The US election implications for Australian agriculture

After months of mud-slinging, the US election is almost here. From tariffs to geopolitical frictions, what could a Trump or Harris presidency mean for Australian agriculture?

The first Tuesday in November. In Australia, it’s synonymous with the race that stops the nation – the Melbourne Cup – but every four years, as Australians go to bed reminiscing on the heroics of 2012’s Green Moon or 2020’s Twilight Payment, another race begins across the Pacific in America, one that has the whole world tuning in.

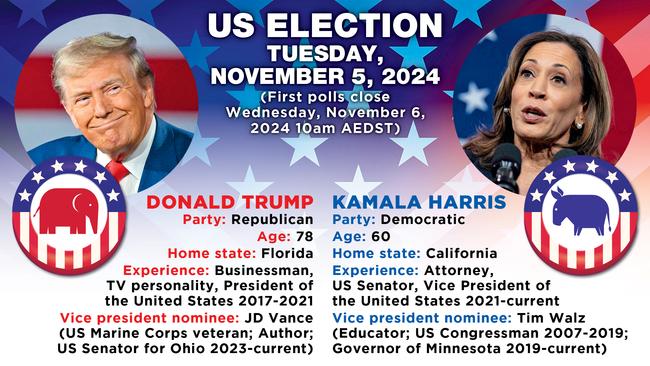

November 5 will see the US go to voting booths to elect its 47th president. On one side of the ballot paper, from the Democratic Party, is current Vice President Kamala Harris, a former Californian prosecutor who is aiming to become the nation’s first woman commander in chief. On the other side, former Republican president Donald Trump, who is hoping to become only the second person, behind Grover Cleveland in the late 1800s, to serve two non-consecutive terms in the White House.

Their campaigns have been heavily disrupted by issues away from policy. Trump has survived two assassination attempts while fighting multiple indictment charges across the country, including for his alleged involvement in the January 6, 2021 attack on the US Capitol following his defeat in the November 2020 election. Harris only ascended to the Democrat ticket after a poor debate performance from current president Joe Biden in June forced him to not seek re-election.

In the fog that is deciphering any tangible policies amid political rhetoric that is more often aimed at disparaging the opposition, it can be difficult to ascertain any expectations from either candidate should they win the election.

For Trump, we can look at his actions from his first term. For Harris, the question is whether she stays the course of the current administration, or looks to shake up its policies. And ultimately, much of what the winning candidate will be able to do in terms of policy will be controlled by the congress that is elected alongside them.

But experts say it is without a doubt that leadership and policy coming from the US has the ability to influence global trade markets like no other, and the result of the impending election will have an effect on Australian agriculture.

In 2023-24, the US was Australia’s second-biggest agricultural export market, with $7.14 billion worth of our product heading to our American partners, behind China at $17.13 billion, according to the Australian Bureau of Statistics. But it is perhaps the relationship between these two countries that will have the greatest influence on Australia post election day.

TERMS OF TRADE

“Our farmers are being decimated right now. They’re being absolutely, absolutely decimated. And, you know, one of the reasons is we allow a lot of farm product into our country. And we’re going to have to be a little bit like other countries. We’re not going to allow so much (to) come. We’re going to let our farmers go to work.”

These were the words of Donald Trump at a rally in Flint, Michigan, on September 18. The protectionist values and ideologies he favoured during his first presidential tenure saw significant tariffs implemented on a variety of foreign products, and this again looks likely to be a hallmark of his administration should he be elected. The self-proclaimed “Tariff Man” has said he would implement a tariff of 10 to 20 per cent on all foreign products, as well as a 60 per cent import duty on products coming from China.

For Australian agriculture, there could be several ramifications for such a decision. Currently, Australia’s largest exports to the US are beef and veal at $3.31 billion, ahead of sheepmeat at $1.23 billion. After three years of drought and a declining beef herd, the US has been looking to Australia, and even more so Brazil, to fill its beef quota. If tariffs are imposed, it stands to reason that Australian producers will be paying more to ship their beef across the Pacific. However, Georgia Edmonstone from the US Studies Centre at the University of Sydney says if history is any guide, the outcome is more difficult to predict.

“A lot of analysis since (Trump enforced tariffs in 2018) has shown that most of the cost of the tariffs were borne by the US customers, rather than the exporting countries,” Edmonstone says.

“It would depend on the specific commodity, specific circumstance of each industry what the impact of the tariff would be, but it might not necessarily fall on Australian producers.” This notion is supported by the US National Bureau of Economic Research that found US consumers of imported goods “have borne the brunt of the tariffs through higher prices”.

It should be noted that in 2018, when the Trump administration slapped a 25 per cent levy on imported steel, Australia, along with some other countries including Argentina and Brazil, was able to negotiate exemptions to the levy. Then-Prime Minister Malcolm Turnbull explained that the reason for the exemption was that Trump believed trade between the two nations should be “fair and reciprocal”. Australian producers will be hoping a similar exemption could be made for agricultural products.

