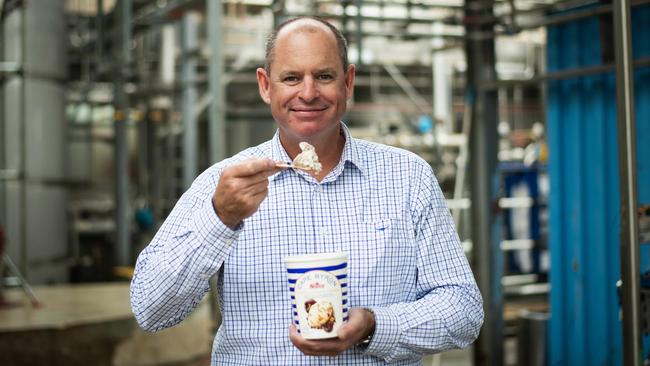

Norco boss Michael Hampson on why they’re Australia’s best paying processor

Is Michael Hampson the most popular processor boss in Australia? Norco is paying well above its competitors. Here’s why.

Giving dairy farmers an opportunity to financially recover from the 2022 floods is a key reason behind Norco’s high opening milk price, according to the co-op’s boss.

Chief executive Michael Hampson surprised the dairy sector earlier this month by offering an opening price of $12.35 per kilogram milk solids.

The double-digit figure is far and above prices offered by competitors such as Saputo, Lactalis and Fonterra, which all opened between $7.80 and $8.30 per kilo milk solids.

“Our hardworking farmers needed us to hold price this year, as they recover from the cost and debts that were built up during the floods of 2022,” Mr Hampson said.

“We are seeing some fantastic green shoots of investment by farmers in the industry in northern NSW and southeast Queensland, and a stable price platform will assist seeing more investment.”

Mr Hampson said softer international prices over the past financial year were a concern for all dairy processors.

However, he added that as a net buyer of commodities, Norco did not experience the difficulty of other processors.

“Any market where domestic product is replaced by imported product is a concern,” Mr Hampson said.

“We should look to preserve our domestic industry for our farmers – why is it right for farmers of other nations to be sheltered from the international market by accessing Australia, while our Aussie farmers are forced out of their home market and are forced to enter the international market, it just doesn’t make any sense.”

Industry analysts say Norco’s status as one of the few remaining dairy co-operatives was a key reason behind the high price offered, compared to its multinational competitors.

Milk2Market general manager Richard Lange said many of Norco’s suppliers may be on multi-year contracts, but its role as a co-operative was also a factor.

“It’s a relatively high price, on par with last year, and there’s a couple of factors that differentiate Norco from other processors,” he said.

“Being a co-operative, their model is focused on higher returns to farmers as a basic rule of thumb, compared to listed processors.

“Norco is less exposed to the butter and cheese markets, which have been hit with a flood of imported stock in the past 12 to 18 months. Their focus on milk, as an inelastic product, helps here — what I mean by ‘inelastic’ is the retail price stays relatively flat whereas cheese particularly jumps around depending on consumer sentiment.”

Australian Dairy Farmers president Ben Bennett said current opening prices were still too low for farmers to make a reasonable return next financial year.

“People have ben asking: Why are Norco paying so well? And the simple answer is that they’re a farmer co-operative,” Mr Bennett said.

“I’ve always been a supporter of co-operatives — unfortunately, that horse has bolted in Australia with Norco one of the notable exceptions.”