Proterra Investment Partners list $400m worth of Australian farm assets for sale

One of Australia’s biggest farm owners is looking to cash-in on record buyer demand, offering up $400 million worth of assets.

One of the biggest owners of Australian farming assets is exiting the country after listing three mammoth agricultural portfolios for sale.

The Proterra Investment Partners have listed their 4448ha Vaucluse, the 23,594ha One Tree and 14,425ha Racecourse portfolios for sale, with a combined value in excess of $400 million.

The US-based investment firm are continuing their exit strategy after selling $360m worth Victorian and South Australian farms in late 2021 to 23 different Australian buyers.

Proterra managing director Becs Willson said the sale of the Corinella Farms cropping

portfolio led the company to fast-forward their 10-year exit plan from Australian farm assets.

“It is a great time to capitalise on the existing strong market while there is an insatiable appetite from investors who want to enter or expand in the agriculture space,” Ms Willson said.

“We have spent the last eight years building these highly productive agricultural operations and, ideally, they are not assets you would want to sell.

“However, the short-term nature of our investment fund combined with high commodity prices and the calibre of the assets, presents us with an opportunity to continue our track record of strong returns to our investors.”

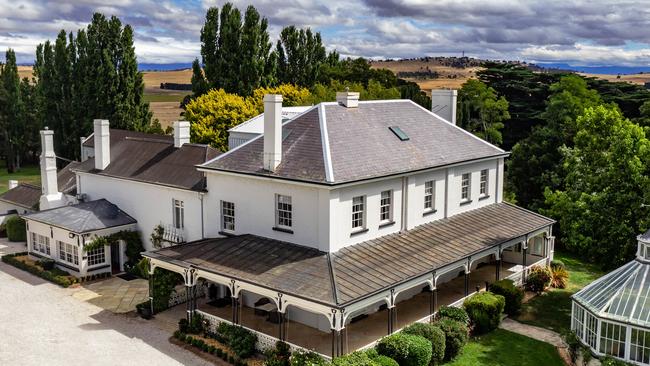

Vaucluse is located in Tasmania’s Midlands region and is the amalgamation of two neighbouring properties forming a dryland cropping, irrigation and grazing giant.

The farm is also home to a 10-bedroom Vaucluse Homestead and a circa 1832 five-bedroom Glen Esk Homestead.

After extensive developments to the portfolio, it is now one of Tasmania’s largest grain producers and holds water entitlements totalling 15,273ML and 9,000ML capacity water

Storages.

The One Tree aggregation consists of 21 individual holdings in southern Queensland and Northern NSW, which are home to a cropping goldmine.

The farms produce high-yielding wheat, barley, chickpeas, fava beans, cotton and sorghum, with 48,000t of combined grain storage added across the portfolio.

Further north, the Racecourse portfolio stretches across three aggregations totalling 14,425ha in the Clairview and Mackay regions of Queensland.

Proterra started their Northern Queensland investments when they purchased the Mackay region’s largest continuous use sugarcane farm in October 2013.

The portfolio has continued to expand with the US-based investors purchasing existing cattle

properties for conversion back to sugarcane production over the last decade.

LAWD are handling the sales with initial Expressions of Interest campaigns closing at 4pm on April 28 for Vaucluse and 4pm on May 5 for One Tree and Racecourse.

LAWD senior director Danny Thomas said with current Australian rural property market conditions he was expecting offers to flood in for the diverse range of holdings.

“Proterra has done an outstanding job to strategically aggregate land and water assets and to transition these into highly productive aggregations, now representing more than $400 million in value, across wide-ranging geographical areas and commodities,” Mr Thomas said.

“Given these factors, we expect the different portfolios to appeal to diverse categories of investors and are foreseeing a very high level of inquiry given the global demand for assets of this quality in this class.”

The sale of these three holdings will mark the end of Proterra’s existing ownership of agricultural assets in Australia, but they have not ruled out further purchases in the future.

“We also now have a track record in executing profitable exit strategies with our investors at the forefront of our timing and are hoping to replicate this unique model across the Australian agriculture industry.”