Lamb prices: Sucker lambs emerging back onto slow market

Store lamb prices are making a long-awaited comeback amid recent wet weather — but there’s still big question marks.

Store lamb prices are starting to rally as lightweight suckers slowly emerge onto the market and ongoing wet weather holds the promise of bumper paddock feed.

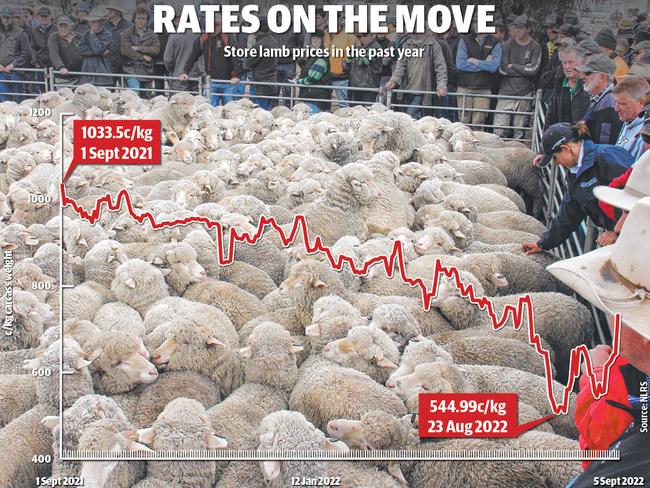

As the below graph shows, the cents-a-kilogram cost of restocking lambs being sold at saleyards has started to climb and has gained more than 100c/kg carcass weight in the past week.

But the rise has to be viewed in the context of the shift from old lambs (which was when prices bottomed out at just over 500c/kg in late July) to new-season lambs which offer higher value from a quality and growth potential with another 10 months of finishing time before teeth become an issue.

On a carcass price equivalent, young store lambs have now pushed above 720c/kg and have been listed at 800c/kg-plus at some saleyards, which is still a long way from the 1000c/kg or more recorded this same time last year.

It could be argued that store lamb values went too high above finished lamb returns last year, leaving producers who sold back into the prime market in the autumn and winter struggling to make a margin.

This year the same positives of high rainfall and boom feed conditions exist heading into the spring and summer, and only time will tell how much it will influence farming spending against the question marks of how to value prime lambs and feed costs going forward. Both the lamb and grain markets have been performing erratically for many months now.

However, there are some interesting observations about early store lamb sales to consider.

The first is dollar-a-head buying, which could be looming as an issue as producers try to limit their risk by outlaying less money and often sacrificing size in the process. It has been a regular feature of store cattle sales with farmers unwilling to pay above $2200 for weaners but they end up paying around $2000 for calves that can be 100kg lighter.

National Livestock Reporting Service data from the weekly Wagga Wagga, NSW, lamb market shows this trend, albeit on small numbers sold. Last week, little store lambs, 12-16kg, averaged $136 at an estimated carcass cost of 864c/kg. The next grade up, 18-20kg, averaged $162 at 793c/kg.

For some people, the $26 difference seem a step to high, but there is a vast difference in size and maturity from a 15kg to 20kg lamb and how quickly it can convert feed.

The same lamb size-to-price issue has played out at Bendigo in the past fortnight. A week ago some good young crossbred store lambs with frame and quality breeding averaged about $150, while this week there was a massive drop in size and type and they still sold for up to $142.

Current store lamb prices are built around limited sales, however, with the sucker season off to a very slow start due to the cold wet weather and reluctance from farmers to commit to selling on an unpredictable market.

Young lamb listings on AuctionsPlus are running four to six weeks behind last year, according to Teeah Bungey from the online platform.

The six-week listing delay will see lamb listings on a rapid rise in the coming weeks as spring warmth and longer days rebound the market and buyer confidence.

“If seasonal constraints continue to impact finishing and selling priorities, the bulk of the offerings could easily be pushed into early summer, given that the high weekly numbers in 2021 were registered in November,” Ms Bungey said.

On paper, the first drafts of prime trade and heavy sucker lambs are also running late. Young lamb numbers at centres like Swan Hill, Bendigo and Deniliquin are tracking well below a year ago. However, the figures are possibly being masked by direct selling.

One agent at Swan Hill said they had sent about 30 loads of sucker lambs direct to processors last week, which had capped the numbers appearing at the fortnightly sale.

Agents at Bendigo have also commented that sucker lamb numbers could remain lower than usual due to producers being enticed by the surety of a fixed price by selling direct or on forward contracts.