Mutton, lamb prices drop

This week’s drop in the lamb and mutton market was another confidence jolt for producers, and has added to the emotional reaction as forward contracts are announced.

Amid the latest plunge in mutton and lamb prices has been the welcome carrot of some forward pricing which has again reopened debate about the potential of the winter market.

In the past week export processor Thomas Foods International put as much as 800c/kg on the table for heavy lambs delivered to its Tamworth, NSW, plant during the depth of winter.

It came as saleyard prices for heavy lambs continued to retreat, starting the autumn on a downward trend and at risk of slipping below an average of 600c/kg – the lowest price point recorded this year.

The average price for heavy lambs sold at Wagga Wagga last Thursday was listed at a ballpark 580c/kg by the National Livestock Reporting Service. And there was no joy in the market at Bendigo on Monday where the lamb market opened softer and progressively cheapened to be quoted as $5 to $15 off the pace of a week ago.

Although it was the shock collapse of the mutton price at Bendigo which grabbed the industry’s attention. Late in the sheep run prices went down to just 100c/kg carcass weight as buyers with limited kill space to fill pulled-out of the market, with at least four processors not participating in the final laneways of ewes which were sold at Bendigo.

It was another confidence jolt for people already confused by the antics of the livestock market this season. And why I raise it is because all this uncertainty becomes an emotional factor in how forward contract prices are viewed.

It was interesting to note that before the Bendigo market the view from a lot of agents was the 720c/kg to 800c/kg for lambs delivered to TFI processing plants this May, June and July wasn’t enticing enough as there is still the strong belief fewer stock have been carried over and a gap in supply will emerge this winter. After Bendigo the mood was more along the lines of “maybe we should be locking some lambs in”.

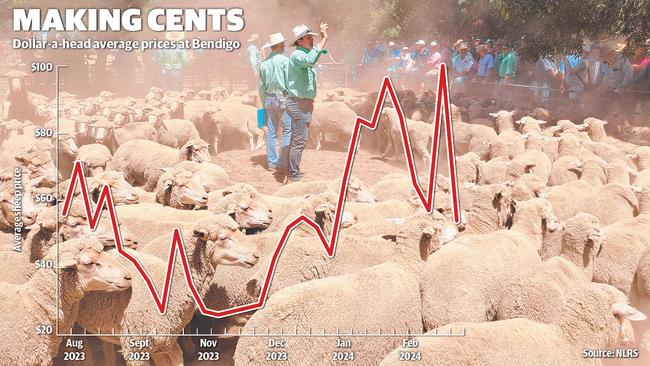

The constant price changes in the auction system has the industry constantly second-guessing itself, with price changes more rapid and extreme than many people can recall. The graph on above is the average dollar-a-head value for sheep sold at the weekly Bendigo prime market since August, based on data from the NLRS.

The graph looks like a child’s prep drawing, but in reality the ups and downs represent constant price changes of $10 to $50 a head that have happened from week to week.

There are 29 sales represented in the graphic, stretching from the first week of August to Monday this week, the first week of March. There has only been eight occasions when the price variance from week to week was less than $5. There was 16 weeks where it changed by between $8 and $20. And five times where it has showed a massive shift of more than $20, including this week where the average came down to a ballpark $54 for sheep compared to $100 just seven days ago.

The market has become notoriously difficult to read, which adds another complexity to decision making around selling livestock and forward contracts.

The forward prices put out by TFI were on a weight grid of 24kg to 32kg for crossbred lambs and varied by month and delivery location.

For Lobethal in South Australia it was 720c/kg for May and 750c/kg for June, with no quote for July as the plant is expected to shut for maintenance. For delivery to Stawell it was 720c/kg for May, 740c/kg for June and 760c/kg for July. For Tamworth in NSW it was 750c/g for May, 770c/kg for June and 800c/kg for July, the higher rates for this plant linked into more transport costs for stock from the south.

It is the first price direction the lamb industry has had for awhile, and TFI needs to be acknowledged for being willing to publicly commit to a rate. Other key processors now seem to be playing more of a private game by going to bigger lamb feeders with prices and doing deals with certain agents to bulk fill orders at money talked about but never really known. Not great for market transparency.

The initial reaction to forward pricing is usually along the lines of processors must know something to be taking that position, and 720-800c/kg is currently about $1 to $2 above the auction rate. However it needs to be noted that TFI is a big business, reportedly requiring more than 150,000 lambs and sheep a week to keep its four plants ticking over and guaranteeing some forward supply makes sense.

As to the strength of the price they are offering – well it comes down to how you interpret the market which, as pointed out, has become extremely volatile.

The biggest positive going forward has been the overall lift in slaughter capacity now the labour market has improved post covid, meaning some of the demand issues that plagued the industry in recent winters should have dissipated.

The upward curve in slaughter has also removed more lambs from the production chain, with bigger numbers of light lambs under 20kg sold as MK or ‘bag lambs’ rather than being purchased by restockers this season.

On the negative is the weak global economy and lamb being a higher priced meat protein that is more subject to being affected by changes in consumer spending. The tool processors can employ in the winter if prices rise to unviable levels is to slow production.

To look at the data, in the past eight years lamb prices have shown a premium in mid to late winter in five seasons, and have gone backwards in three. Last year was the worst case producers faced since 2016, lamb prices going from 796c/kg in January to 519c/kg in July and then lower again to a 472c/kg average in August, according to NLRS data.

The best for producers was in 2019 when the market rose from 646c/kg in January to an average of 947c/kg in July – a gain of $3/kg.

It is not a big call to suggest lamb prices should have some upside this winter with the odds of a more traditional premium appearing based on the higher stock kills of recent months. But the timing and extent of any price gains is purely a guessing game.

Sounds boring but ultimately forward price contracts are a risk mitigation tool and if they offer a comfortable profit margin are worth considering for farmers who have the ability to supply finished stock in the winter months.

In theory producers who purchased store lambs at low prices this season should be in a position to make a reasonable trade this winter.