Risk levels turn Australian banks gun shy

Financial institutions are targeting the firearms industry, claiming it’s too risky to serve gun shop owners.

EXCLUSIVE: AUSTRALIA’s big banks are cutting ties with gun shop owners, claiming the firearms industry is too risky to service.

The push is being led by National Australia Bank, which is shutting accounts of legal and licensed firearms traders, leaving business owners in the lurch as they are forced to try to find new banks, The Weekly Times can reveal.

It is just one of a slew of financial institutions – including the big four banks – that appear to be rethinking their links to the gun industry as they tighten their regulations in the wake of the banking Royal Commission.

Firearm industry representatives fear gun owners and retailers are being unfairly targeted, despite already having to meet stringent rules.

“Licensed firearm owners are the most heavily vetted, the most heavy burden of compliance, and the most frequently vetted by law enforcement in each jurisdiction,” Shooting Industry Foundation Australia spokeswoman Laura Patterson said.

“If any business is open and transparent, then it is the firearms distribution networks.”

The Weekly Times has seen several letters from NAB advising of account closures, including to a gun shop owner in Boonah, Queensland, and to a returned Defence Forces veteran in Ipswich.

A NAB spokeswoman said the bank did not discuss details of individual customers.

“When we welcome new customers or review our existing customers, we assess each customers’ risk to ensure we meet our legislative requirements, and we have the appropriate measures in place to manage that risk,” she said.

“Through these assessments we determine whether we can provide banking services.”

James Blacker – who served in Afghanistan, and is now an ammunition manufacturer – said he had both his business and personal accounts shut down.

A letter on January 30 stated: “NAB regularly reviews the risks associated with providing banking services to customers involved in certain industries. As a result of these reviews, NAB has chosen to cease providing you with banking services.”

When he queried the closure, NAB advised it regularly carried out due diligence checks and reviewed its service offerings: “As per our investigations, it has been identified that NAB must cease its banking services with you as you no longer meet the bank’s risk appetite due to being a firearms business.”

Mr Blacker said he was given 45 days to open new accounts – but was refused service by the Commonwealth Bank, ANZ and Westpac for the same reason.

“It’s completely stuffed me at the moment, I can’t pay any outgoing bills,” he said.

“It’s a big slap in the face. They (NAB) have been taking my money for the last two years, and now they’ve closed my EFTPOS facilities and everything.

“It’s more discrimination against firearms owners – we’ve been back and forth, up and down, with no real outcome perceivable.”

The move has already incensed shooters. Discussions on social media and on NAB’s own Facebook page include dozens of angry gun owners and shooting club members vowing to leave NAB.

Ms Patterson said SIFA had fielded “many” calls from concerned businesses in the past week – and the issue goes well beyond NAB.

Complaints related to several “top-tier” banks, insurance companies and payment gateway services either closing accounts or refusing to deal with gun shops and related firearms industries, she said.

Several complaints have already been escalated to the relevant ombudsman.

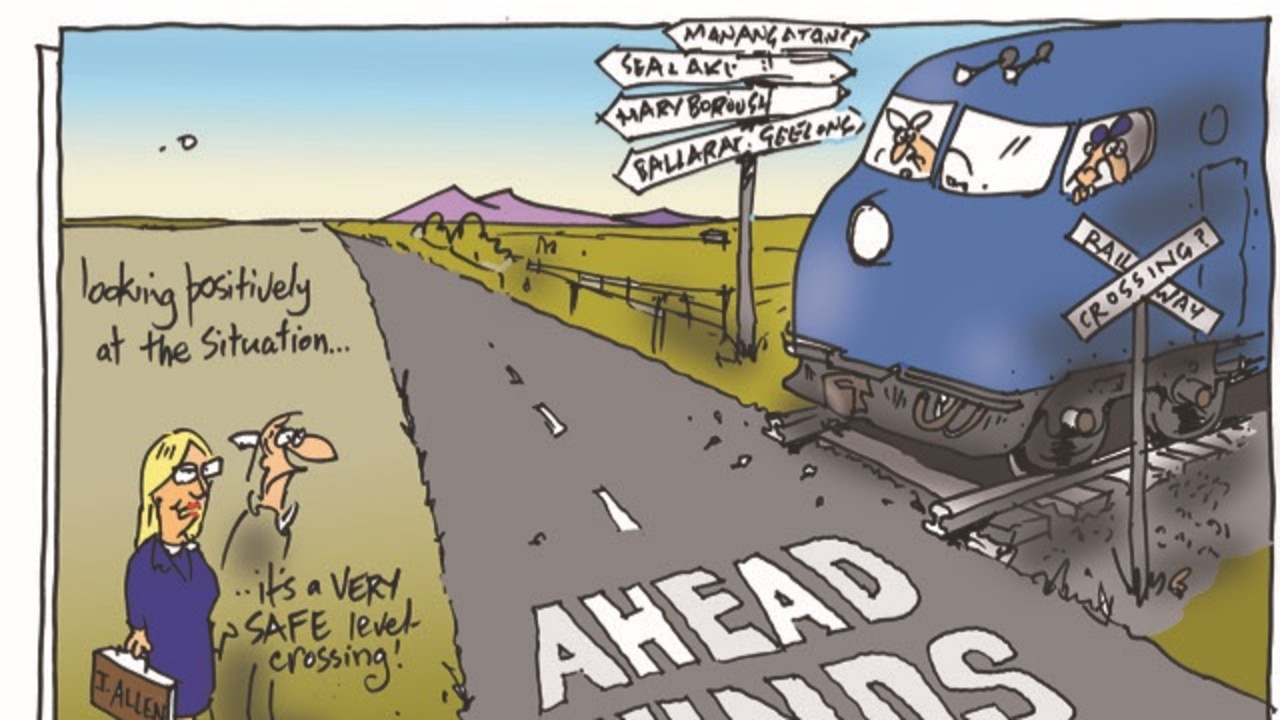

EDITORIAL: BARREL OF HYPOCRISY

The NAB closures come after Bank of Queensland drew criticism late last year for denying a home loan to a gun shop employee. That decision was reversed following a public outcry.

It’s believed the policy change is in reaction to the Hayne Royal Commission, and the need for banks to ensure they are not providing services to criminal activity.

NAB was singled out in the Hayne report for its past misconduct with customers, and is currently facing penalties for several self-reported breaches of anti-money laundering and counter-terrorism laws.

Ms Patterson said financial organisations had to manage risk, but “we should be very aware of throwing legal and audited businesses under the bus”.

Firearms Owners United vice-president Kirk Yatras said gun owners and retailers felt “victimised” by the move, particularly as so far it appeared to mostly affect small business owners in the industry.

“It is completely impossible to run a business without a bank account,” Mr Yatras said.

“If we see a broader adoption of this it could hamper all small businesses.”

It comes as Animals Australia plans to pressure banks into changing their policies on financing livestock production, by ranking the institutions’ attitude to funding live exports and intensive farming.

Ms Patterson said the banks’ position on firearms “could well be the pointy edge of the wedge” and that not just firearms businesses should be concerned.

“There is a growing activist element that calls for the deplatforming of certain entities based on a moral, rather than legal viewpoint,” Ms Patterson said.

“I think that the shooting industry has been for the last 20 years the canary in the birdcage and a lot of the issues we raise about fairness, and demonisation of individuals can have an impact for other industries as well.”