International dairy: Milk pool shrinks as Covid recovery demand grows

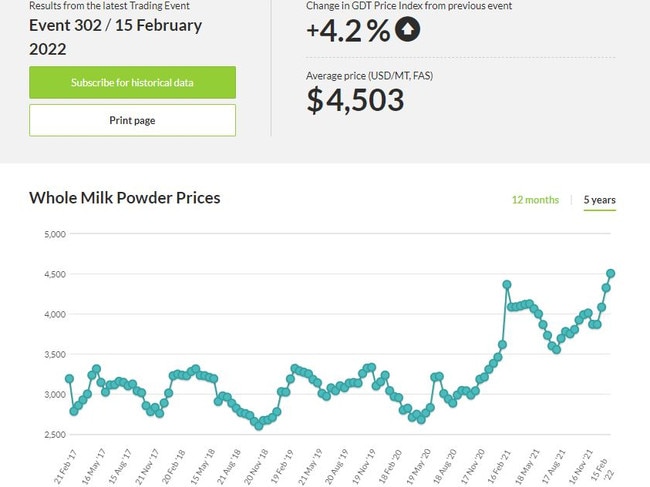

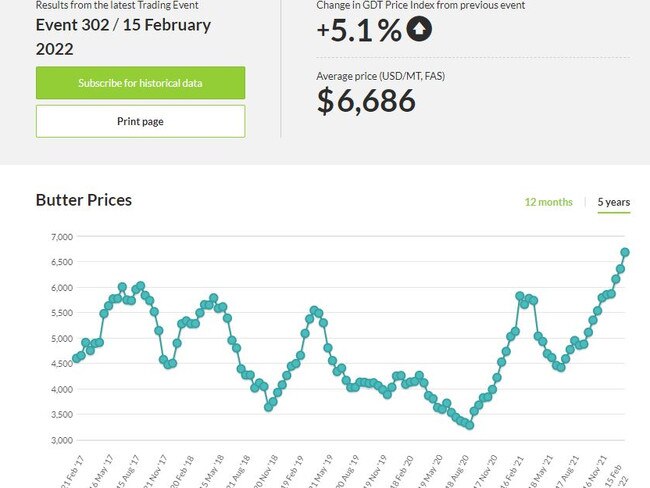

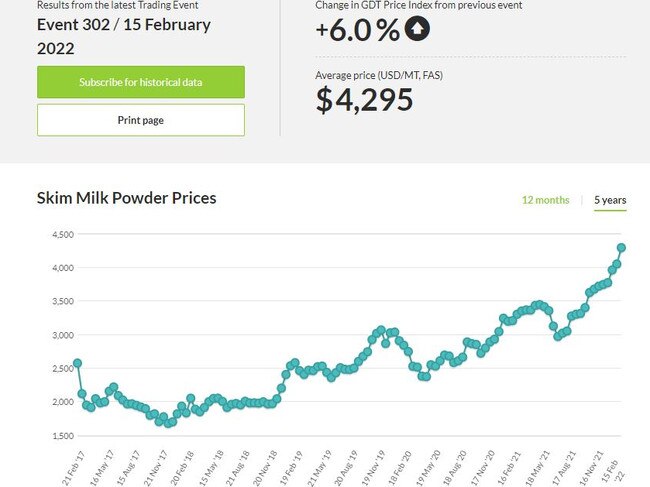

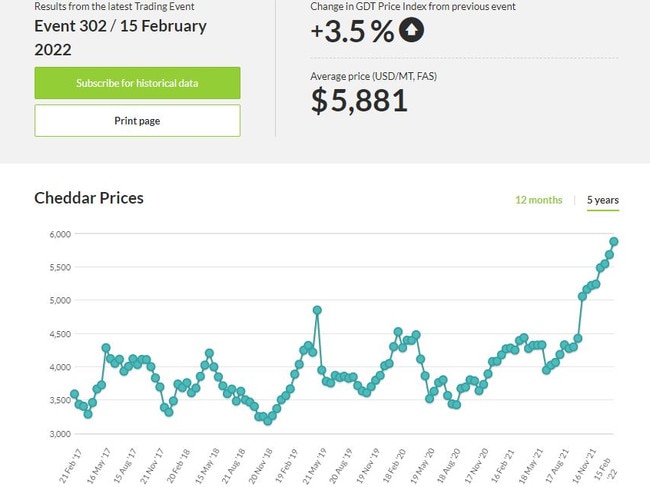

High feed and fertiliser prices have slowed milk production, just as global demand surges. See the price graphs here.

International dairy prices have surged 35 per cent since the start of the 2021-22 season, with New Zealand’s Global Dairy Trade index reaching its highest point in almost a decade.

Wednesday's auction led to a 4.2 per cent jump in the GDT price index, as 180 international bidders from across the globe snapped up 27,726 tonnes of Kiwi butter, cheese and milk powders to set yet another benchmark in a bull market.

Fonterra has already lifted its Kiwi farmers milk price to $9.20 a kg milk solids, equal to $A8.54, in response to the global trend.

But southeast Australia’s dairy farmers have been left wondering when Fonterra Australia, Saputo and Bega will lift their prices beyond the current $7-$7.30/kgMS range.

Rabobank dairy analyst Michael Harvey said global prices had surged on the back of a shrinking milk pool and freight bottlenecks, just as Covid-recovery demand for dairy was taking off.

“New Zealand is past its peak and by the time the season ends its end-of-year production is (set to be) down 2 per cent,” Mr Harvey said.

“Production is also down year-on-year in the EU, US. And they’re not expecting a strong peak (in April-May).”

He said high feed, fertiliser and other input prices were putting pressure on northern hemisphere dairy farmers.

“There’s a risk to the supply outlook, because of where (farm input) costs have gone and what’s happening in Russia,” Mr Harvey said.

“In isolation the drops (in each nation’s milk production) don’t look significant. But when combined together, as a milk pool, they are.”

“It’s not often you get them all declining at the one time.”

On the demand side of the equation, Mr Harvey said that as Asia opened up, post Covid, it’s importers were being “caught short” trying to source dairy products and faced major supply-chain bottlenecks, especially out of the US.

While only 30 per cent of Australian farmers’ milk goes into exports, Mr Harvey said there was still plenty of products, such as bulk cheese that ended up on supermarket shelves, where the price was linked to global markets.