But there is an indirect impact of such tariffs as well, says general manager of RaboResearch Australia and New Zealand Stefan Vogel. “If you think along the tariff lines, we’re going to see countries that are trading with the US facing issues getting all their volumes there,” Vogel says. “So for us in Australia, that probably means the likes of Korea, Vietnam, countries that actually run a sizeable surplus in terms of trade with the US … it will mean some of our most important buyers we have in our Asian market may have less money in their pocket.”

If tariffs cause a rise in trade frictions between countries, such as China and the US, Australia could be caught in an uncomfortable situation.

“The question remains how long Australia and New Zealand can stay neutral in such an environment,” Vogel says. “Obviously, we had import duties into China on products like barley and wine. We got them all back, but in a world with more trade frictions, we may actually see a risk that some negative implications might also come to our exports.”

Harris has also put her support behind tariffs, as long as they are much smaller and targeted. The Biden administration has in fact kept most of the Trump administration tariffs in place since coming into office. Whether Harris, if elected, will choose to wind down the level of some tariffs or keep to the status quo is unknown.

GEO-POLITICAL CONFLICT

Another aspect of global policy to watch is the involvement of the US in conflicts across the globe, most notably in Ukraine and the Middle East.

Before the Russian invasion, Ukraine was one of the world’s top exporters of wheat, barley and canola, all commodities that Australia is also very proficient in. And while they have managed to lift production again in the past year, its ability to produce and export grain directly impacts on the competitiveness of the Australian market.

“Ukraine is our main competitor for canola seed in the European market. We have seen since the war started that Ukraine exports all of their canola rather quickly and aggressively into the European market, with the remainder needed filled by us or the Canadians,” Vogel says.

“If Ukraine can sustain the Russian march, things will be more or less as they are currently, but if Russia can make more progress in the south (where Ukraine’s three main export ports exist), it will limit Ukraine’s ability to export significantly.”

Whether Ukraine can maintain its position against Russia could rely on the support they receive from the US and other partners. During the Biden administration, the US has consistently supported Ukraine’s right to defend their freedom from Russian aggression, provided millions of dollars in security assistance and weapon systems, and consistently condemned Russia.

Vogel expects Harris’s potential approach to be consistent with the current position, but says it will be an interesting watch should Trump be elected.

“Only with the monetary and military support that the Ukrainians received from the US, Europe and other partners have they been able to hold the Russians to the position that they are. Without that support I think it (becomes) a lot harder,” Vogel says.

“Trump has been rather clear that he wants NATO to step up … and basically feels like the EU and other partners within NATO need to do their fair share. So we may actually see less support for Ukraine from Trump.”

Earlier this year, the EU announced it would implement prohibitive tariffs on Russian grain imports. If Russia was to make further progress in the south of Ukraine, fields that previously produced grain for Ukraine to export could then be under the control of Russia, meaning tariffs would be imposed if that grain was to head to the EU.

While it would be incredibly sad for Ukraine, says Vogel, it could result in an increased demand for Australian grain.

In the Middle East, freight costs have risen significantly through the Red Sea due to attacks on ships from the Iranian-backed Houthi rebel group. Ships from Australia have often chosen to take the route below the Horn of Africa instead, increasing journey times by between 30 and 50 per cent.

“We probably will see that Mr Trump puts a bit more emphasis and effort on that region if he reduces the efforts in Ukraine, while with Kamala Harris, we will probably see a continuation of the (current) situation. But the Red Sea will be very hard to resolve,” Vogel says.

“So no matter who’s the president, we assume that this issue with container freights remains for a while.”

Harris’s national security adviser, Philip Gordon, has previously described the Houthi attacks as “outrageous behaviour” and reasserted the US commitment to diminishing the capabilities of the group, while one of Trump’s last foreign policy decisions as president was to designate the group as a foreign terrorist organisation.

While this decision was supported by Saudi Arabia and the UAE, the Biden administration quickly rescinded the designation over fears it would worsen the humanitarian crisis in Yemen. Research organisation the Middle East Institute feels it is unlikely Trump would seek to reverse the current course of action.

The wine industry could also be impacted by any geopolitical friction. Behind animal products, Australia’s largest agricultural export to the US is wine, exporting $385 million worth of it in 2023-24, from 258 exporters in 2023. Premium wine (above $10 a litre) exports to the US have been steadily rising for the past decade, and despite a macroeconomic slowdown, it is still ranked the world’s No. 1 most attractive wine market, according to Wine Intelligence. When Trump was first president he imposed a 25 per cent tariff on wines imported from the EU.

While these were retaliatory tariffs and did not impact Australia directly, and have now been phased out by the Biden Administration, any other new ones could impact demand for Australian wine indirectly.