Red meat exports: US lamb demand on the slide

Americans are less willing to pay top dollar for red meat, sending an important price signal to Australian lamb producers.

Gyrations are appearing in major overseas markets for meat and livestock as the world faces up to record inflation rates and wildly unpredictable economic times.

An interesting case study is the US, which tracks and releases a lot of data.

Some findings to come out recently include:

• A 50 per cent drop in the price of skinless chicken breasts in the US since late June. The US Department of Agriculture last week was quoting this staple meat at $1.79 a pound, compared with $3.60 in late June.

• Domestic lamb prices in the US have fallen significantly, with markets in the major lamb-producing areas reporting drops of up to 50 per cent on levels a year ago, with values still easing.

• There was an estimated 515,676 million tonnes of beef in cold storage across the US at the end of August, 24 per cent more than the amount frozen a year ago and 11 per cent above the five-year average.

• 80 per cent of fine dining restaurants reported fewer customers in the latest monthly survey by the US National Restaurant Association.

• 54 per cent of restaurant operators surveyed are expecting trading conditions to deteriorate in the next six months.

There are numerous issues at play in the US, including major drought and high livestock slaughter. But an influencing factor in all these market swings and sentiments is rising interest rates and tougher economic conditions, which are starting to affect consumer confidence and spending.

Highlighting this has been the performance of chicken, with analysts suggesting the dearer than usual prices have flattened demand while on the supply side production has been ramped up by enthusiastic producers.

It has traits of the saying “nothing cures high prices like high prices”.

“Record high chicken prices have helped ration out demand at both retail and food service, grilling demand has slowed with cooler weather in the US and chicken producers have ramped up production,’’ said Len Steiner, of Steiner Consulting, in his latest observations of the US market.

But with chicken prices falling it puts pressure on other meats such as beef and lamb as consumers go for the cheapest options – a possible issue noted by Mr Steiner.

“There is growing concern that a slowdown in economic activity will negatively impact beef demand in the next 12 months,’’ he said.

In any situation there are winners and losers, and for beef the lower manufacturing grades such as hamburger mince could have some protection as people shift from more expensive eating options to cheaper takeaways.

Such a scenario is evident in US restaurant surveys. In the business category called “fast food and quick casual”, 51 per cent of respondents said they had been serving more customers than a year ago. It is fine dining – think steaks and lamb racks – that have slumped.

But out of all the data coming out of the US, the most concerning for Australian farmers is the state of the American lamb industry.

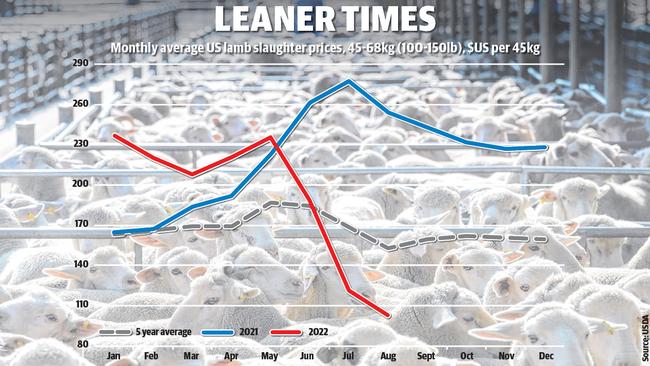

Recent data from the USDA shows a cliff-like fall of US domestic lamb prices at the Sioux Falls market in South Dakota. Prices have deteriorated from the highs of 12 months ago and are now tracking below the five-year price average.

In its latest newsletter to US farmers, the American Sheep Industry Association said the surge lamb had enjoyed during the Covid-19 pandemic as more people cooked restaurant-style meals at home was being eroded by tough economic conditions some predict could lead to a recession.

“While lamb demand was boosted during the pandemic, which led to higher lamb prices, inflation this year has resulted in a decline in real incomes impacting consumers’ willingness to pay for lamb,” Mr Steiner said.

He added that analysis was pointing to a “shift’’ in market drivers for lamb in the US.

“It is clear there has been a shift in some of the factors driving lamb prices,’’ he said.

“Lamb prices became increasingly uncompetitive versus beef during 2021 and became untenable once beef values started to ease lower this year.’’

The drought in the US has exaggerated the changing environment for lamb as more stock was fed and then pushed to slaughter, further unbalancing supply and demand fundamentals.

The USDA said lamb production was up 12 per cent in August – the latest available data – from a combination of more lambs being slaughtered at heavier weights.

Some of the big lamb feedlots in Colorado reported they had 48 per cent more lambs on feed at the start of August.

So far the decline of US domestic lamb prices hasn’t hit imported lamb products, noting Australia is the major supplier of lamb to America with a 74 per cent market share followed by New Zealand at 22 per cent.

But there are warning signs. Mr Steiner said lamb exports from Australia had slowed in September after some big volumes were sent earlier in the year. And prices for some cuts were starting to soften.

“Imported lamb trading is mixed with some high value cuts starting to see downward pressure’’ he said this week. “Bottom line: US market for imported lamb is starting to shift.’’

It is something to keep in mind as store lamb trading starts to build this spring, and these are lambs that will generally be turned into export weights for the US market.