Weak Chinese demand hits Australian dairy opening prices

Australian dairy has made millions from Chinese demand for our produce. But why has the Beijing bonanza gone bust?

Powdered milk mountains in China, stockpiled during its 2022 lockdowns, are weighing heavily on Australia’s farmgate fortunes, experts say.

International milk prices have been tumbling for months with the latest trading result coming at a tricky time for the Australian farmgate.

The headline figure for the Global Dairy Trade index dropped nearly 5 per cent last week to its lowest point since November 2020.

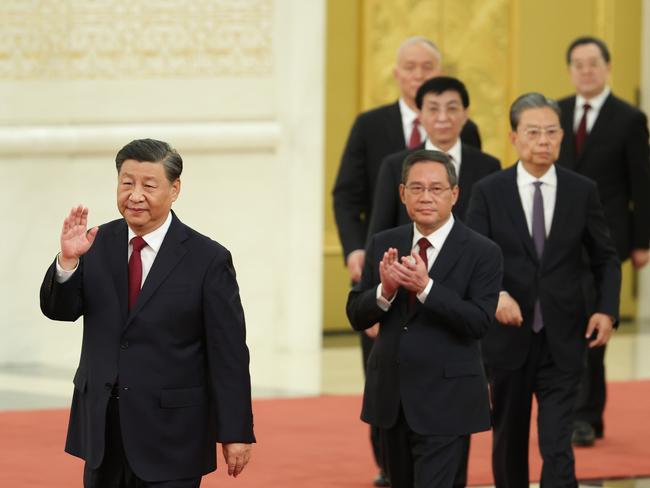

While much of the industrialised world was in lockdown in 2020 and 2021 due to the coronavirus pandemic, China remained largely open and its demand for dairy reached record levels. But its economic hit from coronavirus came later, in 2022, when the Xi regime finally relented on its ‘zero Covid strategy,’ hitting its economic fortunes as a result.

Dairy Australia market analyst John Droppert said while Chinese demand for dairy was weak at present, it was likely to rebound later this calendar year.

He said China had also cultivated a strong domestic dairy sector — which had grown by 7 per cent per annum in both 2021 and 2022.

“There are still Chinese buyers out there for dairy – you could say they are still the main buyers while others have cooled,” Mr Droppert said.

“During 2020 and 2021, the Chinese stockpiled dairy and so by the end of 2022, we started to see a correction in international prices as China made its way through the (dairy produce) it already had acquired.”

Changes to Chinese dietary guidelines in recent years to encourage increased consumption of dairy mean the current price slump won’t last long, analysts say.

“At the moment, China’s per capita consumption of dairy is about 40kg per annum. It was only 30kg per annum a few years back, so demand for dairy in China is increasing,” Mr Droppert said.

“But Japan is double per annum what China goes through and Australia is higher still.

“The nutritional recommendation of 300 to 500 grams of milk or dairy products each day, which was announced last year is an encouraging sign for demand.”

British researchers say Chinese demand for dairy will boost international milk prices later this calendar year.

Agriculture and Horticulture Development Board (AHDB) researcher Soumya Behera said China’s dairy stockpiles will inevitably shrink in coming months, forcing export demand.

“Based on predicted economic growth (in China) of 4.5 per cent for 2023 and 2024, import volumes would be expected to increase by around 6.7 per cent per year,” she said.

“While imports in the first two months remain below previous year levels, it is expected that demand will recover through the year, pulling up import demand.”