VIDEO: Investors leap in to Redland Bay’s white hot property market

Savvy property investors are flocking to a bayside suburb to cash in on price rises averaging $5000-a-month over the past year. VIDEO | Where it’s hot

Savvy property buyers are flocking to Redland Bay, named the top southeast Queensland suburb for investors after it recorded property price rises averaging $5000-a-month over the past year.

The suburb, which fronts Moreton Bay and is the take off point for Macleay, Russell, Lamb and Karragarra islands, rocketed up the charts this year selling more houses than any other address by a margin of 14 per cent.

There were 391 sold properties in Redland Bay in the year to June which compared to another bayside suburb, Deception Bay, where there were 339 properties bought.

Surprisingly both waterfront suburbs had higher sales growth than suburbs in the greater Brisbane area such as Fortitude Valley, Nundah, Kangaroo Point or Chermside.

Data from real estate digital advertising company REA, which operates Australia’s leading property websites, suggested suburbs outside the capital were faring far better on house price sales and growth than those of suburbs in a 5km-10km radius of the city.

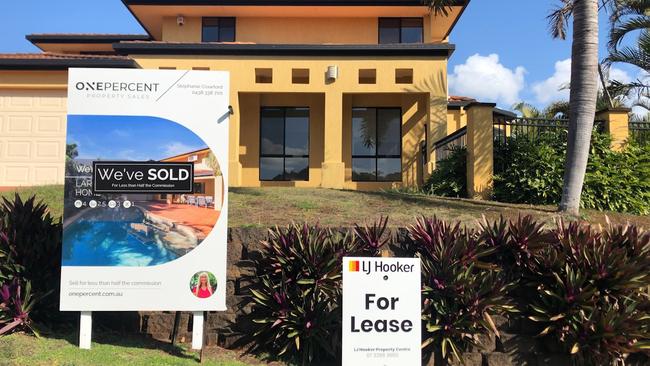

Real estate agents claimed southern investors were driving up prices, snapping up houses to either live in and reap the predicted capital gains or rent out and cash in on the expected rise in rental yields.

VIDEO: WHY REDLAND BAY IS GETTING TOP DOLLAR

The massive interest in the once-small sleepy waterfront Redland Bay township was sparked after a whopping number of new houses came on the market with thousands of others promised in the area.

Every day, property hunters are seen parked in their cars gazing at a bulldozed Redland Bay site dreaming of what a massive Lendlease estate will look like when 3500 houses are built.

Many are southern investors looking to pick up a cheap house-and-land package to live in and watch the capital growth or as an investment in the suburb which recorded a 4.8 per cent increase in rents in the year to June.

Calamvale had the top increase in rents in the southeast region over the year at 6 per cent with Arana Hills, a northside Brisbane suburb, posting a 4.3 per cent increase in rents.

Real estate agents in the area reported house and unit prices across Redland City, which includes the suburb of Redland Bay, were increasing at the rate of about $3000 a month.

Redland Bay values, however, were increasing, on average, by $5000 a month with the median sale price increase from 2020 at $580,000 leaping $640,000 this year.

Redland Bay real estate agent Jesse James said the housing and unit sales market had soared to dizzying heights in the past six months with cashed-up southern investors stagging into the market.

He said prior to Covid, about 70 per cent of house and unit sales in Redland City were local buyers moving within their own bayside suburbs.

But Mr James said in the past six months, house prices were being driven up by competition from interstate prospective purchasers who believed buying now would get them into the market before prices skyrocketed.

He said six-month forecasted estimates added $60,000 to Redland Bay property values without any refurbishments.

A property buyer who paid $500,000 for a house in Redland Bay in April 2020, after the first month of Covid lockdowns, could now expect to add $60,000 to its sale price without any renovations.

Mr James said the address was so popular at the moment, southern investors were even forgoing moving into their newly purchased property immediately just to make the sale.

“We are now seeing more inquiries in Redland Bay coming out of Victoria and South Australia as those investors are sick of being in lockdown,” Mr James said.

“We are also experiencing sight unseen sales regularly, nearly on a weekly basis, with demand boosted as several buyers compete without walking physically through a dwelling.

“We are even seeing buyers placing competitive, written interest contracts against others in the hope they end up the successful purchaser.

“Some of these interstate purchasers are going as far as letting the current owners of the home rent it back for free so the new buyer has peace of mind that the property is being looked after while they cash in with the capital gains.”

UNITS AND RENTS

REA data also showed unit values in Brisbane suburbia had dropped, while in bayside suburbs such as Cleveland and Ormiston, unit prices and values had raced ahead as they had in places such as Fortitude Valley and South Brisbane.

Median rent over the year to June in Alexandra Hills, another Redland City suburb, rose 5 per cent in the year to June with Mt Cotton rents up 4.8 per cent and Cleveland up 4.5 per cent.

As leases expired, existing tenants in Redland were being hit with rent increases of anywhere from $15 a week up to as much is $100 a week.

Tenants who refused to pay were moved out and the vacancy “easily filled” with up to 30 applications on a house in a week.

“In most cases though, the tenants will pay the money because they know if they move out, they will not find another property at that price or simply will not find a property,” Mr James said.

“Cleveland, Ormiston and Capalaba are three suburbs leading the way with huge growth in values, zero vacancy for rentals and an increased demand for living in those suburbs.

“If we compare those suburbs with houses being the predominant requirement, then it’s Redland Bay Alexandra Hills and Wellington Point that continue to have huge demand from prospective buyers.”

During 15-months of Covid, open homes had also been attracting record numbers in Redland Bay with as many as 140 people in 20 minutes through a house and up to 16 written contracts to purchase that property in 20 minutes with massive swings in divergence in offers.

One property with 120 people through it in 20 minutes had 16 offers, the lowest $470,000 and the highest more than $700,000.

Mr James said his business was swamped every day with inquiries and while agents were doing their best to return phone calls it was difficult to keep up.

“Three or four years ago, we would get three people through six open homes and now we get 60 people through three open homes so our workload has substantially increased,” he said.

“While it’s great for the industry and the homeowners, it is causing supply issues for buyers, who need to be prepared to put their best foot forward first up as they generally are not getting a second chance due to 80 per cent of sales scenarios being a multiple offer situation.”

More Coverage

Originally published as VIDEO: Investors leap in to Redland Bay’s white hot property market