Lamb market in rarefied air

Heavy lambs have been making close to $300 at saleyards this November, with rates comparable to the celebrated 2021 season.

Heavy lambs making $300 at saleyards in November in the “spring flush” of stock is unheard of, and this statement is backed-up by 10 years of data.

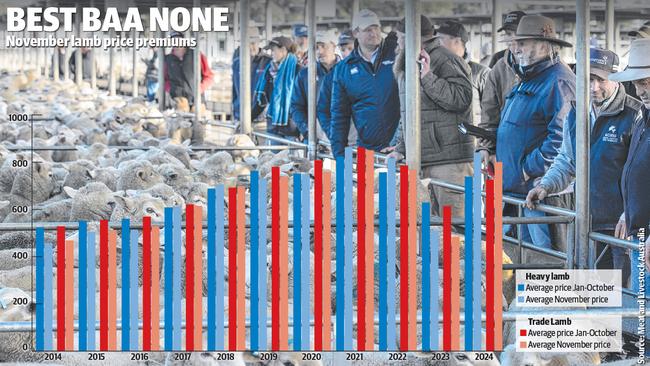

As the graphic on this page shows, it is very rare for prices for heavy and trade lambs to be at dearer levels in November compared to the off-season months of January to October which takes in the winter period.

Multiple saleyards on Monday reported heavy slaughter lambs above 900c/kg carcass weight, according to reports compiled at Bendigo, Dubbo and Corowa by the National Livestock Reporting Service.

One pen of extra heavy shorn lambs estimated at around 34kg topped at $300 at Bendigo amid an ongoing shortage of prime lambs with weight and elevated abattoir kills.

The following figures explain what is happening in terms of supply and demand dynamics.

The total lamb and sheep kill reached a new record of 718,311 head for the week ending November 15, which is the latest available data. Of this slaughter, 447,080 were lambs and the balance sheep.

Yet in the latest rolling price average for heavy lambs the NLRS only counted 1169 head at the major prime markets which weighed above 30kg. As a result prices for these export lambs have lifted 70c/kg in the past week to now be tracking at an average auction rate of 862c/kg.

This price level now matches the celebrated rates which the industry enjoyed when flocks were being rebuilt in 2021 after the extended drought. As mentioned earlier, it is rarefied air for the lamb market to be this good at this time of year.

Which raises the question, where to from here?

And the answer to that is very much linked to the carry-over of lambs and what is being fed to be turned-off next year.

To analyse the data first, and thanks to Erin Lukey, senior market analyst from Meat and Livestock Australia who delved into the statistic database and pulled-out all the store lamb figures from the major prime markets.

And the figures confirm the general gut feel out there among agents and buyers that more lambs have gone back to the paddock as buyers take advantage of the price discrepancy between light to heavy lambs, making trading look a profitable option.

The following data is the number of store lambs captured by the NLRS at saleyards for the period from September to now, noting the figures should be viewed as a trendline as not every lamb is price captured at every market.

The store lamb numbers for September until now were:

2024: 312,879 lambs

2023: 266,708 lambs

2022: 224,897 lambs

2021: 349,754 lambs

2020: 273,217 lambs

Overall, the carry-over of store lambs from NLRS monitored markets this season is 10 per cent larger than the five year average.

Obviously a lot of store lambs now get traded on AuctionsPlus and numbers on this platform have been robust, and it is interesting to note that of the 60,000-plus new-season lambs offered online last week NSW “remained the largest purchasing state” at more than 28,000 head.

NSW is the state to watch in terms of lamb volumes to come back into processors next year.

Riverina Livestock Agents director and auctioneer James Tierney, Wagga Wagga, NSW, said he agreed with the argument that more store lambs had been sold and carried over this season.

But said it had to be considered alongside a potential overall smaller pool of lambs due to poor lambing survival and percentages in some key regions – the main example being the Western District of Victoria.

And the other issue to consider was the record mutton kill which was likely to reduce sheep numbers next year and help support the lamb market as processors won’t be able to shift production to sheep as easily.

“My thoughts are more store lambs have gone out than last year, but this needs to be balanced by the fact I don’t think there is as many lambs overall out there,” he said.

“And going forward processors are definitely going to have less sheep put in front of them, so I don’t think there is going to be any catastrophic change to lamb prices.

“But that said I wouldn’t be surprised to see the lamb market soften in February, March and April as shorn numbers come back in, however at this stage I really can’t see a need for rates to go below 800c/kg (for quality heavy lambs),” Mr Tierney said.

His comments tally with other feedback from Victorian agents who told The Weekly Times they don’t expect the market to maintain current buoyant levels but believe it should hold a healthy price base – an example often touted was 800-820c/kg for 30kg lamb, or $240 to $250.

To play devil’s advocate. Referring to the figures above, 2021 was the most comparable recent season to the current market, with heavy lambs tracking at 860c/kg in November and a similar carry over of lambs of 300,000-plus.

Historical data from the NLRS shows heavy lamb prices went from 862c/kg in November, peaked higher at 875c/kg in December, then dropped to an average of 815c/kg in January and 793c/kg in March.