Kiwi lamb rises level playing field

New Zealand’s lamb price advantage over Australia is diminishing, giving our exports a more even competition.

New Zealand lamb prices have started to ramp up, in positive news for Australian producers as they head towards the spring selling sucker season.

In the past eight weeks the indicator price for New Zealand lamb has improved by the equivalent of $A1/kg, helping close the gap to Australian values.

As New Zealand is Australia’s main export competitor for lamb into countries such as the US, China and the European Union, the lower rate of its product was a cause for concern as it had an obvious price advantage, which was showing up in sales data.

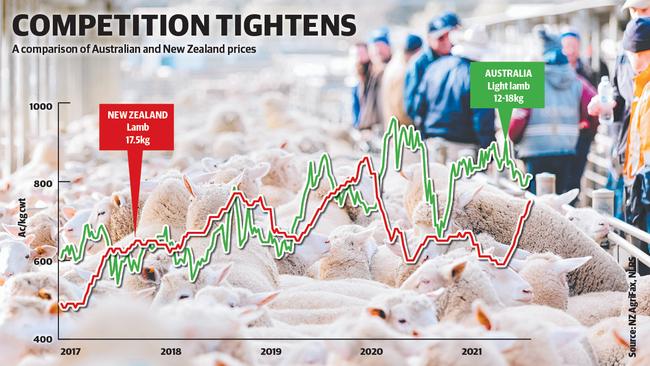

The graph shows the trend line for Australia’s lightweight lamb category (used because New Zealand produces a smaller carcass size) against ruling New Zealand values.

It shows how prices between the two countries tracked reasonably together before the Covid-19 pandemic hit early last year when New Zealand lamb values took an early and harsh price hit due to the big volumes of product it was shipping to China at the time.

To highlight this, New Zealand lamb began last year at the equivalent of A770c/kg carcass weight and mutton at 650c/kg, and by April were at lows of 600c/kg and 480c/kg.

In comparison, the light Australian lamb price started last year at 764c/kg and strengthened to only record a few weeks below 700c/kg throughout the year. And mutton in Australia was a star performer last year.

Of course, Australia’s price patterns, while affected briefly by confidence dips around the difficult Covid-19 outbreak and country lockdowns, were essentially driven by the breaking of the drought and flock rebuilding.

It has taken a much longer time for the New Zealand market to recover its form, which had been causing an unusually large price gap between the two nations.

Mecardo analyst Adrian Ladaniwskyj said data showed the longer-term price difference between Australian and New Zealand lamb prices was about 10 per cent, and sometimes lower during the spring as Australia’s premium saleyard rates were reduced by the annual flush of suckers.

But when New Zealand lamb prices were at 600c/kg earlier in the year, the difference to Australia was out to 28 per cent, he said.

“This level of discount was much larger than the 10 per cent average over the past five years, putting Australian lamb at the largest export price disadvantage for years,” he said.

It could be argued that the more competitive price point of New Zealand was starting to show up in global export figures.

For April, New Zealand lamb exports to the US were 41 per cent higher than in 2019 (skipping the comparison to last year due to the shipping and demand disruptions caused by Covid-19), and its sales to China were 28 per cent higher than the previous three years to that destination.

To have New Zealand lamb prices improving and on a more level playing field with Australian values is good news for the industry as a whole, as it reduces undercutting and downward pressure from one country having a much lower price point.

In further good news, mutton prices in New Zealand have also rebounded and are trending neatly alongside Australian values for sheep.

There is a different scenario playing out in Europe at present around lamb prices, with values falling from extremely high levels.

The indicator price of lamb in the United Kingdom has tumbled from a peak of 679.5 pounds a kilogram for “deadweight” (slaughter) lambs in mid-April, down to 518.8p/kg in the first week of July.

Translated into current Australian prices, it is the equivalent of $12.60/kg down to $9.61/kg.

The spin English market analysts are putting on it is that it is seasonal, with the supply of their new-season lambs starting to build.

But is also linked to the fact UK lamb prices became too high against other European nations they compete with such as France, a similar scenario faced by Australia with New Zealand pricing.

“Since May the gap between French and GB (Great Britain) lamb prices had been widening, a result of GB prices continuing to hold their strength while French prices dropped back,” the Agriculture and Horticulture Development Board in the UK told its members in a market report last week.

“How our prices perform against those on the continent (such as France) is of particular relevance at this time of year, because this is when (Great Britain) typically moves to a net exporting position (as lamb slaughter rates lift),” the report said.

“If GB prices remain at a premium to those in France, our exports will be less competitive and we could see export demand drop back. This was seen in April with lower UK lamb exports resulting from our high domestic prices and reduced food service demand.”

It shows how meat is still very much traded on price around the world, even though brands and production stories are starting to have more of an influence.

MORE

LAMB WEIGHT PLAYS PIVOTAL ROLE IN PRICE DIFFERENTIAL