% | 288,592,912 | $42,563,451 |

| CBY | Canterbury Resources | 0.035 | 67% | 7,728,242 | $4,146,259 |

| ERL | Empire Resources | 0.004 | 33% | 150,000 | $4,451,740 |

| RLG | Roolife Group Ltd | 0.005 | 25% | 103,926 | $4,784,125 |

| TMK | TMK Energy Limited | 0.003 | 25% | 496,831 | $18,651,130 |

| TMX | Terrain Minerals | 0.005 | 25% | 430,000 | $7,242,782 |

| T3D | 333D Limited | 0.011 | 22% | 80,083 | $1,585,651 |

| L1M | Lightning Minerals | 0.091 | 21% | 93,808 | $7,749,624 |

| NVU | Nanoveu Limited | 0.035 | 21% | 6,205,359 | $16,073,062 |

| LML | Lincoln Minerals | 0.006 | 20% | 100,000 | $10,281,298 |

| WAK | Wakaolin | 0.085 | 20% | 286,222 | $37,178,023 |

| WYX | Western Yilgarn NL | 0.027 | 17% | 703,306 | $2,847,620 |

| EPM | Eclipse Metals | 0.007 | 17% | 347,100 | $17,158,914 |

| GTR | Gti Energy Ltd | 0.004 | 17% | 10,147,536 | $8,888,849 |

| IPB | IPB Petroleum Ltd | 0.007 | 17% | 50,000 | $4,238,418 |

| STM | Sunstone Metals Ltd | 0.007 | 17% | 3,000,000 | $30,900,022 |

| MGL | Magontec Limited | 0.220 | 16% | 449 | $15,132,316 |

| FFF | Forbidden Foods | 0.008 | 14% | 675,000 | $4,005,564 |

| W2V | Way2Vatltd | 0.008 | 14% | 2,087,375 | $6,528,659 |

| BNR | Bulletin Res Ltd | 0.041 | 14% | 14,381 | $10,570,080 |

Alterity Therapeutics' (ASX:ATH) shares more than doubled after announcing positive results from its Phase 2 trial of ATH434 in early-stage multiple system atrophy (MSA), showing significant clinical improvement. ATH434 slowed disease progression by up to 48% at the 50mg dose and reduced iron accumulation in key brain regions, with a strong safety profile. The results have the company optimistic about future FDA discussions, as there's currently no approved treatment for MSA.

Alma Metals (ASX:ALM) and Canterbury Resources' (ASX:CBY) Briggs copper-molybdenum project in Queensland just wrapped up its 2024 drilling program, revealing some positive results. A new discovery was located at the Southern porphyry target, located 300m southeast of the current resource, showing good copper and molybdenum grades. All this data is now feeding into an updated resource estimate and mining study, with results due mid-2025. While Alma was unchanged, CBY rose 57% as of 1pm AEDT.

Nanoveu (ASX:NVU) just tapped Mark Goranson as CEO of its Semiconductor Technologies division. With 40+ years in the game, including top roles at TE Connectivity, ON Semiconductor, and Intel, Goranson is set to lead the charge in developing ultra-low-power SoC tech. This comes as Nanoveu wraps up its acquisition of EMASS, a leader in AI-enabling chips.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 30 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 400,536 | $11,649,361 |

| VFX | Visionflex Group Ltd | 0.002 | -33% | 70,586,000 | $10,103,581 |

| OB1 | Orbminco Limited | 0.002 | -25% | 410,669 | $4,333,180 |

| ICR | Intelicare Holdings | 0.007 | -22% | 665,010 | $4,375,693 |

| VEN | Vintage Energy | 0.004 | -20% | 121,177 | $8,347,656 |

| ZIP | ZIP Co Ltd.. | 2.620 | -20% | 45,723,570 | $4,269,282,122 |

| MGU | Magnum Mining & Exp | 0.009 | -18% | 2,546,342 | $8,902,975 |

| TMS | Tennant Minerals Ltd | 0.009 | -18% | 3,733,343 | $10,514,795 |

| CMD | Cassius Mining Ltd | 0.014 | -18% | 864,383 | $10,914,756 |

| ALV | Alvomin | 0.050 | -17% | 154,689 | $7,029,533 |

| HTG | Harvest Tech Grp Ltd | 0.015 | -17% | 1,186,879 | $15,948,881 |

| ERA | Energy Resources | 0.003 | -17% | 350,014 | $1,216,188,722 |

| A1G | African Gold Ltd. | 0.066 | -16% | 7,840,842 | $30,154,065 |

| QPM | QPM Energy Limited | 0.063 | -16% | 14,544,270 | $189,095,680 |

| 1AI | Algorae Pharma | 0.006 | -14% | 113,200 | $11,811,763 |

| LSR | Lodestar Minerals | 0.012 | -14% | 1,575,803 | $2,710,638 |

| RC1 | Redcastle Resources | 0.006 | -14% | 587,720 | $5,204,968 |

| SKK | Stakk Limited | 0.006 | -14% | 628,000 | $14,525,558 |

| VRC | Volt Resources Ltd | 0.003 | -14% | 8,520,947 | $15,428,838 |

| SCN | Scorpion Minerals | 0.019 | -14% | 341,992 | $9,008,036 |

| AEV | Avenira Limited | 0.007 | -13% | 2,174,132 | $25,352,272 |

| EVR | Ev Resources Ltd | 0.004 | -13% | 1,637,267 | $7,250,013 |

IN CASE YOU MISSED IT

Thanks to recent amendments to the Environmental Planning and Assessment Act 1979 (NSW), Silver Mines (ASX:SVL) now has a clear pathway to seek reinstatement of development consent for its Bowdens silver project.

It follows a busy quarter, during which the company completed a $25 million placement, updated the project's Ore Reserve and MRE, and announced the results of an Optimisation Study. The study reaffirmed Bowdens as a globally significant silver project with strong economics and potential for further growth.

At Stockhead, we tell it like it is. While Silver Mines is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: ASX rises despite Fed’s wait-and-see; Alibaba’s AI shakes Nvidia