Beef exports slide in September

A variety of economic and weather-related factors caused beef exports to slide in September. Here’s what that means going forward.

Beef exports have slowed so the real question remains is it all weather-related or is there an aspect of the “canary in the coal mine” happening as economic turmoil swirls globally.

Hitting the headlines this week were the latest shipment figures for beef out of Australia during the month of September.

The volume of product exported slid back to 70,295 tonnes shipped, according to data from the Department of Agriculture, Fisheries and Forestry. All the figure-crunching has concluded that it is the lowest September beef exports since 2005.

Market analyst Matt Dalgleish, of Episode 3, looked into destinations and found significant drops to major customers including Japan, the US, China and South Korea.

The raw sales data for these countries in September was:

* 15,791 tonnes exported to Japan, down 27 per cent on the previous month and 30 per cent below the five-year average trend line for exports to this destination.

* 14,917 tonnes to China, down 11 per cent but still 3 per cent above the longer-term average;

*13,635 tonnes exported to Korea, down 26 per cent and back to the September average after some strong monthly results earlier this year;

*8564 tonnes to the US, down 43 per cent with the trade now 53 per cent below the five-year September average to this country.

The extremely wet conditions, coupled with a spate of public holidays in September and ongoing staffing issues at meatworks, has been blamed for the slowdown in exports due to less cattle being slaughtered.

It is a simple scenario of less cattle processed so less meat to sell. There is also the Covid-19 hangover of freight and disruption to shipping logistics.

However there is also feedback that demand and pricing for beef is starting to slow on the world stage as countries ramp up bank interest rates to slow record inflation levels and consumers pull back from spending.

The Weekly Times spoke to a representative of a major exporter on Monday who said there had been some major discounting for beef into several countries in recent weeks and Australian cattle were overpriced.

He said the extreme wet weather and fall of the Australian dollar were protecting producers from the reality of what was shaping up on the export front. He threw out a figure of manufacturing cows being $400 over the odds against export returns.

But it is a figure that can’t be easily substantiated. When The Weekly Times questioned why they kept buying if losses were in fact that high, he countered with the argument processors had just managed to rebuild staffing levels and couldn’t afford to drop production or cut shifts for fear of losing trained workers again.

Ultimately the truth about the drop in export beef volumes probably lies somewhere between low cattle supply due to the extremely wet spring and easing demand as meat importers nervously watch consumer sentiment and world events.

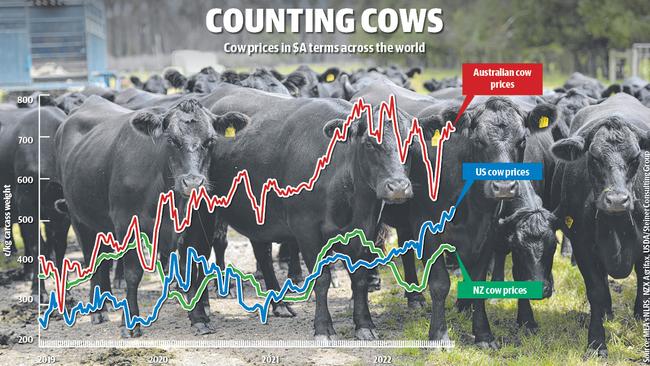

We can drill down into cow prices, as they are the segment of the cattle market that acts as the “canary in the coal mine” in regards to the health of the beef industry.

The price of cow beef in US dollar terms has dropped below the levels of a year ago, due in part to big kills in the US as it battles drought. The latest quote by Steiner Consulting has 90 chemical lean cow beef (90 per cent red meat, 10 per cent fat blend) trending 10 per cent lower than a year ago.

The saving grace for Australian producers has been the drop in the Australian dollar to a 2.5-year low of 63c against the US greenback. As a comparison, the exchange rate was 73c a year ago.

This 10c drop in the Aussie dollar gives countries buying Australian red meat more bang for their back. To do the calculations in reverse; at today’s exchange rate of 63c an importer spending one US dollar actually gets the buying power of $1.58 Australian. When it was 73c that one US dollar worked out at $1.37.

The low Australian dollar plus wet weather and herd rebuilding are the major reasons good beef cows have been able to stay above 400c/kg liveweight at Australian saleyards in recent weeks. Demand signals on the world stage have started to soften.

As the graph on this page shows, Australia still easily has the dearest cow market against the developed export nations of New Zealand and the US. The cow prices on the chart have been converted to Australian dollar terms by Meat and Livestock Australia, which tracks these statistics.