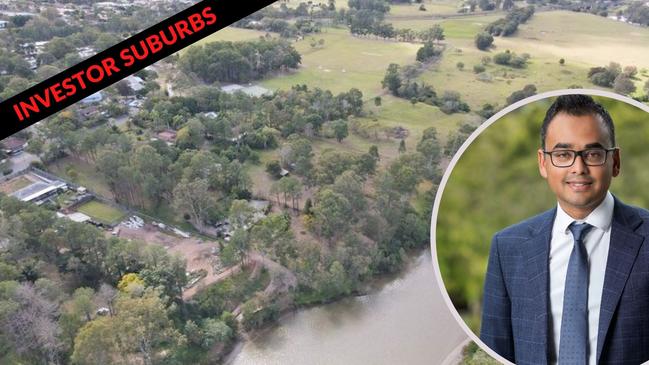

Logan’s top riverside addresses where investors are finding joy

Logan suburbs have seen the highest unit rent yields across the state, fashioning what was once known as a crime haven into an investors’ delight.

Property investors still looking to pick up a bargain in southeast Queensland are now eyeing off the units market with a southside region attracting savvy southern investors.

Logan, south of Brisbane, is leading the way.

What were once regarded as Logan backwaters and crime-ridden suburbs for the underprivileged, have emerged as some of the best spots for investor growth.

Investors are buying units after scanning real estate data looking for properties where median values have dropped over the past year and where rents have risen.

Instead of looking at Brisbane’s inner city unit market, they are buying into suburbs where properties are producing rental yields for both houses and units above 5 per cent.

The state’s greatest rise in rents for houses was in Laidley, where rents went up 6.5 per cent over the year, according to global online real estate advertising company REA Group.

Logan suburbs of Kingston and Woodridge, were not far behind with both experiencing rises in house rents of 5.9 per cent.

Five of the top 20 suburbs for rental yield for houses were in Logan, with Eagleby, Crestmead and Logan Central all close to the local hospital, university and Tafe college.

The average price for a rental house in Woodridge this week, according to realestate.com was $315 a week.

With a 26 per cent growth in annual demand for rental houses in Waterford West over the past year, real estate agents were predicting greater investor interest in the area.

Rental demand for houses grew a massive 34 per cent in Logan’s emerging suburbs of Park Ridge and Greenbank with suburbs such as Loganholme also experiencing a 24 per cent spike.

Unit rentals also rose in Logan with Woodridge recording the state’s highest rental rise, a whopping 8.2 per cent over the year to June.

Eight of the top performing suburbs for rental yields were in Logan with Slacks Creek, Beenleigh, Mt Warren Park and Kingston all recording rental yields of greater that 7 per cent for the year.

Eagleby, Marsden, Edens Landing, Springwood, and Daisy Hill will also make top investor spots after all recording rental rises of between 6.4 and 7.1 per cent.

Data from REA also showed investors of a typical Woodridge unit were finally starting to cash in this year with rental income outstripping mortgage repayments on average by $604.34.

But that return has been a long time coming for most in the Woodridge unit market, which has only seen a 4.4 per cent growth in rents since 2001.

In Queensland, Redland Bay was top of the list of suburbs being sought out by investors, according to data from global online real estate advertising company REA Group.

The bayside suburb had 391 house sales in the year to June and was where investors, on average, were making $163 clear from income from monthly rents after mortgage repayments.

Logan, the neighbouring city, topped the list of suburbs where housing values, dominated by units, have recorded the lowest percentage change over the 12 months to July 1.

Bethania, a suburb which has its own train station and is dotted with prestigious acreage properties bordering the Logan River, recorded an 8.8 per cent drop in median value to $293,354.

Units in Loganlea also recorded a 7.9 per cent drop in median value to $277,974 with nearby Waterford West, also bordering the river, experiencing a 7.4 per cent drop in median value.

A one-bedroom unit in Bethania can be rented for $195 a week and a two-bedroom unit $245 a week.

But the majority of properties on the market for rent were in Loganlea with an average price of $330 a week.

Ipswich also attracted southern investors to suburbs such as Raceview, Fitzgibbon, Taigum and Rothwell.

Logan, Beaudesert and Ipswich made a national list of suburbs selling for under median value mainly due to a weak unit sales market.

In Brisbane, CoreLogic data revealed over the past quarter no houses had sold at a loss.

Ray White Marsden principal Avi Khan said unit investors were becoming more dominant but homeowners were also still looking to cash in on the heated market.

“At the moment, 31 per cent of the homes for sale in Queensland belong to investors, which is a record number and goes to show confidence in the market,” he said.

“Finding a suburb where properties are selling under median values is becoming more difficult because we have a perfect storm of buyers with investors and owner occupiers competing for homes.

“Suburbs such as Waterford West and Loganlea have become highly desirable given their proximity to schools, highways, transport and hospitals,” he said.

“They also provide great yield for investors.”

Here is our list of 20 suburbs where investors are finding some joy in the unit market.

CoreLogic’s research director Tim Lawless said every Brisbane suburb had recorded a rise in house value, while 12 suburbs recorded a fall in unit values over the year.

The Loganlea-Carbrook region had four suburbs within the weakest performing suburbs list, followed by Chermside, Sandgate and inner-city Brisbane regions.

“While this trend for units (to decrease in price) may be at least partially due to a preference shift away from higher density housing options during a pandemic, another factor could be increased popularity of working from home where more Australians are looking for larger living spaces,” Mr Lawless said.

“Another factor contributing to the softer performance across the unit sector could be that investors, who often prefer units over houses, have been relatively slim on the ground.

“Based on data to May 2021, investors comprised only 26.8 per cent of housing demand, up from a recent low of 18.9 per cent in September last year, but well below the decade average of 32.3 per cent.

“The softer conditions may be associated with supply levels outweighing demand. This doesn’t necessarily mean unit supply in these areas is high; some of these markets are likely to be experiencing low demand for medium to high density styles of housing as preferences shift towards detached housing options.”

The suburbs featured in the top 20 list are from a diverse array of areas around Brisbane including inner city through to suburbs around the outer fringe.

Not all southeast Queensland units suffered a weakening in prices.

More Coverage

Originally published as Logan’s top riverside addresses where investors are finding joy