Australian cow price falls, US 90CL beef up

There is hope for cow beef prices, analysis compiled by a livestock expert has found. We break down the figures you need to know.

The value of cow beef being sold into the United States just reached its highest price level in more than a year, suggesting that if producers can ride out this dry period the next decent rain event should give the cattle market another big bounce.

More improvement in the US market for cattle has lifted the indicator price for 90 chemical lean grinding beef to the equivalent of 855c/kg in Australian dollar terms, shipped to port in the US.

This is the highest level this indicator (sometimes referred to as cow-beef, grinding beef, hamburger beef or manufacturing meat) has been since the winter and spring of 2022. And this is the category of export beef which underpins the performance of the overall cattle market.

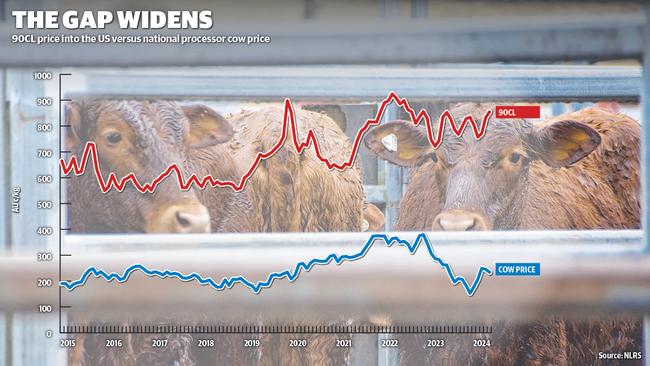

The graphic below shows the trend-line for imported 90CL beef into the US, based on figures published by Meat and Livestock Australia and converted into Australian dollars.

To have the 90CL price trending up and sitting at such a high level in a week where Australian cow prices at saleyards collapsed by up to 50c/kg shows supply is the culprit rather than demand.

It suggests that another rapid rise in cow price, once it rains this autumn and the flow of stock to abattoirs and saleyards slows, is almost certain – think January this year.

When markets re-opened after Christmas the average saleyard price for processing cows went from 188c/kg liveweight to 264c/kg in just four weeks. It marked a gain of about 80c/kg or nearly $500 for an average 600kg cow in less than 30 days.

At this stage the cow market hasn’t quite collapsed to the low levels of spring last year, but its heading that way judging by the average price of 215c/kg paid for more than 1000 beef cows sold at Wagga Wagga in NSW on Monday this week. The sale was quoted as 40c/kg cheaper on heavy beef females, some of the lighter and leaner cows back by up to 70c/kg.

Such erratic results and big price swings are leaving a sour taste for producers. And it hasn’t been only happening for cattle, but also mutton and lamb. Price changes of $20 to $50 for sheep and lamb, and up to $250 for cattle – sometimes in the space of just a few days – are difficult for vendors to accept gracefully. It creates distrust, resentment and bitterness.

Particularly in the case of cows when you look at the price performance of grinding beef into the US, against the price for processing cows sold via auction in Australia.

The last time the 90CL beef price was up at levels around 850c/kg the saleyard cow price was at 340c/kg to 380c/kg. The current price gap between the two trend lines is unusually large at more than 620c/kg – based on today’s listed rate of 855c/kg for 90CL and 230c/kg nationally for kill cows.

The last time The Weekly Times touched on this subject the feedback from one senior meat industry figure was the writer had a “vendetta” against meat processors, seemingly for pointing out the obvious that when the price gap is this wide processors are making plenty of money from export cow beef.

The other side of the analysis is that the figures indicate there is a lot of upward price potential for export cows. Based on historical outcomes, when the US 90CL price is up at these levels it supports a rate of 300c/kg and arguably better for kill cows.

Which leads back to the opening point. In theory at least, a decent rain event like what happened in January could easily propel the cow price back above 260c/kg again.

It is not a big call, and in reality farmers themselves are already factoring this into their decisions, an example being strong rates of 400c/kg-plus for the best of the well-bred calves at the Mountain Sales last week.

To look at what is happening in the US, the US manufacturing beef market has been pushed higher by a faster than expected decline in cow kills. The latest data by Steiner Consulting had the US beef cow kill back 12 per cent across February, and the dairy cow kill down 15 per cent. The price of domestic 90CL grinding beef in US (sourced from US cows) hit a new record value of US$323 carcass weight last week, Steiner said.

So far the US cattle market is playing out as expected, gaining strength on low numbers as the herd is rebuilt after years of drought. Australia is out of step with it at this point.