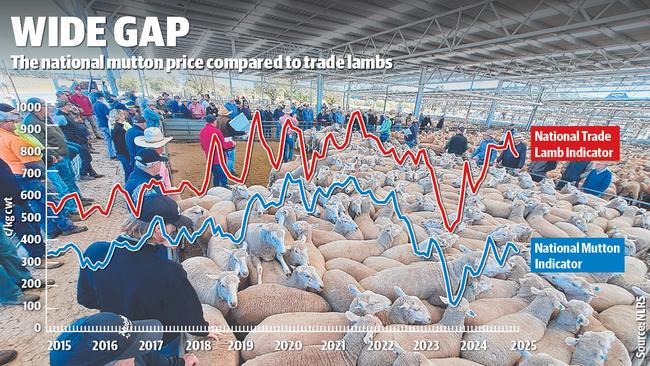

Why there is an unusually wide lamb to mutton price difference

A price gap of nearly 350c/kg has developed between mutton and lamb following a mutton sell-off. See the latest.

The increase in lambs, sheep and cattle being slaughtered each week is a positive the livestock industry can carry into the autumn and winter period.

The increased production reflects the investment processors have put into re-building skilled workforces after the disruption of Covid, and the strong export demand for red meat at favourable returns. Meatworks will be reluctant to give up these positions, creating supply and demand pressure, which could hit quite quickly if an early and widespread autumn break eventuates.

There has already been some positive market reaction to a slow down in sheep numbers, with several saleyards including Bendigo, and NSW centres of Griffith, Wagga Wagga and Forbes posting improved price averages either side of 400c/kg carcass weight in the past week.

Unusually high sheep numbers have been propping up small kill chains, and arguably helping keep a cap on lamb prices as processors take advantage of cheap mutton to fill production schedules.

This is highlighted by the latest available slaughter data for January.

Last month 860,669 sheep were processed, according to Meat and Livestock Australia data, an increase on the 632,573 sheep which went through meatworks last January. Add to this the big kill of lamb, and the combined mutton and lamb slaughter for January this year was 2,981,968 head, up more than 670,000 on 2024 levels.

Agents anticipate a big slow down in sheep numbers heading into autumn lambing, although there will be another flush of empty ewes after pregnancy scanning which has just started for the early joined stock.

But there has been some interesting feedback from buyers remarking on the number of ewes in the early stages of pregnancy which have been slaughtered this year. It reflects the water and feed shortages plaguing some grazing areas and which has forced farmers to cull deeper into breeding flocks.

The mutton sell-off has distorted sheep pricing in comparison to lambs. As the graphic on this page shows, the price difference between mutton and lamb is unusually wide at nearly 350c/kg.

There is plenty of upside price potential for mutton once supply slows, as the high sell-off of ewes dates back into mid last year, suggesting if the season improved the pool of cull and older ewes available to processors would tighten considerably.

While discussing mutton, it is worth noting the pain West Australian farmers are in with sheep prices in that state. They are back at dismal levels from a combination of farmers quitting the industry and also under sell pressure from a lack of water and feed.

In the past fortnight mutton prices in Western Australia have slid back down to an average of 200c/kg carcass weight, with light sheep virtually unsaleable at $1 to $20 and some not receiving any buying support at all.

The cost of freight, and animal welfare issues, means it is unfeasible for light sheep to be trucked into the eastern states.

Meanwhile, to return back to production levels the cattle kill has ramped-up very quickly this year in a positive sign for eager processors who are keen to take advantage of the money being offered for beef in key export markets.

The eastern states weekly cattle kill bounced back above 140,000 cattle by the third week of January this year in a much quicker recovery from the holiday period. In comparison last year the weekly cattle kill did not get over 120,000 during all of January and February.

The money to be made from manufacturing beef in the current climate of a low Australian dollar and high demand from the United States has been the carrot to ramp up kills quickly.

It is a view supported by the latest commentary out of the US by Steiner Consulting.

“Currently, the US market is paying significantly more than Asian markets and combined with the strong US dollar and the absence (so far) of tariffs on Australian beef, shipping to the US remains an attractive option for Australian exporters.”

“January shipments to the US are typically limited as Australian plants resume production after the holidays. However, at 24,685 tonnes, January shipments were 22 per cent higher than a year ago. Based on the shipping pace in the first two weeks of February, Australian exports for the month are projected to reach 34,500 tonnes – 62 per cent higher than the previous year.”

Like the mutton price graph on this page, saleyard prices for cows appear undervalued when compared to current export rates for 90 chemical lean grinding beef into the US – the healthy margin explaining the big volumes of meat being shipped in.