Fonterra Australia carve up: sparks competition fears

Fonterra’s sale of its Australian assets has sparked farmer fears of fewer players and competition for their milk. See the risks.

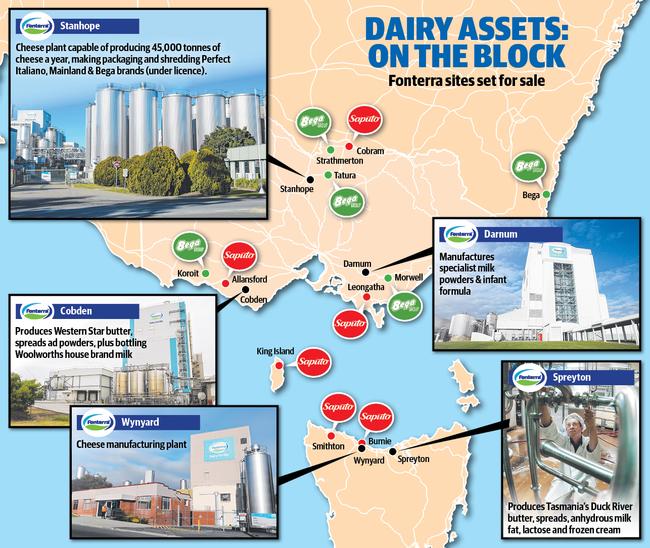

Fonterra’s plan to sell off its Australian processing plants and brands has triggered competition fears among dairy farmers, as the industry prepares for one of the biggest asset carve ups in its recent history.

Both Australian Dairy Farmers president Ben Bennett and United Dairyfarmers of Victoria president Bernie Free have already flagged their opposition to the sale of Fonterra’s Cobden plant to one of its major rivals, Bega or Saputo.

Mr Free said the precedent had already been set in 2018, when the Australian Competition and Consumer Commission blocked Saputo’s purchase of Murray Goulburn Co-operative’s Koroit plant.

At the time the ACCC said if the deal had gone ahead “Saputo’s Allansford plant and Murray Goulburn’s Koroit plant would have over two thirds of the raw milk processing capacity in the southwest Victoria and southeast South Australia” – about two billion litres.

Limits on Bega and Saputo buying Cobden may create an opening for other players, such as Bulla, although its chief executive Allan Hood dismissed the idea.

Further afield, dairy industry analysts say Fonterra’s sale of its Stanhope cheese processing plant also raises competition concerns in northern Victoria and the Riverina, as does the sale of its Darnum plant for Gippsland farmers.

The Weekly Times understands the ACCC is keeping a close eye on the Fonterra asset sale, given it regards each dairy region – the southwest, north and Gippsland – as separate markets.

Rabobank dairy analyst Michael Harvey said details on how Fonterra would sell its Australian assets remained “a little bit grey and hard to work out”.

“It’s going to be complex and the ACCC will be looking at competition at the farm gate and downstream trade,” Mr Harvey said. “To me it’s about primary processing, which they will assess at the regional level.”

Fonterra announced in May that it would sell off its brands and Australian business – Fonterra Oceania – over the next 12-18 months to focus on its core ingredients business, appointing advisers to assist with assessing its divestment options.

At the time Fonterra chief executive officer Miles Hurrell said the co-operative had already “received unsolicited interest in parts of these businesses, making now a good time to consider their ownership”.

Mr Harvey said rumours had been circulating on private equity firms coming in to buy up the whole of Fonterra Oceania, which were just as likely to then carve up and sell different parts of the business.

Bega and Saputo’s interest in Fonterra’s assets is unknown, given both have rationalised parts of their businesses in the past two years in the wake of fierce import competition, high farmgate prices and a shrinking milk pool.

Saputo closed its Maffra plant last year, cut back production in Leongatha, is reviewing its King Island operation and faces industrial action at its Burnie plant.

In its 2024 annual report, Saputo states it is in the midst of consolidating 11 facilities into six, “to improve our operational efficiencies and strengthen our competitiveness.

“Going forward, and in light of the shrinking milk pool, we are focused on prioritising our efforts towards more value-added categories that will generate stronger returns, improve our operating cost structure, and provide a solid foundation for success.”

Meanwhile Bega signed off on a joint report last year stating it was forging ahead with the transition from simply dairy processing “to a predominantly branded business”.

Other Australian dairy industry analysts said Bega may look at buying Fonterra’s Darnum powder plant, and cutting back or closing its older Tatura operation, given northern Victoria’s milk production continues to fall, from 1.63 billion litres in 2020-21 to about 1.44 billion last season.

Lactalis may also see an opportunity in buying Fonterra’s Stanhope plant, which would give the international cheese specialist access to its first large-scale Australian cheese processing site.

Such a move would help offset farmer concerns over a duopoly developing between the two major primary processors in the north, Saputo and Bega.

In Tasmania, farmers may also face reduced competition as Fonterra weighs up the sale of its Spreyton and Wynyard plants.

Apart from Burnie, Saputo has spent $20m shifting its Maffra driers to Smithton, where it is producing powders and frozen natural cream cheese, which allows it to park more milk in a state that is driven by more seasonal production.