NSW Dairy Farm Monitor highlights north-south divide

A farmgate divide between northern and southern NSW dairy farmers has been revealed. Here’s how much it costs to run a farm north of the Murray.

A regional dairy price divide in NSW has widened this season between the north and south, the state’s farmer lobby leader says.

NSW Farmers dairy committee chairman Malcolm Holm said the release of the NSW Dairy Farm Monitor Project numbers indicated a small pricing gap in 2023-24 that has opened up into a cash chasm this financial year.

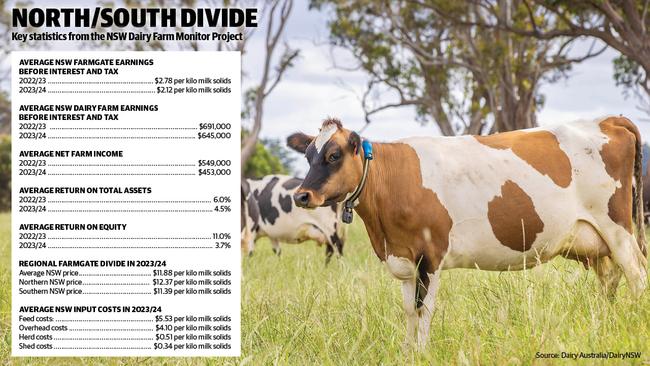

The 2023-24 report conducted by Dairy Australia showed the average NSW farmgate price was $11.88 per kilogram of milk solids.

The regional divide in 2023-24 was nearly a dollar with the average northern NSW price at$12.37 per kilo milk solids and the southern NSW price at $11.39 per kilo milk solids.

Since the final tabulation of the 2023-24 report, Mr Holm said southern NSW farmers were receiving not much more than $8.20 per kilo milk solids, like their Victorian counterparts.

“NSW has two different dairy stories this season. You’ve got the northern NSW region, which is better linked with Queensland pricing and paying roughly the same as the 2023-24 season, or perhaps a little less,” Mr Holm said.

“Then you have southern NSW, which is more reflective of the state of Victorian pricing, and the farmgate there dropped 10, 15, 20 per cent — down to nearly $8 per kilo milk solids.

“Victoria really has three distinct dairy regions whereas in NSW, it’s over a wider geographic area, so there’s a range of climatic conditions at play. Some parts of the state have done well with rain and fodder, other parts of the state had endured a dry year and are doing it tough with input prices.”

According to the 2023-24 NSW Dairy Farm Monitor Project, the average NSW farmgate earnings before interest and tax fell from $2.78 per kilo milk solids in 2022-23 to $2.12 per kilo milk solids last financial year.

The report found the average NSW dairy farm earnings before interest and tax in 2022-23 were $691,000, falling to $645,000 last season, meaning the average net farm income went from $549,000 in 2022-23 to $453,000 in 2023-24.

“The Dairy Farm Monitor is a really helpful project for looking back and keeping track of the industry but it doesn’t reflect current conditions,” Mr Holm said.

“Input costs have settled since last season but there’s been a lot of change at the farmgate. You’ve got to remember it’s a project that starts 18 months ago and finishes six months ago, so it’s a snapshot in time.”

According to the 2023-24 report, feed costs led the way in eating into farmgate profits at $5.53 per kilo milk solids, while general overhead costs tallied at $4.10 per kilo milk solids, herd costs were $0.51 per kilo milk solids and shed costs were $0.34 per kilo milk solids last season.

Dairy Australia economics, data and insights head Helen Quinn said the 2023-24 NSW report “revealed another year of above average profitability for participating dairy farms, despite significant challenges.”

The average earnings before interest and tax was $645,000 per farm business ($2.12 per kilogram of milk solids), making it the third highest in the 13 years of the project, after accounting for inflation,” Ms Quinn said.

“The average milk price in NSW was slightly lower, and seasonal conditions varied across regions. The year began with a relatively dry period, followed by wetter autumn conditions along the coast compared to inland areas.”

“Variable costs rose by 9 per cent, mainly due to higher costs for purchased feed and agistment. Overhead costs also increased across the state.”

Victoria’s 2023–24 Dairy Farm Monitor created controversy when released in October, with farm lobby leaders saying the latest financial year study did not provide an accurate snapshot of the state of the sector.

The long-running monitor of 80 farms across Victoria found the average farmgate profit in 2023-24 was $2.64 per kilograms of milk solids.

Monitor analysts said the 2023-24 average Victorian farmgate price fell slightly to $9.64 per kilogram milk solids, a one per cent decrease on the 2022-23 high farmgate figures.

Australian Dairy Farmers president Ben Bennett said the self-selection method of the Victoria monitor meant it did not provide the total picture of how Victorian farmers performed last financial year.