Dairy price gap: farmers get $6/kg for butterfat that sells for $12.75/kg

Butterfat is selling for $12.75/kg on the global market, while Australian dairy farmers are getting paid $6/kg. We take a look at why.

Australian dairy farmers are being underpaid for their milk fat, receiving about $6 a kilogram compared to a Global Dairy Trade auction price for butter of $10.20/kg.

The butterfat pricing gap widens even further to the equivalent of $12.75/kg on global markets, given butter is 20 per cent water.

Local processors are offering farmers just $6 to $6.60/kg for their butterfat, while selling blocks of Australian-made butter, such as Western Star, on Woolworths’ and Coles shelves for the equivalent of $16 a kilogram.

Even imported NZ butter, wrapped in Coles and Woolworths home brand packaging, is selling for the equivalent of $12.80/kg.

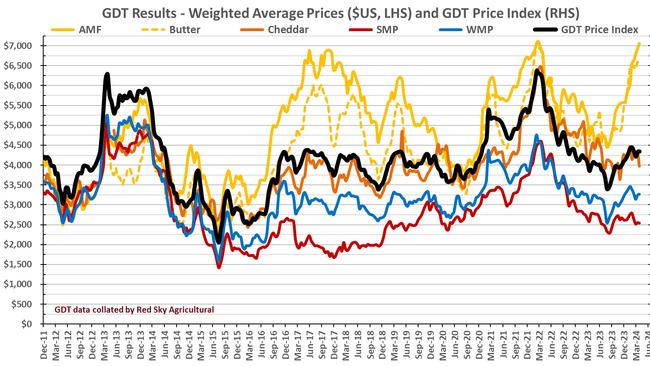

Global markets have consistently paid far more for butterfat than protein for most of the past decade, with butter selling this month at the GDT for $10,200 a tonne, while skim milk powder floundered at $3900/t

Yet in Australia most processors offer farmers milk supply agreements that price protein at $10/kg to $12/kg, with butterfat priced at little more than half that amount.

In contrast US processors have been paying farmers more for butterfat over the past decade to boost production.

US Department of Agriculture advanced pricing milk price orders for May have been set at $US2.89 per pound of butter, compared to $US1.17 a pound for non-fat dry milk.

Dairy industry analysts Scott Briggs said US farmers had responded by lifting butterfat in their milk from about 3.65 per cent in 2010 to 4.15 per cent today.

“It’s clear the US farmer has responded to butterfat being more important in the milk cheque,” Mr Briggs said.

As to why Australian processors have not responded to higher global butterfat prices, Mr Briggs said it appeared to simply come down to “the current arrangements having been around for decades due to inertia and no real recognition that change can deliver a better outcome for the industry”.

Australian Dairy Farmers president Ben Bennett said personally he felt paying an incentive to lift butterfat production was needed.

“The timing is good and it could be built into the pricing for the coming season, with the milk price opening,” Mr Bennett said.

“It has the potential to add hundreds of millions of dollars to the dairy industry’s bottom line.”

Cobden dairy farmer Duncan Morris said the current pricing structure “started when fat was out of favour in the world (30 years ago)” and it shows how there’s “just a total disconnect” with global markets.

The Australian Dairy Products Association Australian cheif executive Janine Waller said dairy processors pay farmers on a range of Protein:Butterfat ratios.

“They do this to ensure they have the ingredients they need to produce their product mix.

“It also means dairy farmers have a choice in who they supply and which ratio they select

based on their own farm production systems.

“As we understand, higher protein suits many Australian farmers as they feed grain most of

the year.”