US steer weights at record highs, as beef production rises

Cattle production in the United States is higher than last year, boosted by some big slaughter weights including a new record average for steers set this month.

There are more nuances to current United States cattle production than the simple idea the country is in a herd rebuilding phase and its high beef prices are being driven by a shortage of supply.

In tonnage terms US grain-fed beef production is actually trending above last year’s levels, boosted by some big slaughter weights including a new record average for steers set this month.

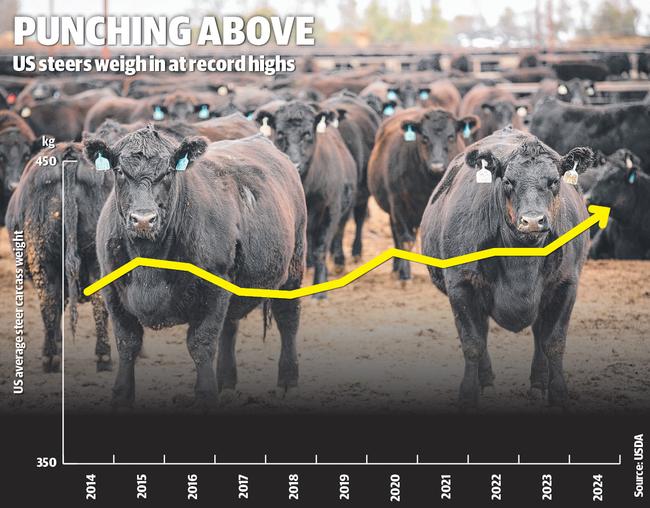

In the first two weeks of October the average carcass weight for US steers was 430.91kg carcass weight, marking it the first time it has gone above 428kg in the past decade.

The graphic on this page shows the steady growth of steer carcass weights in the US since 2014, this month hitting record highs, according to data from the US Department of Agriculture.

To put it into perspective, the average male cattle carcass weight listed by the Australian Bureau of Statistics in 2023 for Australia was 347.7kg. So on paper every steer processed in the US is delivering around 83kg of extra beef compared to its Australian counterpart.

For the year to date fed beef production in the US is trending at 7,625,857 tonnes to be 2 per cent up on the same 10-month period in 2023.

The disparity comes from the fact placements of steers and heifers into feedlots has remained strong despite the US slowing down its cow kill after years of drought. The latest data from US market analysts Steiner Consulting was an estimated 11.6 million cattle on grain in the US at the start of October, matching the levels of a year ago.

Factors behind the steady flow of cattle into feedlots has been cashflow and price, and key parts of the US returning to drought-like conditions. A case highlighted by Steiner was the state of Oklahoma, with feedlot placements up 19 per cent across this region in the latest survey due to the poor season.

The positives from all this is US beef prices have been able to sustain a high price run despite their own robust grain-fed production figures and the country being targeted by major exporters including Australian, New Zealand and South America with grinding beef.

The US breaks down its data into fed and non-fed bull and cow categories. The US cow slaughter for the first 10-months of this year is tracking 15 per cent below the same period in 2023, while bull processing is down 7 per cent.

But with US heifer placements still high into feedlots the American herd rebuild is going to be slow, and many analysts are still tipping the best of US cattle and beef pricing is still to come.

Although to keep maximum competition in the global beef trade, Chinese demand has to remained strong.

Export sales to China did slow in September, quoted down by 27,000 tonnes or a retreat of 11 per cent on a year ago. Much of the drop was attributed to New Zealand, which has started to shift more of its reduced beef production to the US for the higher prices on offer.

Steiner consulting said it was telling that New Zealand beef exports to China during September were down 24 per cent whereas sales to the US only improved 8 per cent. It suggested a strategic change by New Zealand processors rather than a sign of a significant demand issue out of China.

“We believe the primary reason for the reduction in Chinese imports is an overall decline in NZ beef supply, and they have shifted their focus to the US market for the higher prices on offer,” Steiner analysed.

Which leads to the topic of why Australia’s cow price has fallen back down to a rolling saleyard average of 264c/kg liveweight, dropping nearly 40c/kg since mid September.

Supply seems to be the dampener on the market, with a flush of cattle coming out of NSW and Queensland. On paper at least the cow market should still be able to sustain rates of 300c/kg-plus as the grinding beef indicator into the US has actually lifted again to be trending above 930c/kg delivered to port.