Coopers pulls out of Australian Open tennis sponsorship amid dropping profits

SA brewing giant Coopers has pulled out of a major sponsorship deal with the Australian Open, as the company reports a major cut to its annual profit.

SA Business

Don't miss out on the headlines from SA Business. Followed categories will be added to My News.

- Coopers releases hops-driven new Extra Pale Ale

- How to get the most out of your Advertiser subscription

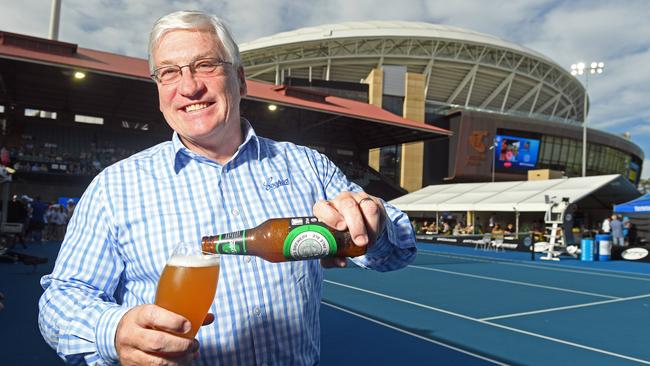

Coopers has pulled out of its annual sponsorship of the Australian Open tennis event, and will instead invest in advertising its brand across key domestic markets.

The SA brewing giant took over from Heineken as official beer partner of the event in 2017, and has had exclusive pouring rights since.

The original deal was for three years, with Coopers notifying organisers earlier this year of its intention not to trigger a two-year extension option.

However, Coopers managing director Dr Tim Cooper told The Advertiser on Friday the deal was costing the company close to $3.5 million a year and the money was better spent on advertising in key markets including NSW, Victoria and WA.

“Because of our desire to spend more money on advertising the Coopers brand we thought we couldn’t continue the sponsorship,” he said.

“It was costing us around $3.5 million a year and we felt we couldn’t continue that.

“We need to try to improve our performance in NSW, increase the number of salespeople there and increase our advertising spend.”

NSW is Coopers’ biggest market, with a 26.1 per cent share of the brewer’s annual beer production.

While volumes rose by at least 2 per cent in every other state last financial year, sales into NSW were flat.

Coopers released its 2019 financial results on Friday morning, reporting a 7.2 per cent increase in annual revenue to $254.6 million.

Rising barley and energy costs, and intense competition resulted in profit before tax falling from $34.3 million to $23.1 million.

Dr Cooper said the increased popularity of craft beer was having a major impact on the international beer market, and he expects the industry to go through a period of consolidation.

“I think it’s quite likely that it will because the number of brewers is probably unsustainable,” he said.

“It’s a couple of things - the number of craft beers out there but also the interest in craft beers from the big brewers - Lion and CUB - they’ve bought craft brewers or created their own craft beers.

“What we have to do is try and reinvent ourselves a bit by introducing new beers - over the past 18 months we’ve delivered a number of new products and all of our growth is now coming from those new products.

“We feel there’s enough we can do in bringing out new products that we don’t have to buy another brewer.”

Coopers launched its Session Ale in packaged format in March 2018, while Coopers Dry was released the following September and the Original Pale Ale was made available in cans in August last year.

Dr Cooper said the new releases were tracking well, while the release of Sparkling Ale in cans last August had also been well received.

“Coopers Dry entered the market to replace Coopers Clear and has been able to carve out a share of the dry or low-carb sector with sales exceeding initial expectations,” he said.

“The release of Coopers Original Pale Ale in cans in August 2018 helped boost sales for our leading product, especially in the second half of the year. The Pale Ale cans have greatly exceeded the sales of the former Dr Tim’s Traditional Ale.”

Overall sales volumes were up 2 per cent, driven by higher demand in Queensland, where the company reported a 6.1 per cent increase in sales volume.

Dr Cooper said while sales volumes had increased to 76.8 million litres last financial year, the company’s bottom line had been hit by rising costs and more competition in the market.

“The reduced profit was attributable to a changing sales mix, higher barley prices and more competitive market conditions with some segments showing declines in retail pricing,” he said.

“The latter renders difficult our ability to recover higher excise duties and costs arising from the imposition of container deposit schemes.

“Interest and borrowing costs increased by $1.7 million during the year reflecting the debt incurred by the malting project and previous share buybacks.”

Coopers opened its 54,000-tonne capacity malting plant in November 2017 alongside its brewery at Regency Park.

Malt sales for the 2019 financial year rose by 132 per cent to 44,300 tonnes, although this was from a low base.

“The maltings is now running close to full capacity, providing significant improvements in malt quality and cost savings on one of our key raw ingredients,” Dr Cooper said.

Dr Cooper said sales of manufactured partner brands fell 11.4 per cent, partly attributable to the conclusion of an agreement with Brooklyn Brewery in December 2018.

He said sales in the first few months of the new financial year had been positive, with strong growth in XPA, which was released in can format in August.

Coopers shareholders, representing several generations of the Coopers family and a small group of non-related investors, will receive a fully franked dividend of $13 per share, up from $12.50 in the previous year.