Over-the-hooks lamb sales surge

In a rush to lock in returns, producers are selling more lambs directly to abattoirs. Here’s how it’s affecting auction yardings and prices.

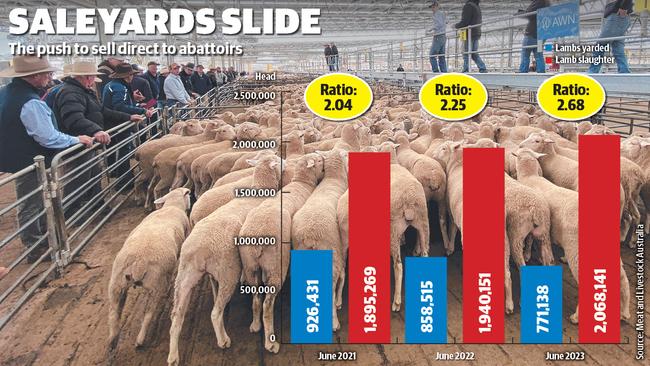

For every one lamb going through the saleyard system, nearly three were slaughtered last month, highlighting the massive shift to direct selling as producers opt for the safety of a set price.

Go back two years ago to the winter of 2021, when prices were trending strongly above 800 cents per kilogram carcass weight – and went on to peak at over $10/kg briefly – the ratio of lambs yarded to slaughter was at two.

The figures were calculated using weekly slaughter data published by Meat and Livestock Australia, and yarding numbers collected by the National Livestock Reporting Service.

The time period was the five weeks covering the month of June.

In 2021, there were 921,431 lambs yarded across June, while slaughter was listed at 1,895,269 which works out to a ratio of 2.04, or for every one lamb in the auction system, the equivalent of two were being processed.

This year in June there were 771,138 lambs yarded against a slaughter of 2,068,141 for a ratio of 2.68, meaning for every one lamb in the auction system nearly three were being processed. (see graphic).

It appears to be among the highest yarding to slaughter ratio seen in the industry, and tallies with feedback from agents of how it has become extremely difficult to secure kill space for lambs this winter.

The rush to sell direct has reportedly allowed some processor-buyers to become very selective, with several agents reporting that if clients don’t have a trading history with certain companies they can’t even get their stock in the queue.

The growth in over-the-hook selling also raises questions about the impact it is having on lamb values.

While the influence of saleyard prices on setting contract and spot values has always been debated, there is no doubt having heavily booked kill space has been a factor in erratic and cheaper results in the auction system this year as buyers drift in and out of sales.

It is possible to make the argument that the action of producers committing bigger volumes of lambs direct has fed into the downward price trend. Agents can attest to the numerous times this year that over-the-hook prices have been rolled back by 20c/kg or more as processors used the lack of competition in the auction system to reduce offers.

You certainly can’t blame producers for wanting some security and a guaranteed price, but there is the potential downside of mass direct selling that needs to be acknowledged. That is particularly the case as the lamb industry is going to become a greater game of numbers moving forward.

This week MLA released its lamb and sheep projections document, which details its latest analysis on the state of the flock including production forecasts.

The key figures included:

•A current sheep flock of 78.75 million (with a breeding ewe base of 46.14 million ewes) – the biggest sheep numbers in Australia since 2007;

•In 2023 lamb slaughter is forecast at 21.87 million, rising to 22.4 million in the following year; and

•Sheep slaughter is tipped to reach 7.83 million as more older ewes are quit after the rapid build-up of flocks post the drought.

The industry is now poised for the sucker lamb run to commence, with agents expecting early pens to start coming in within the next four to six weeks.

Price outlooks are not optimistic, considering the backlog of old lambs that still need to be filtered through the system into August. It will be interesting to monitor the numbers that come out for the Wagga Wagga prime market on Thursday, and Bendigo next week, following dearer prices at these saleyards in the past week.

Agents at Bendigo believe numbers could double, or even triple, off the very low base of around 4600 lambs sold at the last two markets.

The MLA projections also included some price forecasting from six industry analysts that are combined and averaged out. Their crystal-ball gazing has the national trade lamb indicator at 537c/kg cwt by Christmas time, and the heavy lamb indicator at 553c/kg carcass weight.

This is not outside the realms of how the market has been performing, with a spread of 450c to 600c/kg across the most of the better presented slaughter lambs.

But a lot could depend on the weather pattern in September. Dry weather across this pivotal spring month could undermine both demand for store lambs and pressure areas to sell, while some timely rainfall could cement the season and confidence.

Lets hope the Bureau of Meteorology’s run of predicting dry conditions, that don’t eventuate, continues.