Restocker cattle, weaner prices

Weaner calf prices have risen almost 70c/kg in the past month, so just how far will restockers push the market up?

The stellar price rises for young cattle this year brings with it the question of how far restockers will push the market ahead of the baseline prices for key slaughter categories.

Already in four weeks the weaner market has lifted by about 70c/kg liveweight, or the equivalent of $230 a head using an average calf weight of 330kg.

Highlighting this is the results from Wangaratta, which held another two key feature weaner sales last week after selling in the opening week of January.

Last week the 4695 steer calves sold at Wangaratta averaged 381c/kg, against an average of 315c/kg for steers sold on January 2 and 4. The average heifer price last week was 330c/kg against a ballpark 260c/kg early in January.

There must be some bittersweet feelings out there among calf producers, who through the sheer mechanism of timing, can only lament the money that could have been as the market has steamrolled on since those opening sales.

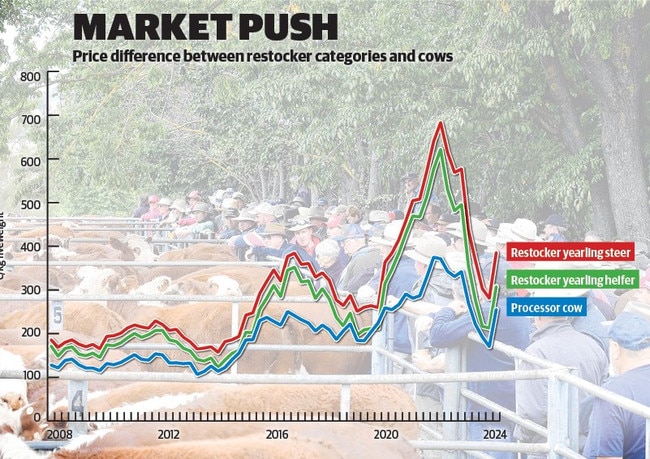

The graphic below shows the price trend line for yearling steers and heifers sold to restockers against the baseline for slaughter cows, as it is grinding beef that really underpins the market. The prices are sourced from weekly prime sales monitored by the National Livestock Reporting Service.

Young cattle prices are starting to pull away from the cow price. At the moment the national cow indicator is tracking at 255c/kg liveweight, while restocking yearling steers are at 385c/kg and heifers 307c/kg. It means the price difference between cows and restocking cattle has reached 130c/kg for steers and 50c/kg for heifers.

Looking back over the past 15 years it is a moderate price differential, particularly for heifers. In the autumn of 2016 the cow price was similar to today at 250c/kg, and young heifers were at 345c/kg and steers 376c/kg.

But as the graph shows, market trends did become very distorted in the past five years when the drought and herd rebuilding came into play. At its peak in 2022 the price difference between cows and young cattle ballooned to 310c/kg for steers and 250c/kg for heifers.

With the benefit of hindsight this was dangerous pricing and many producers faced significant losses when the cattle market dropped.

And interestingly, the lessons of the past two years need to be put into the debate when considering possible further price raises for young cattle this season and beyond.

At the Wangaratta weaner sales last week there was feedback that some producers were already starting to shift their focus towards heifers as the steer price pushes higher, with young females having the dual benefit of costing less per head and being able to be joined if the market goes pear-shaped again.

Elders agent David Simpson, from Bathurst, NSW, was a volume buyer of calves at Wangaratta last week. He said they were handling more heifers this year as a “safety mechanism”.

“Heifers you have an out as you can always join,” he said, adding that they were also focusing on purchasing better quality and heavier stock this summer as other ways to mitigate risk.

“We want to be able to exit out with finished stock before next summer – we are certainly looking at ways to reduce risk as we need to make a quid as we didn’t make anything last year,” he said.

It shows there is still some carry over caution from the events of 2023 and shock drop in cattle values, however this will probably drift out of the market if export cattle continue to sell strongly and producer confidence grows.

And to refer back to the graphic on this page, an element of the high cattle prices in 2021 and 2022 was the booming US beef market.

When cattle prices hit their peak in 2022 returns for 90 chemical lean grinding beef were tracking above 900c/kg into the US, which translated into a saleyard cow average in Australia of 374c/kg.

The latest data coming out of the US suggests grinding beef values on the world stage could ramp up again due to the US having the lowest herd number since the 1960s.

The official figure out of the US Department of Agriculture was a US cattle herd of 87.2 million, down another 2 per cent from the January 2023 survey. While a low herd figure was anticipated it has added to the bullish mood coming out of the US in regards to beef and pricing.

If the US beef market ramps up, and rain continues to fall in Australia, prices for young cattle will gain momentum.