Concerns over high ewe slaughter

Ewe slaughter is being dragged forward by the unkind seasonal conditions with the mutton kill the highest it has been in late winter since the millennial drought year of 2018.

Ewe slaughter is being dragged forward by the unkind seasonal conditions with the mutton kill during August the highest it has been in late winter since the millennial drought year of 2018.

As the income from old sheep helps shape the money, farmers are prepared to pay for replacement ewes at the upcoming spring store sales, the sell-off, and its impact on mutton values, which are something to monitor.

In the past month, the mutton price has shed 50c/kg carcass weight, the national saleyard price going from trending at just over 400c/kg in early August to be tracking at an average of 355c/kg cwt this week.

It means the average dollar per head return has dropped under $100 again, the latest National

Livestock Reporting Service data showing a rolling average of $93 for the 15,000 sheep transactions included in this week’s Monday saleyard indicator.

In modern trading times it is a low-ball price, as aside from the price crash of last year, the mutton market had been holding a value above 400c/kg cwt since 2017.

At its peak in 2021 when mutton values were tracking over 600c/kg cwt a 26kg bare shorn ewe was worth $170, and there were plenty of extra heavy crossbred ewes making over $200 per head.

However, the current average of $93 for old sheep looks reasonable against the distorted market of last spring when mutton values plummeted. Exactly a year ago this week, the average return for cull ewes were just $39 per head.

While no one wants to see a return to disastrously low mutton prices, there is some tension around the sheep market and the pressure it could face if no decent rain arrives in the next few works leading to a failed spring across a wider area.

There is a lot of sheep out there to sell, as framed by the latest updated figures released by Meat and Livestock Australia as part of its industry forecasts.

The key figures from MLA’s latest report were that the mutton kill is to remain elevated this year at an estimated 10 million sheep for a rise of 3 per cent. The scenario MLA suggested for 2025 was for sheep sales to continue to ramp up, reaching 11.3 million head as producers move to sell down the “elevated breeding ewe and wether flock’’.

If the season becomes more challenging in terms of feed and water supply more ewes could be sold earlier rather than being kept for another lambing next year.

The move to sell cull ewes early is already evident as producers face up to the reality of a high percentage of lambs not making sucker grade this spring and limited paddock feed.

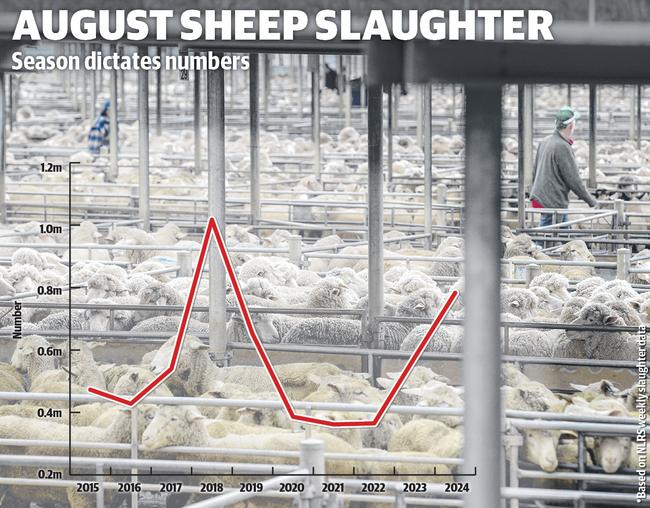

The graphic on this page shows the August mutton kills dating back 10 years. The 783,280 head processed last month makes it the second highest August sheep production since 2015, coming in only second to the tough drought year of 2018.

Nutrien Bendigo auctioneer Nick Byrne said lambs were being weaned, and ewes quit early this season as farmers prioritised feed against the backdrop of concern over mutton values: “People can’t see the sheep job improving from here,’’ he said.

An interesting way to look at current sheepmeat production is to consider the ratio between lamb and sheep supply. In August, for every sheep being processed, there were 2.6 lambs slaughtered. This the ratio of 1:2.6 is among the highest mutton-to-lamb ratios seen across the industry in the past 10 years.

Last August the ratio was one sheep processed to every 3.3 lambs; in 2022 and 2021 it was just one sheep to every 4.4 and 4.1 lambs, and this tighter sheep supply was what drove the market to record high mutton values of above 600c/kg cwt.

In 2021, when mutton was at record highs of 650c/kg cwt, young Merino ewe prices set a record of $512 at the special Merino sale at Hay in mid September. It highlights the link between old ewe income and replacement breeders.

This week marked the first of the special Merino ewe sales, with the Hillston sale posting a top of $270 amid reports of dull demand once off the top feature lines of young ewes with size and breeding.