Cattle prices stay strong as drought drives feed shortages

Cattle prices have remained strong despite drought and feed shortages across Australia. See the latest market analysis.

Young cattle have been selling strongly considering the drought conditions plaguing much of the south, but that doesn’t make them expensive from a buyer or traders perspective.

Being able to purchase replacement feeder steers at similar liveweight costs to those being sold is a favourable trading position that often doesn’t exist in a more traditional season.

The same positive trading rule exists for cattle being taken onto heavier slaughter rates, with both weight gain and the bonus of a higher sale price per kilogram for fed trade and export animals also possible.

After selling at another capacity store market of 6500 head at Barnawartha last week, Corcoran Parker auctioneer Justin Keane said for northern buyers able to get weight onto cattle at a reasonable cost the market looked very buyable.

“From a trading perspective there has been a lot worse (trading) gigs than the figures currently in front of people,’’ he said.

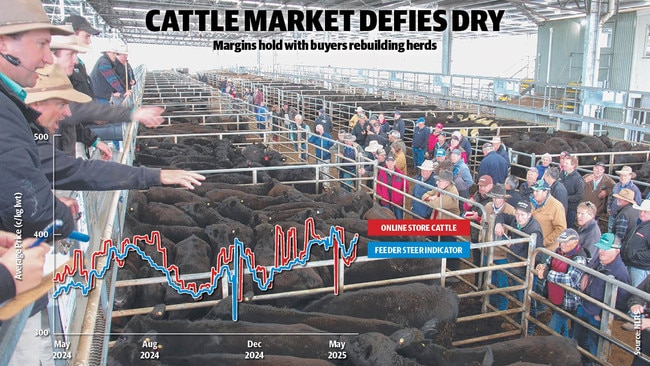

The graphic on this page shows the tight alignment of feeder steer prices in NSW compared to the online cost of young replacement cattle.

The feeder steer price indicator for NSW is currently at 396c/kg liveweight based off saleyard selling, with agents advising the best lines of Angus steers are currently being sold direct at average of around 430c to 440c/kg.

The national online average for young cattle is sitting at close to 400c/kg for mixed sex calves, but again with the best lines of Angus steers from 420c to 460c/kg which mirrors the feeder steer trend.

For heavy slaughter cattle, agents gave the Weekly Times the following broad figures. Heavy

slaughter cattle selling direct to meatworks at 750c to 800c/kg carcass weight equivalent, working out at $2200 plus for steers processing out over 280kg deadweight. Compare this $2200 to the better runs of weaner and yearling steers at $1200 to $1400 and it gives that broad change-over gross margin of around $1000 per head.

It is the favourable trading scenarios which have kept a solid floor under the southern store market as parts of Victoria lapse into extreme feed and water shortages. Added to this is the expectation that cattle prices will improve once rain and feed eventuates in the south and the drought sell-off of stock rebounds back into herd rebuilding and a shortage of supply.

And this segways into the cow market. After dipping to an average low of 243c/kg lwt in mid May for beef cows, the national saleyard average is now marching back up with gains of 20c plus recorded in the past week.

For exporters, the cow market is still tracking at very favourable levels when compared to returns for grinding beef into the US. Despite the political disruptions of President Trump and his on and off-again tariffs, the manufacturing beef trade into the US has remained at record levels.

The latest data conversion still has 90 chemical lean grinding beef into the US trending nearly

$10.50/kg in Australian dollars, off slightly from the all time record high of $10.85 set in March it is still giving processors strong profits against the current saleyard cost for cull cows. On paper at least there is a lot of room for the cow price to lift in Australia, in the longer-term the market has the potential to deliver record values for cull cows due to the high number already processed in recent months.

And talking of records, heavy lambs at $10/kg plus carcass weight equivalent has hit the headlines.

The only caution to all the excitement is to understand that only quality lambs showing breed quality and finish are commanding this money. Look deeper into market reports and there is still plainer and lighter lambs starting with $8/kg and $9/kg price tags.

And like with cattle, there is still opportunities to feed lambs as rates for store and feeder lambs are generally below the record money being put on the table by processors for heavy and export lambs delivered in the winter.