Analysis: How hard it is to make money in livestock right now

Turning a profit in the livestock industry is becoming more challenging as the market climate worsens. Here’s why.

Trying to find the silver lining in current livestock markets is difficult, but maybe it is in the form of the ‘backhanded’ profit.

If it sounds intriguing, you are not alone, as it is not a familiar term. However, we are in rarefied times of cattle being worth much less than they were just three, six and 12 months ago, which is a gut-wrenching situation for traders and producers.

A ‘backhanded’ profit is creative accounting and a nice spin on the more blunt advice of ‘take your medicine, sell the stock for less than you paid for them, but then buy back in at a lot lower money’.

Numerous conversations have been had around this scenario lately as many in the industry face up to the fact that cattle are currently streaming into meat processors and feedlots for less money than they cost.

A working example. According to data from the National Livestock Reporting Service, the rolling average price for bullocks sold in Victoria is currently listed at 317c/kg liveweight or $1915.

Go back to 2022, and these steers cost more than $2000 each as weaners and yearlings.

Add in feed, labour, time, transport, selling costs etc. – it all adds up to big trading losses. And it is happening across the spectrum; heifers costing over $2000 last autumn now can’t be sold for anything near that as PTIC females due to calve this winter.

But sell those grown steers at $1915 and buy back in a nice run of yearlings at $1000 to $1200, and there is your ‘backhanded’ profit.

Sold for $1915, your inventory is back in the paddock at $1200, leaving you $700 as so-called profit to the bank.

This scenario does not stand up to proper accounting and certainly doesn’t work if you have borrowed money to purchase stock or are trying to pay off a farm mortgage.

But if you own everything and are in a good financial position, you can afford to spin the figures like this and bat on to trade another day with inventory, owing you a lot less money. And it is certainly being talked about as one way to get through the current situation.

Even if you are a nonbeliever in creative accounting, the scenarios above highlight one key positive: store cattle and lamb prices are now similar, or even below, the cents per kilogram rates that finished stock are making. And that is rare.

Consider this. A year ago, at prime markets, yearling steers back to the paddock were averaging 640c/kg liveweight on NLRS data, and the premium lines at store sales were over 700c/kg.

At the same time, heavy steers at saleyards were averaging 485c/kg liveweight, meaning store buyers were paying a premium of 150c to 200c/kg above finished rates.

At certain points in recent seasons, the difference got out to about 300c/kg, which looked ridiculous at the time and now has proven to be just that.

Now that margin has narrowed to the point it is possible to buy young steers for similar cents a kilogram rates to what feeders and heavier steers are selling for and historical data shows such parity is unusual and a bonus for traders.

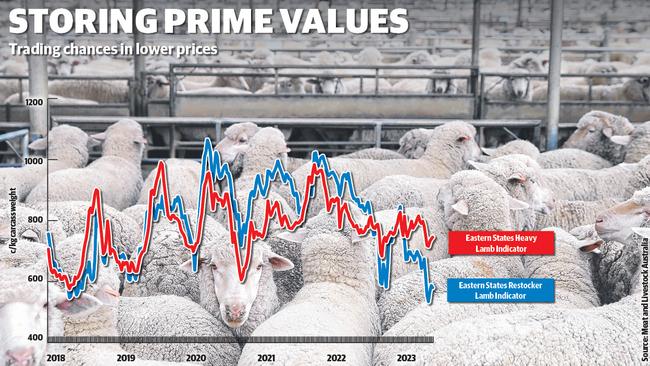

The figures for lamb are even more exaggerated. As the graphic on this page shows, the trend lines have swapped, and the price of store lambs is now well below that of heavy prime lambs. As a result, the gap has grown to nearly 200c/kg, which is something the industry hasn’t seen for years.

The one positive from the current chaos in livestock markets is that store values have become much more aligned with finished stock.

But that is about as much sugar-coating as you can put on the current state of play.

Lamb prices have continued to weaken this week and face hurdles going forward.

Key exporters such as TFI will shut some plants for maintenance in the coming weeks, putting further pressure on demand and kill space.

The Weekly Times understands exporters have now taken 700c/kg carcass weight off the table for lamb this winter, with rates pulled back to 600c to 620c/kg for June and July, with the best rates short bursts of 680c/kg towards early August.

For farmers who have grain-fed lambs to big weights this winter, it is a kick in the pants as stock well above 32kg carcass weight, barely making more than $200 now.

The top at Bendigo on Monday was $215.

For cattle, the outlook is just as depressing, with meat works booked heavily for the next four to six weeks as they take advantage of very cheap stock out of the north.