Grain growers, sheep producers spurn farm management deposits but dairy farmers lodge cash

Farmers have lodged less in farm management deposits in 2019-20, largely due to drought in eastern Australia impinging on cash flow.

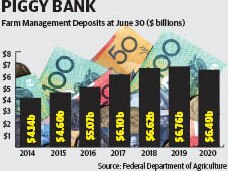

THE recent east coast drought has resulted in the lowest peak in Farm Management Deposit contributions by Australian farmers in three years.

New figures show farmers had $6.49 billion lodged in FMDs by June 30 this year.

But it is the first time in a decade the annual June peak did not exceed the spike of the previous year.

FMDs hit a record $6.76 billion in June last year, following the previous high of $6.62 billion set in June, 2018.

Farm management deposits are a means for farmers to defer income earned in good seasons to subsequent tax years to even out the volatility in commodity prices.

Farmers generally reassess their income in June to decide whether to deposit funds in FMDs before the end of the tax financial year.

The FMDs are somewhat of a barometer of how different industries are travelling in the agriculture sector.

Grain growers have generally been the biggest users of FMDs.

This year, they deposited less than the previous year, ending a six-year run of rising peaks in deposits.

According to the data, sole grain growers had lodged $1.37 billion in deposits by the end of June, the lowest peak since $1.36 billion was lodged in June, 2017.

Mixed pastoral and grain operations had lodged $1.46 billion in FMDs by June 30 this year, the lowest since June 30, 2016, when $1.26 billion was lodged.

Grain Growers Australia chairman Brett Hosking said the smaller amount lodged by grain growers would be due to the east coast drought but probably also reflected lower crop yields in Western Australia.

“Croppers were some of the hardest hit in that (east coast) drought,” Mr Hosking said.

“I think we could see another smaller spike (in FMDs) next June as farmers put income into recovery rather than tax management.”

Mr Hosking said some drought-affected farmers were likely to withdraw previous deposits now to offset costs of sowing this year’s harvest.

Beef producers just missed out on eclipsing their record deposits set in June, 2018, with $1.015 billion lodged by the end of last month.

Beef and sheep producers, plus those that only run sheep, had lower deposits than last year.

That would indicate that sheep and grain producers had suffered during the recent east coast drought.

Horticultural producers continued a run of five years of rising June FMD peaks, with $754 million lodged by the end of last month.

Surprisingly, dairy farmers increased their deposits this past year to $305 million, falling just shy of their record of $308 million set in June, 2015.

In April, 2016, the market collapsed when Murray Goulburn and Fonterra slashed their farmgate returns and dairy has been considered to be in the doldrums ever since.

While milk prices have been high during the past year, many have experienced a rise in the cost of inputs, such as irrigation water, grain and hay.

United Dairyfarmers of Victoria president Paul Mumford said milk producers were increasing their business skills and it was likely they were taking advantage of tools such as FMDs.

Mr Mumford said dairy farmers had substantially higher milk prices than previous seasons last financial year but higher costs.

He said it was possible some dairy farmers already had FMDs from previous years and had lodged more in June but would roll some existing deposits out this year to pay those higher costs.

MORE